Proxy Market Research 2023

Welcome to this fifth edition of Proxy Market Research – an annual report on the proxy server industry. To this day, it remains the only public resource providing large-scale technical benchmarks and an all-around view of the leading proxy services. You can use it to learn more about the market, compare major providers, and make informed decisions concerning proxy server infrastructure.

This year’s report covers 12 companies. They range from market leaders like Bright Data and Oxylabs to up-and-coming providers such as IPRoyal and Webshare. We overview five products, with a particular emphasis on residential and mobile proxy networks.

Compared to the previous year, we’ve expanded the collaboration with proxy providers, asking them to complete a survey. The results are aggregated and presented in the section on market trends. We’ve also tried to make the report easier to navigate by making its different sections expandable. Finally, each section on a proxy type includes an evaluation graph for quick comparison; some may find them too opinionated, but there’s always hard data to fall back on.

The majority of data were collected in February and March of 2023.

Participants

This year’s research includes 12 proxy service providers. Together, they occupy the majority of the proxy server market – especially in the area of residential proxies.

We reviewed many of these companies in our previous researches. This allows us to track their progress over time. Infatica and Webshare participate for the first time.

The adjacent tabs provide brief summaries of each participant.

Backed by the equity fund EMK Capital, Bright Data is a juggernaut that offers all-inclusive proxy services anywhere in the world. The provider targets business customers and Fortune 500 companies, positions itself as an ethical proxy service, and has built a strong ecosystem of data collection tools around its proxy networks. Bright Data fights as fiercely in court as it does in the market.

- Country: Israel

- Founded: 2014

- Proxy networks: datacenter, residential, ISP, mobile

- Web scraping tools: general-purpose and search engine APIs, scraping browser, cloud web scraping IDE

- Data services: datasets, e-commerce insights

GeoSurf is a market veteran that targets enterprise customers. A broad selection of cities and a residential VPN historically made it a popular choice among ad intelligence and localization companies. Nowadays, many of GeoSurf’s services are tailor-made for clients. The provider seemed to be struggling for the last few years, but it looks to be in a better place now.

- Country: Israel

- Founded: 2009

- Proxy networks: residential, ISP

- Web scraping tools: general-purpose API

A Singapore-based company with largely Eastern European staff, Infatica focuses on selling residential proxies to mid-range and enterprise clients. The provider was among the first to foreground ethics. It sources proxies via an SDK and offers them at very competitive enterprise prices.

- Country: Singapore

- Founded: 2019

- Proxy networks: residential, datacenter

- Web scraping tools: general-purpose API

IPRoyal made a name for itself with a range of affordable proxy services. Since 2021, it’s grown into a robust provider with a large client base. IPRoyal maintains its own residential proxy pool through an app called Pawns. For now, the provider focuses on the lower-mid end of the market, though it wouldn’t mind giving the premium competitors a run for their money.

- Country: Lithuania

- Founded: 2021

- Proxy networks: datacenter, residential, ISP, mobile

- Web scraping tools: –

A subsidiary of Safe-T group and one more participant from Israel. Originally the major provider of ISP proxies, the company now sells four rotating proxy networks to cover more ground. NetNut primarily targets enterprises with data collection needs and proxy resellers. It also used to actively participate in the sneakerhead niche via a daughter company Chi Proxies.

- Country: Israel

- Founded: 2018

- Proxy networks: datacenter, residential, ISP, mobile

- Web scraping tools: –

One of the market leaders, Oxylabs controls the largest datacenter, residential, and mobile IP networks today. In addition, the provider offers an arsenal of tools for extracting data from the web, some based on cutting edge AI & ML technology. Oxylabs targets mid-to-large businesses, wooing them with SLAs, insurance, and personalized support.

- Country: Lithuania

- Founded: 2015

- Proxy networks: datacenter, residential, ISP, mobile

- Web scraping tools: general-purpose, search engine, social media, and real estate APIs

One of the first bandwidth-sharing marketplaces, PacketStream has been a strong budget option and reseller’s choice for several years now. However, it’s experienced few changes since 2019, which has allowed competitors to mimic the provider’s business model and reduce the price gap. PacketStream’s overall package remains compelling today, but it’s starting to get long in the tooth.

- Country: United States

- Founded: 2018

- Proxy networks: residential

- Web scraping tools: –

A self-proclaimed largest US proxy provider and a datacenter proxy powerhouse. Started as Blazing SEO, the company rebranded in 2022 to show the extended scope of its services and target audience. Rayobyte currently tries to build its own ethically-minded residential proxy pool and aims to become a one-stop-shop for any data collection professional.

- Country: United States

- Founded: 2015

- Proxy networks: datacenter, residential, ISP, mobile

- Web scraping tools: general-purpose API

A long-standing proxy provider, Shifter built its client base by solving the major limitation of residential IP networks – traffic limits, basing the pricing on ports instead. The provider targets business clients and resellers that can afford paying hundreds to thousands of dollars for increasingly unlimited access.

- Country: United Kingdom

- Founded: 2015

- Proxy networks: datacenter, residential, ISP

- Web scraping tools: general-purpose and search engine APIs

The third major player beside Bright Data and Oxylabs, Smartproxy found its fame by offering a highly balanced rotating proxy service. Though considered a premium provider, Smartproxy emphasizes value and ease of use: it offers top-shelf quality while cutting fringe features to reduce the price. Recently, the company has been building tools to capture more value from its proxy networks.

- Country: International

- Founded: 2018

- Proxy networks: datacenter, residential, mobile

- Web scraping tools: general-purpose, search engine, e-commerce, and social media APIs, no code scraper

- Other tools: antidetect browser

Similarly to Infatica, SOAX is a provider with Eastern-European roots and international presence. It sells residential and mobile IPs to SMBs and enterprises. As a company, SOAX invests a lot into company branding, makes big yearly performance improvements, and has one of the best starting packages in terms of features.

- Country: UK

- Founded: 2019

- Proxy networks: residential, ISP, mobile

- Web scraping tools: general-purpose API

One of the newer companies on our roster, Webshare supplies individuals and SMBs with all kinds of proxy servers. Its polished self-service flow and extreme customizability have made the provider an increasingly popular destination – so much so that Webshare reached 10,000+ active customers and was acquired by Oxylabs in 2022.

- Country: US

- Founded: 2018

- Proxy networks: datacenter, residential, ISP

- Web scraping tools: –

Market Trends

This section provides an overview of the proxy server market. It’s based on our own market knowledge, as well as responses from a survey we sent to all participating providers. You’ll learn about the current state of the industry, popular proxy types and use cases, and possible directions for the future.

State of the Market: Fast Growth, Cautious Optimism about the Future

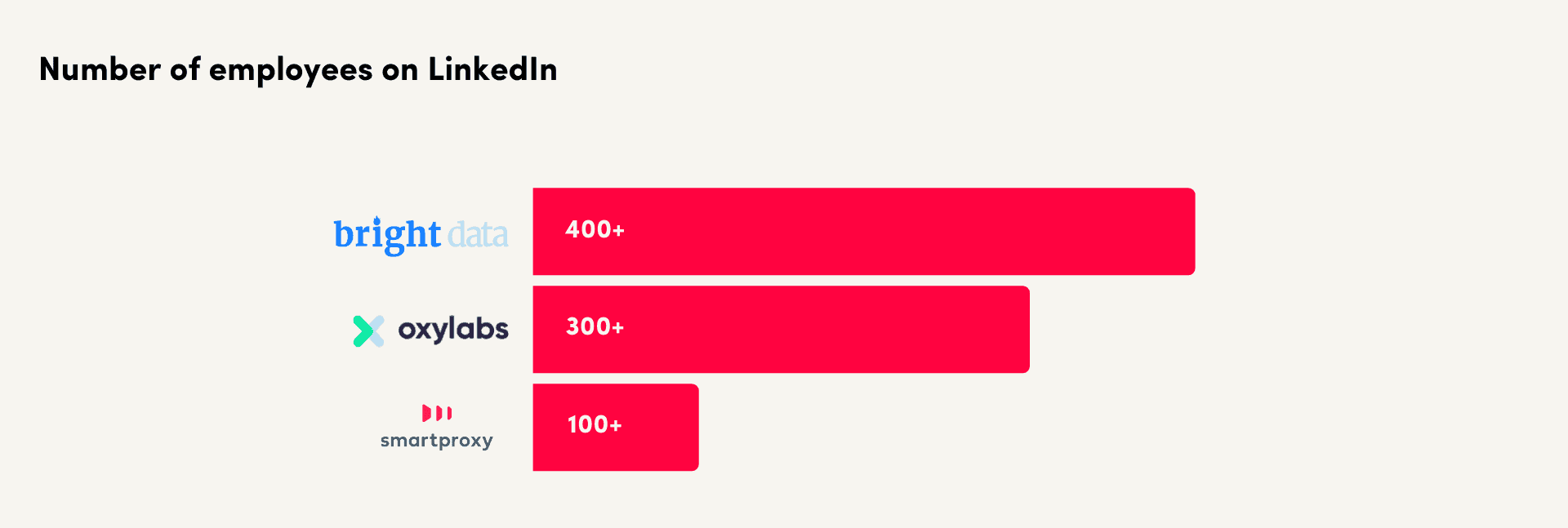

- 2022 was a great year across the board, with providers like IPRoyal and Webshare growing multiple times, and the largest players now having hundreds of employees under their belts.

- The barrier to entry remains low thanks to mobile proxies, but the competition is toughest in the enterprise, and we may start seeing market consolidation.

- Economic uncertainty hasn’t affected the participants yet; some believe this will continue, while others claim to be ready to weather possible storms.

Full version

In our survey, IProyal reported tenfold growth in data usage compared to 2021. Webshare, which runs on self-service and inbound marketing channels, doubled its revenue in 2022 and introduced new proxy types. NetNut, whose money was hemorrhaged by legal disputes and infrastructure investments, has managed to become profitable again. Rayobyte’s residential proxy product took off, and GeoSurf hired additional people to build customized solutions for its clients. It was a good year across the board.

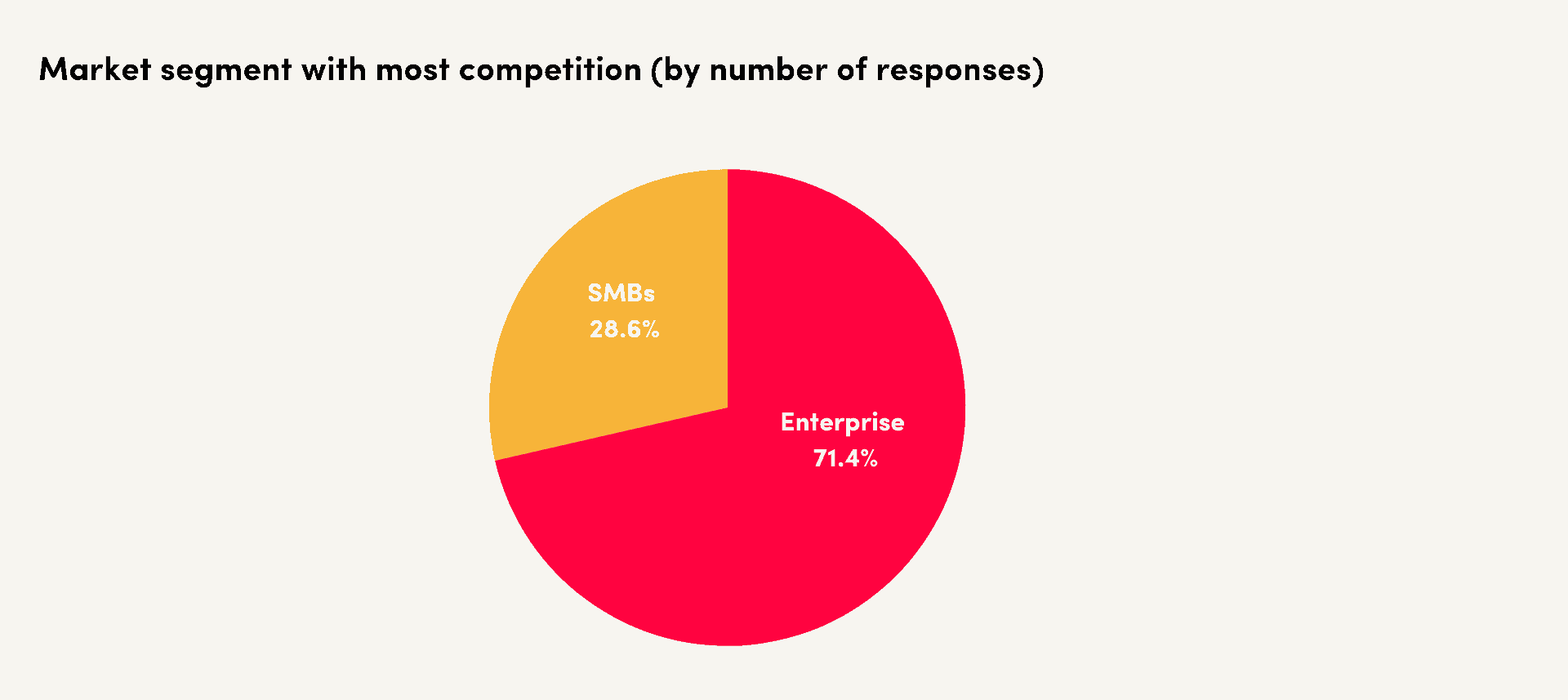

When asked about competition, most participants believed that it had increased. However, they didn’t necessarily treat it as a bad thing. According to Webshare, many are resellers who will have a hard time scaling down the road. GeoSurf noticed that the number of providers returned to its starting position after growing early in the year. The majority found it hardest to compete in the enterprise segment.

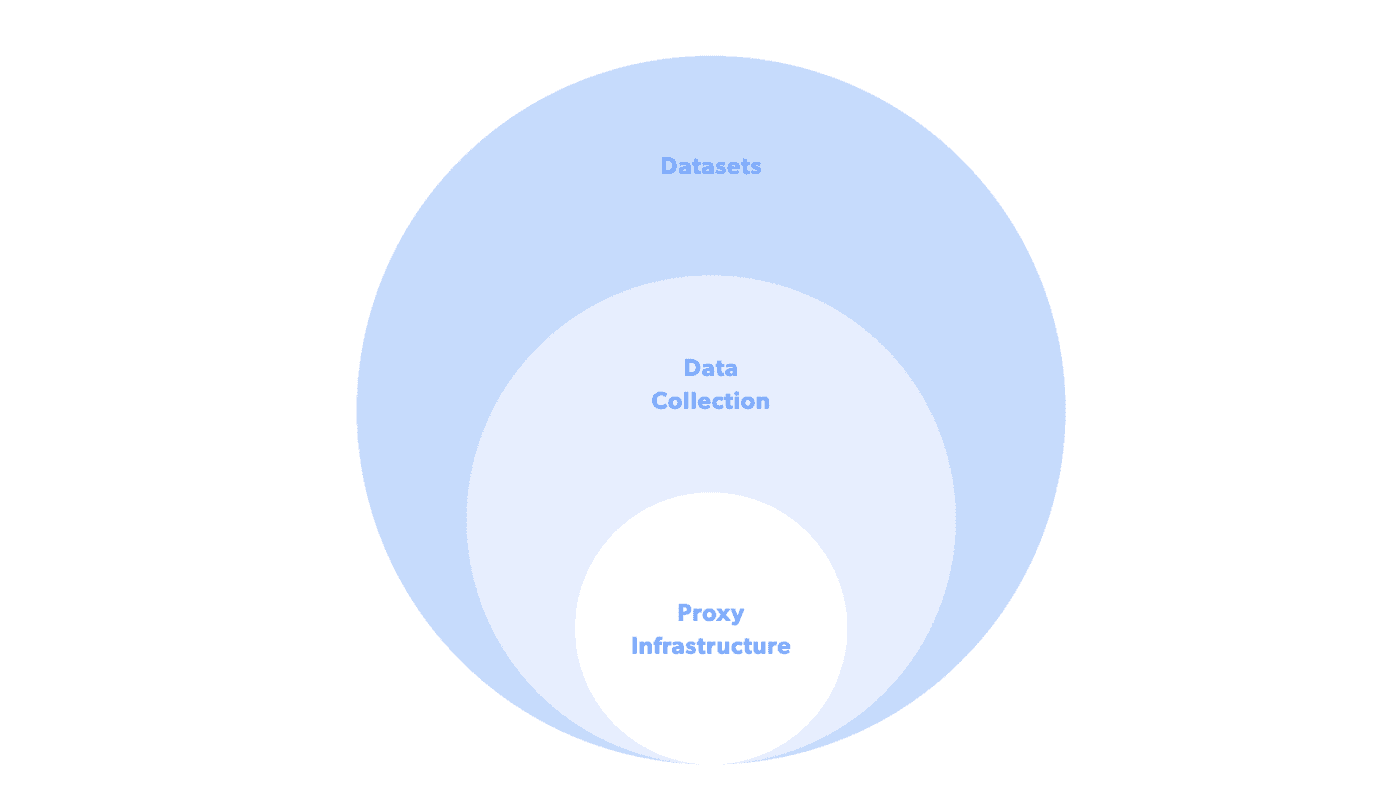

Market Direction: Up, Up but Not Away from Proxies

- Providers have been expanding horizontally, but they’ve placed the most focus on releasing APIs to cover the web scraping (and to some extent, data parsing) stages of the data extraction lifecycle.

- The participants have high hopes for their new tools, expecting fewer companies to run in-house scrapers in the future.

- Despite this, they have no plans to discontinue selling proxies, though proxy servers in their raw form may support fewer use cases.

Full version

Growing fast in a booming industry, proxy providers naturally want to capture as much of it as possible. In addition to increasing market penetration with existing products, there are two ways to accelerate growth: horizontal and vertical expansion.

Horizontal expansion allows providers to boost their addressable audience through new proxy products. We saw multiple companies bolster their line-ups in 2022:

| Datacenter | Mobile | ISP | Residential | |

|---|---|---|---|---|

| NetNut | ✅ | |||

| Oxylabs | ✅ (rotating) | |||

| Rayobyte | ✅ (rotating) | |||

| Shifter | ✅ | ✅ (fast & on-demand rotation plans) | ||

| Smartproxy | ✅ (IP-based shared) | ✅ | ||

| Webshare | ✅ |

That being said, proxy servers are a resource, and they occupy only a small portion of the data extraction lifecycle. Having accumulated more manpower, expertise, and financial leeway, providers have increasingly started moving up the data value chain.

So far, the focus is on addressing the scraping (and, to some extent, parsing) stages with APIs and smart proxy networks like Zyte’s Smart Proxy Manager. This makes sense from multiple perspectives: the provider can save resources by better optimizing the scraping logic, while developers have an easier time accessing websites behind toughening protection systems.

The expansion to APIs has been going on for some time now, but it especially accelerated during the last year. Infatica, Oxylabs, Shifter, Smartproxy, and SOAX all launched new products within that time frame. Today, only four out of the 12 participants offer no web scraping tools, with one of them (NetNut) planning to introduce something in the near future.

Available web scraping products (* – released in 2022-2023)

| Bright Data | General-purpose, search engine APIs, cloud scraping IDE*, scraping browser API*, datasets*, e-commerce insights* |

| GeoSurf | General-purpose API* |

| Infatica | General-purpose API* |

| IPRoyal | ❌ |

| NetNut | ❌ |

| Oxylabs | General-purpose (incl. proxy-like Web Unblocker*), search engine, e-commerce, real estate* APIs |

| PacketStream | ❌ |

| Rayobyte | General-purpose, Google, Amazon APIs |

| Shifter | General-purpose*, search engine* APIs |

| Smartproxy | General-purpose*, search engine, e-commerce*, social media* APIs, no-code scraper* |

| SOAX | General-purpose API* |

| Webshare | ❌ |

Providers have high expectations for the new tools. All survey participants expected their usage share to grow in relation to proxies, forecasting that fewer companies will run in-house scrapers in the future. Bright Data’s scraper, Web Unlocker, was already the driving force in 2022. The provider also places high bets on data sets and on-request scrapers, as companies look to cut operational costs in the face of economic uncertainty. (According to Bright Data, 30% of IT budgets go to unstructured data management.)

Despite this trend, proxies are going nowhere. Every respondent identified their role as core, foundational, or at least significant, with no plans to remove them from product portfolios. At the same time, most have plans to further build upon proxy networks, which may impact the ways how clients can use raw proxy servers (for example, by reducing the number of available targets).

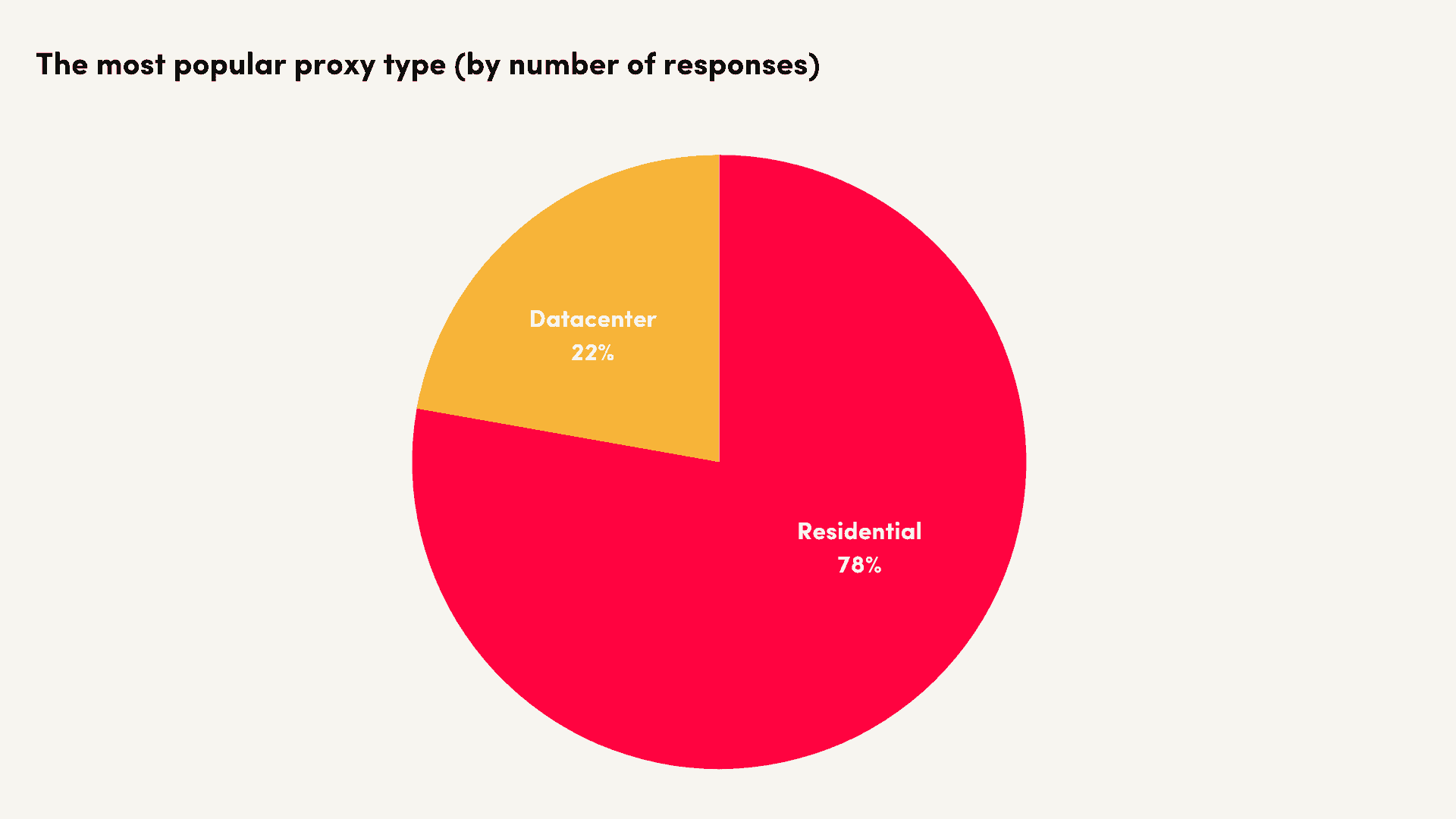

Proxy Types: Residential IPs Remain the Most Popular Product

- Only two providers, Webshare and Rayobyte, have non-residential proxies as their dominant proxy type.

- The demand for ISP proxies is largely covered by specialized vendors in the sneaker scalping niche.

- We believe that major providers currently under-utilize mobile device farms, which have a thriving market in online communities.

Full version

When we interviewed Bright Data a year ago, we found that datacenter and residential proxies took 95% of the provider’s proxy use. In other words, the other two types, ISP and mobile proxies, were used only 5% of the time. This remains true a year later, with datacenter proxies being favored by budget-conscious customers and residential proxies seeing the most popularity with enterprises.

What about the other survey participants? In all but two cases, residential proxies proved to be the most popular proxy type. One exception was Webshare, which sold only datacenter IPs until very recently; its shared proxies generated three quarters of the revenue. The second was Rayobyte, which specializes in datacenter proxies and experienced steady growth.

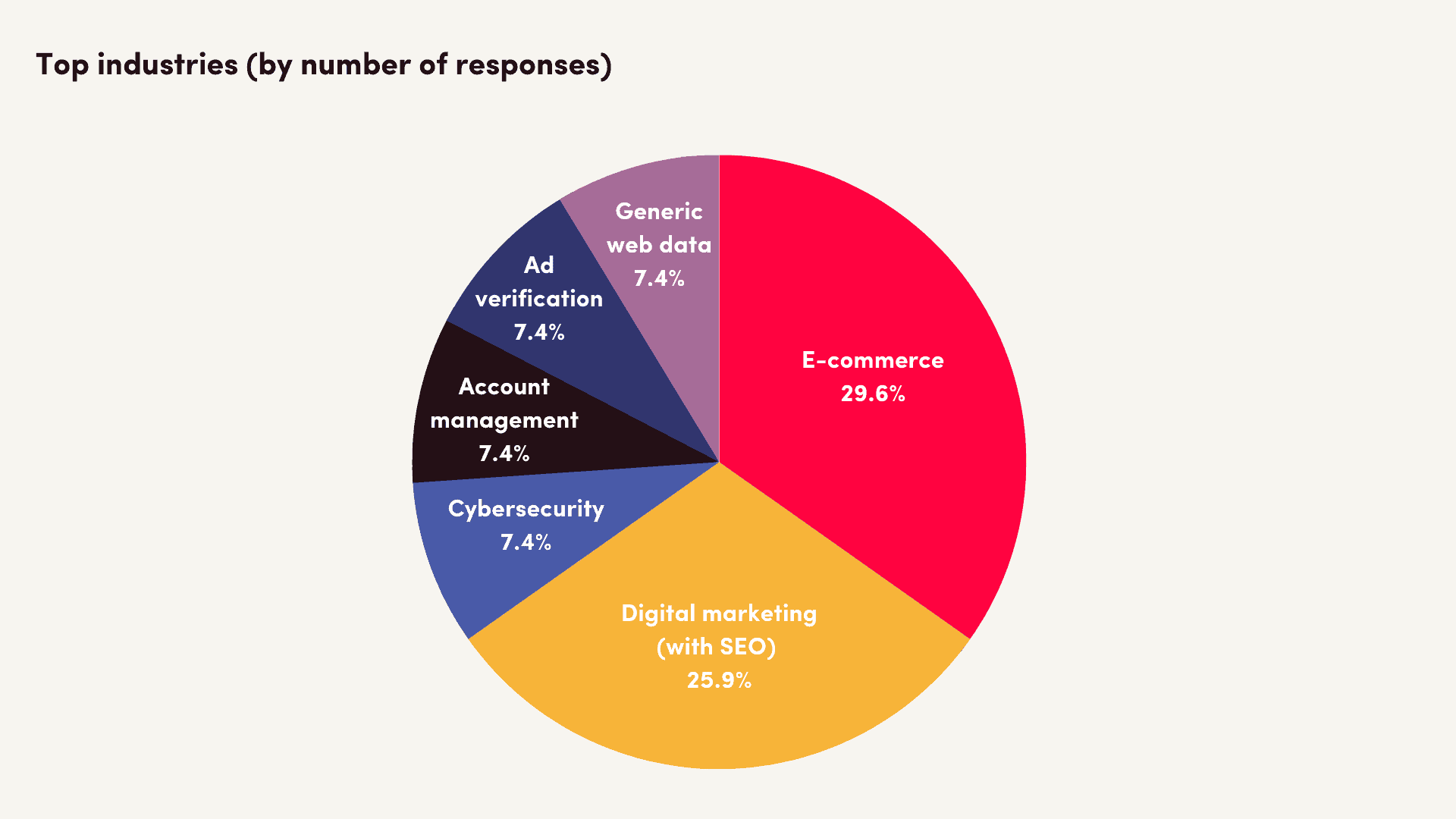

Use Cases: E-Commerce Reigns Supreme, Data for AI Makes an Appearance

- E-commerce is the largest business vertical for most providers, sometimes generating up to 50% of their business.

- Aside from declining sneaker proxy sales, there have been no major changes in 2022.

- Several participants identified data for decisions-as-a-service businesses as a potentially big (even enormous!) use case.

Full version

We asked the survey participants to list between three and five of their top industries. The other oft-mentioned use cases were digital marketing (including SEO), cybersecurity, ad verification, account management, and generic web data extraction. In brief, all the usual suspects.

The survey also included a question about changes that took place in 2022. Half of the respondents reported no major changes, other than the overall increase in demand. NetNut mentioned a drop in sneaker scalping, which we’ll get to in a second. Bright Data managed to unlock the financial services industry and expects it to continue growing fast.

Looking into the future, one use case that has inevitably surfaced is data for AI models. SOAX named this emerging business model Decisions-as-a-Service, where technologies like ChatGPT help people get quick and simple answers to their questions. Multiple surveyed providers emphasized the need for accurate and large-scale data to train these models. To rephrase Oxylabs, the potential in this space for data collection companies is enormous.

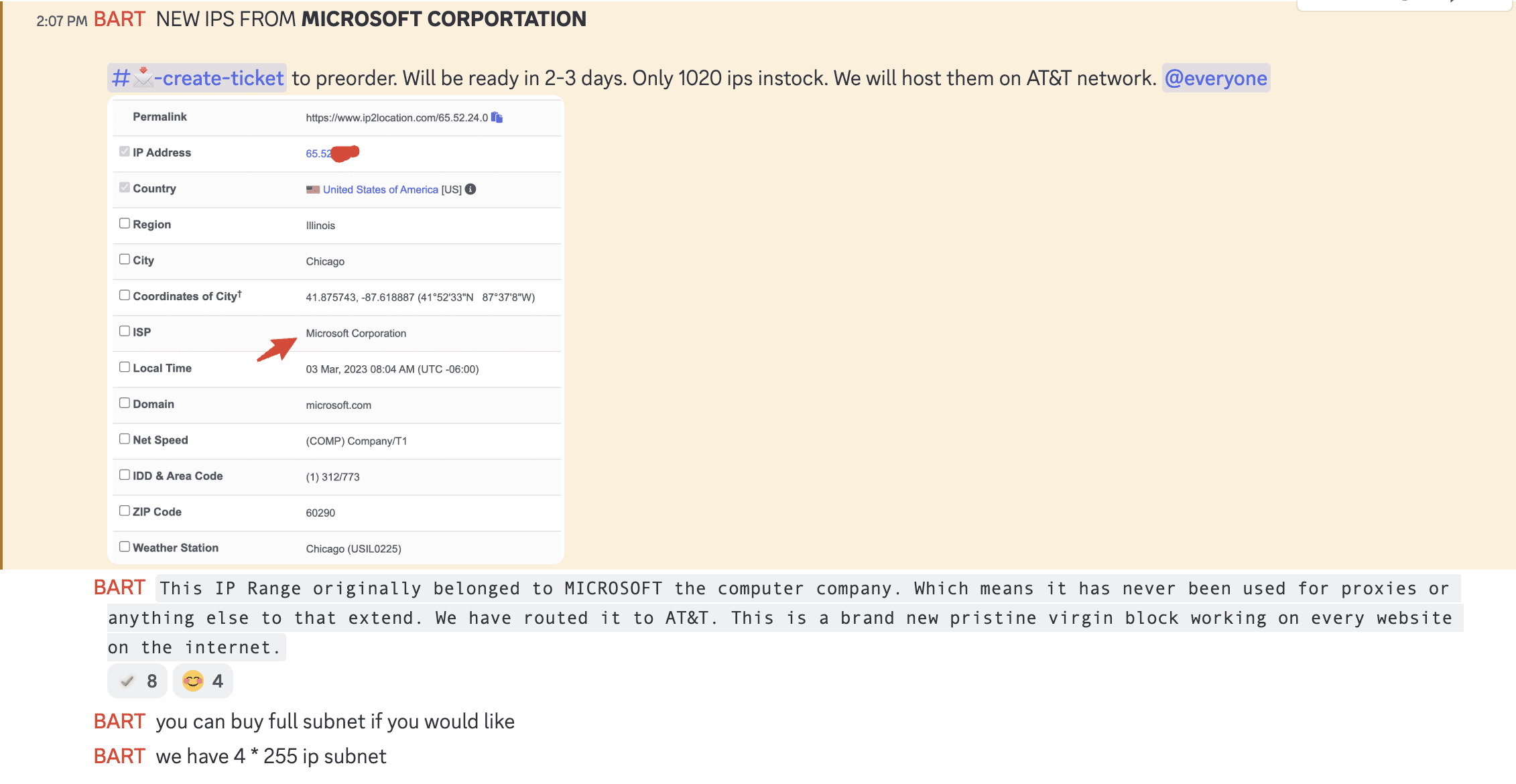

(Not Quite) a Post Mortem: The State of Sneaker Scalping

- The decline in sneaker scalping has affected all members of the ecosystem, hitting bot prices and forcing some proxy vendors to expand their audiences.

- Nike and Shopify stores remain the two websites worth targeting.

- Despite the shrinking market, thousands of users continue to visit our sneaker-related pages every month.

Full version

Last year, we wrote about the hard times that had befallen the sneaker botting industry. Pressured by tightening website defenses and fewer releases, sneakerheads were leaving for more profitable avenues like GPUs, consoles, and NFTs. What has happened since then, and where does the niche stand in 2023? In brief, it’s trudging along, but changes had to be made by all members of the ecosystem.

First, sneakerheads no longer target the same websites. The former bread baskets, Yeezy Supply and Footsites, have both fallen off. Yeezy Supply is gone due to a series of unprofitable drops and recent Kanye scandals, whereas Footsites have largely transitioned to raffle releases and no longer offer the generous stocks they used to. At this point, Nike and around a dozen Shopify stores remain the targets worth the effort.

The prices of most sneaker bots have tanked. Past faves like Cybersole now cost hundreds instead of tens of thousands of dollars; even Wrath, which consistently brought results, goes for less than $3,000 for lifetime access. It’s not the best time to be a shoe bot seller.

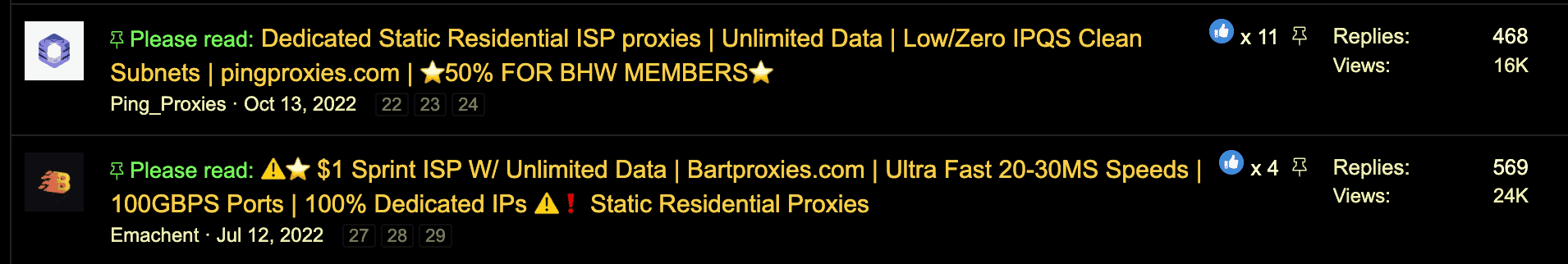

Sneaker proxy vendors have also been affected. Some, namely Leaf Proxies and Oculus Proxies, have merged together. Others, such as Bart Proxies and Ping Proxies, have expanded their services to general-purpose use cases in places like Black Hat World. Quite a few smaller resellers likely closed without fanfare.

The general sentiment ranges from negative to cautiously realistic. Is it possible to earn money reselling shoes? Yes, but no longer easy. Can you still make a living doing so? Nowadays, the answer is often no, else it comes with multiple asterisks (such as sizable prior experience or ability to survive the slow months). For many, shoe botting has once again taken the role of a side hustle in addition to their regular day job.

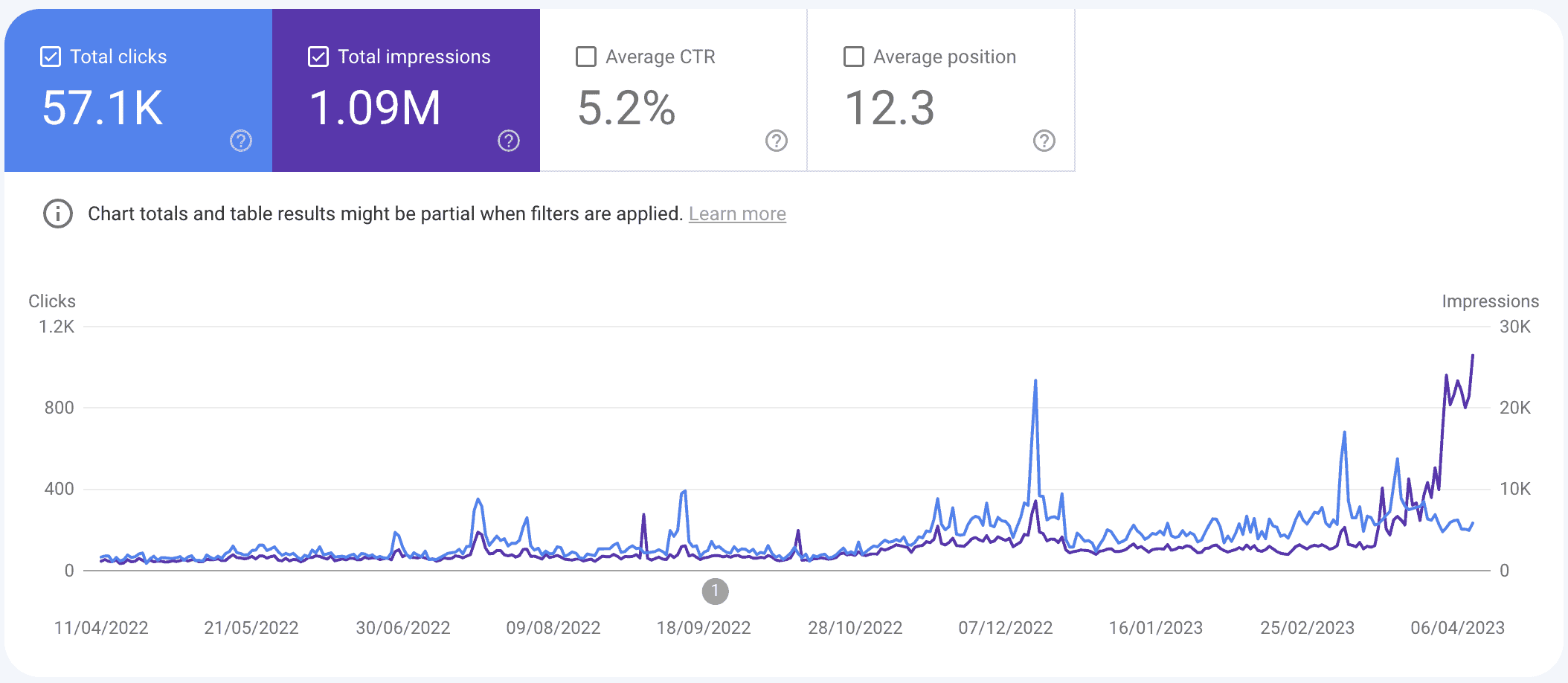

Still, the interest in sneaker botting hasn’t dried out. We are privileged to occupy some of the top Google positions for sneaker-related queries, and sneaker bot listings remain among our largest pages.

Are these simply the latecomers, or does the industry still have life left? That’s tough to say, but for now, shoe cooks continue looking for their grails.

Business Ethics: Proxy Networks Are Experiencing (and Embracing) More Scrutiny

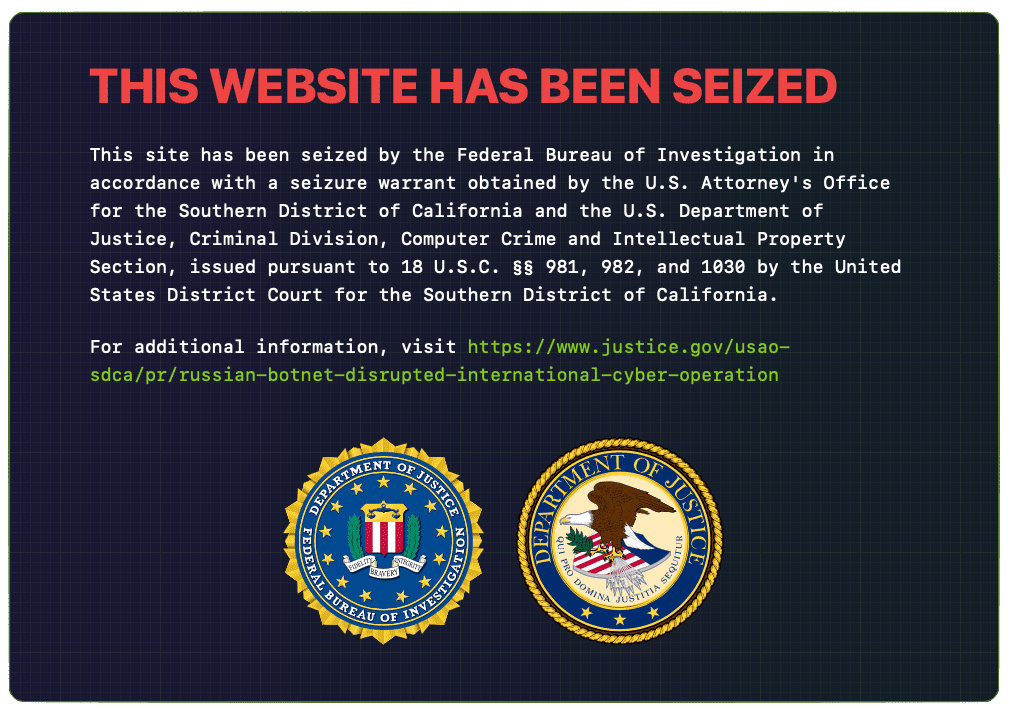

- The crackdowns of RSocks and 911 S5 shook the industry in 2022.

- Commercial proxy services have started prioritizing ethics, which reflects not only in marketing materials but also KYC processes.

- As a result, businesses are less likely to treat their relationships with providers as shameful secrets (according to the providers).

Full version

On the bright side, commercial proxy services have started treating ethical business practices as an increasing priority. Initially a concern of Bright Data and Oxylabs, ethics has now made its way into the websites of SOAX, IPRoyal, and other emergent companies, at times even taking center stage. More providers now feel the need to explain their IP sourcing practices, and their KYC processes have become more stringent, often with the help of external specialists.

Last year also saw some interesting initiatives. Five major proxy providers banded together to start The Ethical Web Data Collection Initiative, and SOAX launched a podcast focusing on ethics in the web data collection industry. We too have conducted interviews with Bright Data, Oxylabs, SOAX, Rayobyte, and the newly formed i2Coalition about the ethicality of sourcing and using proxies.

The majority of our surveyed participants approached the topic with optimism. They believed that the outlook toward proxies has shifted from perceiving them as hacking tools to treating proxy servers as a foundational part of the internet. Clients (especially enterprises) are increasingly asking about IP sourcing practices, and they’re less likely to treat the business relationship as a necessary but shameful secret.

Fully understanding that most of the replies would be PR-friendly, we decided to throw a curveball: how do you distinguish a real commitment to ethics from virtue signaling? The answer is two-fold: research and ask.

You should research how the provider vets customers, how it gets proxies, and whether the sources express clear consent. Ideally, this information should be publicly available; otherwise, you can always ask. Third-party audits help, and a little open source intelligence (like Googling the company’s name with certain keywords) goes a long way toward giving you a more balanced view of the service.

Legal Challenges: Social Media Platforms Pressure the Industry

- In 2022, the case of HiQ v. LinkedIn confirmed that scraping public data is legal and made litigation for CFAA violations less likely.

- However, social media platforms have shifted to arguments based on breach of contract.

- There are several high-profile cases taking place – we expect the industry to lay low about social media scraping in the meanwhile.

Full version

- One, the CFAA (an anti-hacking law from 1986) doesn’t apply to publicly accessible data. The community lauded this as a great win, as companies relied on the CFAA to bully web scrapers – and because it incurs criminal liability! So, when the Ninth Circuit affirmed its position in April 2022, many sighed in relief.

- Two, breach of contract will become a new basis for lawsuits, and so far courts have been much friendlier to corporations here. HiQ lost on this count in October, even if the litigation process continues. This causes concern: this January, Meta sued Voyager Labs for allegedly running multiple bot accounts; however, the recent lawsuit against Bright Data barely even mentions bots – it’s enough that the company had business profiles on the platform (you can read the complaint here or listen to Bright Data CEO’s take here).

General Observations

This section provides general insights into proxy networks. Compared to the market trends, it’s based on hands-on data we collected while testing the participants. Here, we aggregate and compare different proxy types, as well as highlight notable developments from the product standpoint.

Expand

Residential and Mobile Proxy Infrastructures Have Become Impressively Robust

Webshare believes that the majority of proxy services are still slow and unreliable. While we tend to agree, the performance of peer-to-peer proxy networks has improved greatly. Residential proxies today barely lag behind datacenter addresses (without special optimizations), which was unthinkable several years ago.

For example, here’s the success rate of US-filtered proxies when connecting to the nearest server of a global CDN:

And here’s the response time – with our benchmark webpage (several kilobytes) and Amazon’s product pages (around 1 MB response size):

SOAX is a great case in point for how much optimization can impact performance. And even providers like Oxylabs, which already led the pack, still manage to make significant speed gains every year despite facing diminishing returns:

Mobile IPs Cost x3 More than Residential, x30 More Than Rotating Datacenter Proxies

It’s no secret that mobile and residential proxies are expensive compared to datacenter proxies. But by how much, exactly? The graph below illustrates the price differences between these three products. Simply put, a rotating datacenter proxy network will let you open 30 times as many pages as a similarly-priced mobile plan.

Of course, this comes at a cost: fewer locations and a significantly worse success rate with strict websites. Even in our limited-scale test (~2,600 connections), every third request with rotating datacenter proxies failed to reach Amazon. Running them with social media or Google wouldn’t have been a pretty sight:

ISP Proxies Face Issues with IP Databases, Inflate US Residential Proxy Pools

In most aspects, ISP proxies are very similar to datacenter proxy servers. But they do have one important difference: such IPs must be related to internet service providers that offer services to consumers.

This raises several challenges: 1) the provider may contract obscure regional ISPs – their IPs may not appear as residential in databases; 2) It takes time until an ISP announces new IPs on its network and the updates appear in databases.

We saw the effect of these challenges first hand. Each participant had the opportunity to hand-pick 100 ISP proxies for our tests. Even then, the latest (March) version of IP2Location still identified a good part of them as datacenter:

The same problem affected residential proxy networks, as well. In particular, providers tended to inflate their US pools with what we assume were ISP proxies. As a result, the same IP2Location identified up to a third of their IPs as non-residential:

While this may not necessarily affect you in real-world use, some websites care about IP reputation and could block such proxies more.

Self-Service Has Become a Necessity – Even for Premium Providers

Gone are the times when you had to fill out lengthy forms and wait for salesmen to get in touch. Today, most providers have on-boarding flows that require no interaction with people. Mobile proxy networks remain an outlier, but that’s because some participants treat them as beta or situational products. We expect things to change soon.

New Proxy Filtering Options Have Entered the Scene

After several relatively stagnant years, residential and mobile proxy networks are starting to see new features. In particular, it’s now possible to get proxies with ZIP code and OS filtering.

The features aren’t exactly new. 911 S5, the formerly popular proxy provider, had ZIP-level targeting for years. But legitimate businesses were reluctant to implement it. For now, the two providers that have it, Bright Data and Oxylabs, don’t advertise the option much – you can mostly find mentions in the documentation.

OS-level targeting came with Smartproxy’s mobile proxies in 2023. It’s a useful feature if you need to emulate a particular mobile system, and changing request headers isn’t enough.

For many, these features will be nice to have. But the need for geo-targeting has risen in general. SOAX reported that the share of requests with precise targeting has increased by 2.5 times – in some countries, by four to seven times.

Residential Proxies

Residential proxies are the most popular proxy type in our research – all 12 participants sell them. They’re also among the most used in general; and with websites continuing to close down, their role should increase further.

| Bright Data | GeoSurf | Infatica | IPRoyal | NetNut | Oxylabs |

|---|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| PacketStream | Rayobyte | Shifter | Smartproxy | SOAX | Webshare |

| ✅ | ✅ | ✅ | ✅ | ✅ | Not tested |

We’ll be looking at the advertised and actual pool sizes of these proxy networks, their performance in ideal conditions and with real targets, available features, and pricing strategies.

Proxy Pool

The comparison of advertised proxy pools shows four clear leaders: Oxylabs, Bright Data, Smartproxy, and Shifter. Their numbers haven’t changed for a while; as we’re dealing with dynamic residential IPs, they should be treated as rough monthly estimates.

Testing conditions: 1 million requests over 21 days, made from Germany, using the provider’s unfiltered proxy pool, to the nearest server of a global CDN (in relation to the proxy IP).

We can see that advertised numbers don’t translate accurately to practice. Shifter’s unfiltered pool returned fewer unique IPs than the much smaller SOAX. In the same way, PacketStream had fewer IPs than IPRoyal, despite advertising x3.5 proxies.

It’s important to note that some providers exclude specific locations from their unfiltered pool, which may impact the results. For example, you won’t find many US proxies when targeting Smartproxy’s random endpoint.

Some providers managed to grow their pools significantly: SOAX doubled its number, and Rayobyte grew over 10 times! Others, like PacketStream, Shifter, and IPRoyal, shed IPs from their unfiltered gateways.

Testing conditions: 500,000 requests over 14 days (or 140,000 over 7 days in Australia), made from Germany, using the provider’s country gateways, to the nearest server of a global CDN (in relation to the proxy IP).

The gap between proxy pools increased when we targeted specific high-demand locations. If Bright Data’s unfiltered pool was only twice larger compared to Infatica, it had eight times more US IPs.

Overall, Oxylabs, Smarproxy, and Bright Data clearly had the largest proxy networks. NetNut overperformed (especially in the US), and SOAX achieved more than expected, as well. On the other hand, PacketStream seems to be having a hard time.

Notice the two Rayobytes in the graph. For some reason, the majority of this provider’s proxies in Germany, France, and Australia weren’t actually from those countries. This was likely caused by a configuration error on Rayobyte’s end.

Percentage of proxies that the IP2Location database recognized as residential (ISP, ISP/MOB, and MOB categories).

| Unfiltered | US | UK | DE | FR | IN | AU | Provider average | |

|---|---|---|---|---|---|---|---|---|

| Bright Data | 98.12% | 99.10% | 99.76% | 98.90% | 97.95% | 97.97% | 98.27% | 98.58% |

| Smartproxy | 96.96% | 95.93% | 97.30% | 99.47% | 99.71% | 98.00% | 98.13% | 97.93% |

| Oxylabs | 96.95% | 96.23% | 97.40% | 97.80% | 98.26% | 97.97% | 97.81% | 97.49% |

| PacketStream | 95.80% | 86.58% | 96.16% | 95.92% | 97.29% | 97.40% | 91.24% | 94.34% |

| Rayobyte | 96.89% | 84.28% | 96.64% | 92.44% | 97.55% | 97.52% | 94.07% | 94.20% |

| SOAX | 96.08% | 61.51% | 99.41% | 97.80% | 98.28% | 96.18% | 99.15% | 92.63% |

| IPRoyal | 94.08% | 93.43% | 98.00% | 97.41% | 94.48% | 64.03% | 98.82% | 91.46% |

| NetNut | 91.11% | 95.51% | 89.87% | 71.01% | 86.97% | 91.71% | 83.39% | 87.08% |

| Shifter | 94.99% | 79.83% | 93.58% | 93.44% | 77.27% | 95.67% | 72.20% | 86.71% |

| GeoSurf | 93.24% | 62.83% | 80.40% | 90.07% | 86.53% | 95.12% | 88.38% | 85.22% |

| Infatica | 93.02% | 73.10% | 73.41% | 91.69% | 91.41% | 96.08% | 76.55% | 85.04% |

| Category average | 95.20% | 84.39% | 92.90% | 93.27% | 93.25% | 93.42% | 90.73% |

Though unwieldly, the table lets us see how many of the IPs we received were truly residential. Overall, Bright Data, Smartproxy, and Oxylabs had the cleanest proxy networks. On the other end, there’s GeoSurf, Infatica, NetNut, and Shifter with less than 90%.

SOAX was doing very well until we reached the US. In fact, this location had the lowest number of residential IPs overall, so let’s take a closer look at what happened.

It looks like the providers were trying to boost their pools with datacenter or lower quality ISP proxies. In all but a few cases, Ashburn was among the top locations, which is telling. Some of these proxies may become residential once IP databases update, but they can cause issues in the meantime.

Infrastructure Performance

Testing conditions: same as the pool test.

Let’s have a look at how well the residential proxy networks performed. We’ve been running Proxy Market Research for several years, so this gives us the benefit of historical comparison (at the expense of brevity – but you can click on data labels to hide).

Four providers can now connect successfully over 99% of the time. This is impressive and shows that infrastructure is no longer a major bottleneck (maybe except for major usage spikes like sneaker releases).

IPRoyal and NetNut performed the worst, but even then the success rate remained around 90% throughout three weeks. Something went horribly wrong with GeoSurf’s unfiltered proxy endpoint – the country pools did much better.

Response times have also improved – for some. Smartproxy and Oxylabs have become undisputed speed demons, breaking away from Bright Data. We can also see that SOAX, Shifter, and PacketStream have all made notable optimizations to their infrastructure.

At the same time, providers like NetNut and IPRoyal have actually become slower. NetNut has reduced its reliance on ISP proxies compared to 2022, which may have been the culprit.

Success rate comparison:

| Unfiltered | US | UK | DE | FR | IN | AU | |

|---|---|---|---|---|---|---|---|

| Bright Data | 99.17% | 98.87% | 99.27% | 99.32% | 99.43% | 99.29% | 99.37% |

| GeoSurf | 57.77% | 96.77% | 92.04% | 92.68% | 92.88% | 90.71% | 93.36% |

| Infatica | 95.95% | 97.96% | 97.60% | 98.76% | 98.07% | 96.62% | 98.31% |

| IPRoyal | 89.56% | 95.18% | 92.77% | 96.99% | 97.37% | 93.24% | 64.15% |

| NetNut | 93.52% | 96.65% | 79.10% | 79.50% | 77.87% | 58.36% | 97.51% |

| Oxylabs | 99.61% | 99.80% | 99.66% | 99.60% | 99.69% | 98.80% | 99.78% |

| PacketStream | 97.77% | 96.94% | 97.67% | 98.79% | 98.30% | 97.93% | 98.25% |

| Rayobyte | 98.34% | 98.43% | 98.93% | 98.77% | 98.46% | 98.46% | 98.94% |

| Shifter | 98.43% | 98.45% | 98.53% | 98.52% | 99.10% | 98.83% | 99.04% |

| Smartproxy | 99.43% | 99.71% | 99.63% | 99.60% | 99.66% | 98.72% | 99.71% |

| SOAX | 99.03% | 98.29% | 99.53% | 99.44% | 99.55% | 98.58% | 99.30% |

| Average | 93.51% | 97.91% | 95.88% | 96.54% | 96.40% | 93.59% | 95.25% |

Response time comparison:

| Unfiltered | US | UK | DE | FR | IN | AU | |

|---|---|---|---|---|---|---|---|

| Bright Data | 1.02 | 1.12 | 0.55 | 0.59 | 0.60 | 1.60 | 1.53 |

| GeoSurf | 5.18 | 1.48 | 2.73 | 2.68 | 2.69 | 3.21 | 2.79 |

| Infatica | 1.20 | 0.90 | 0.41 | 0.46 | 0.48 | 1.22 | 1.64 |

| IPRoyal | 3.73 | 2.50 | 1.70 | 1.57 | 1.52 | 2.58 | 4.10 |

| NetNut | 2.13 | 1.93 | 2.07 | 1.73 | 2.48 | 2.15 | 3.12 |

| Oxylabs | 0.57 | 0.72 | 0.40 | 0.42 | 0.38 | 1.47 | 1.19 |

| PacketStream | 1.15 | 0.85 | 0.91 | 0.92 | 0.88 | 1.47 | 1.49 |

| Rayobyte | 2.30 | 2.02 | 2.21 | 2.44 | 2.28 | 3.09 | 2.63 |

| Shifter | 0.88 | 1.00 | 0.80 | 0.49 | 0.44 | 1.06 | 1.44 |

| Smartproxy | 0.57 | 0.76 | 0.41 | 0.39 | 0.38 | 1.51 | 1.16 |

| SOAX | 1.05 | 0.95 | 0.55 | 0.64 | 0.55 | 1.81 | 1.65 |

| Average | 1.80 | 1.30 | 1.16 | 1.12 | 1.15 | 1.92 | 2.07 |

Performance with Popular Targets

Testing conditions: ~2,600 connection requests to each target, made from Germany, using the provider’s US proxies, fast rotation settings, and a custom non-headless script.

The line depicting success rate averages is much wavier than we expected it to be. Quite a few providers had trouble with the social media network and especially Google. Unfortunately, Bright Data and Oxylabs block the search engine, so we couldn’t see how these market leaders compare to the rest.

All things considered, SOAX and Infatica had the best showing. GeoSurf couldn’t handle Google at all, while IPRoyal displayed mediocre performance across the board.

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| SOAX | 99.06% | 0.82% | 0.11% | 3.76 |

| Infatica | 98.00% | 1.71% | 0.29% | 3.53 |

| Smartproxy | 97.43% | 0.77% | 1.80% | 3.27 |

| GeoSurf | 95.81% | 3.27% | 0.91% | 4.25 |

| Bright Data | 95.49% | 2.70% | 1.81% | 3.95 |

| Oxylabs | 94.33% | 0.67% | 5.00% | 3.31 |

| Shifter | 89.61% | 3.33% | 7.06% | 3.59 |

| NetNut | 92.74% | 3.06% | 4.20% | 4.37 |

| PacketStream | 89.08% | 5.38% | 5.54% | 3.60 |

| Rayobyte | 85.66% | 6.03% | 8.31% | 4.63 |

| IPRoyal | 85.45% | 9.64% | 4.91% | 5.22 |

| Average | 93.06% | 3.46% | 3.49% | 4.00 |

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| SOAX | 98.15% | 1.85% | 0.00% | 1.88 |

| Infatica | 95.21% | 4.79% | 0.00% | 1.65 |

| Rayobyte | 85.11% | 14.89% | 0.00% | 3.43 |

| Shifter | 83.23% | 16.77% | 0.00% | 1.79 |

| PacketStream | 78.71% | 21.29% | 0.00% | 1.72 |

| Smartproxy | 77.68% | 22.32% | 0.00% | 1.85 |

| NetNut | 70.37% | 29.63% | 0.00% | 2.68 |

| IPRoyal | 62.77% | 37.20% | 0.04% | 3.39 |

| GeoSurf | 19.40% | 80.60% | 0.00% | 2.61 |

| Bright Data | Blocked | |||

| Oxylabs | Blocked | |||

| Average | 76.25% | 23.75% | 0.00% | 2.35 |

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| SOAX | 99.55% | 0.45% | 0.00% | 1.67 |

| Smartproxy | 99.08% | 0.92% | 0.00% | 1.90 |

| Oxylabs | 98.98% | 1.02% | 0.00% | 1.50 |

| Bright Data | 98.04% | 1.96% | 0.00% | 1.98 |

| NetNut | 97.71% | 2.29% | 0.00% | 2.28 |

| Infatica | 96.24% | 3.76% | 0.00% | 1.45 |

| PacketStream | 85.38% | 14.62% | 0.00% | 1.49 |

| Shifter | 81.81% | 18.19% | 0.00% | 1.68 |

| Rayobyte | 76.21% | 23.79% | 0.00% | 2.85 |

| GeoSurf | 75.06% | 24.94% | 0.00% | 2.77 |

| IPRoyal | 73.43% | 26.57% | 0.00% | 3.39 |

| Average | 89.22% | 10.78% | 0.00% | 2.09 |

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| SOAX | 99.51% | 0.49% | 0.00% | 2.39 |

| Smartproxy | 99.41% | 0.59% | 0.00% | 1.98 |

| Oxylabs | 99.37% | 0.63% | 0.00% | 1.88 |

| Infatica | 98.76% | 1.24% | 0.00% | 2.14 |

| Shifter | 98.73% | 1.27% | 0.00% | 2.18 |

| NetNut | 97.37% | 2.63% | 0.00% | 3.29 |

| Rayobyte | 97.16% | 2.84% | 0.00% | 3.89 |

| Bright Data | 96.97% | 3.03% | 0.00% | 2.47 |

| GeoSurf | 95.96% | 4.04% | 0.00% | 3.20 |

| PacketStream | 93.28% | 6.72% | 0.00% | 2.18 |

| IPRoyal | 83.07% | 16.93% | 0.00% | 4.90 |

| Average | 94.84% | 5.16% | 0.00% | 2.78 |

Features

Everyone supports country filtering nowadays (though Shifter still charges for it!). While rarer, city targeting is also widely available, at least for enterprise clients. On the other hand, it’s still hard to access ISP-level filtering without conditions being imposed on you.

SOCKS5 is another feature residential proxy services aren’t keen on. The protocol has a lot of potential for abuse, and proxy sellers rarely offer it in full (for example, with UDP support or non-HTTP(S) ports).

* – extra cost, ** – select/enterprise clients. Scroll to see all columns.

| Location targeting | Rotation | SOCKS5 support | Authentication methods | Unlimited threads? | ||||||

| Country | City | ASN | ZIP code | Every request | Sessions | Custom duration | ||||

| Bright Data | ✅ | ✅* | ✅* | ✅* | ✅ | ✅ | With Proxy Manager | ✅ | 2 | ✅ |

| GeoSurf | ✅ | ✅* | ✅** | ❌ | ✅ | ✅ | 1, 10, 30 mins | ❌ | 2 | ✅ |

| Infatica | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | 5-60 mins | ✅ | 2 | ✅ |

| IPRoyal | ✅ | ✅ | ✅** | ❌ | ✅ | ✅ | 1 sec - 24 hrs | ✅ | 2 | ✅ |

| NetNut | ✅ | ✅* | ❌ | ❌ | ✅ | ✅ | ❌ | ✅ | 2* | ✅ |

| Oxylabs | ✅ | ✅ | ✅** | ✅ | ✅ | ✅ | 1-30 mins | ❌ | 2 | ✅ |

| PacketStream | ✅ | ❌ | ❌ | ❌ | ✅ | ✅ | ❌ | ❌ | Credentials | ✅ |

| Rayobyte | ✅ | ✅ | ❌ | ❌ | ✅ | ✅ | ❌ | ❌ | 2 | ✅ |

| Shifter | ✅* | ❌ | ❌ | ❌ | ❌ | ✅ | 5-60 mins | ✅ | IP whitelist | ✅ |

| Smartproxy | ✅ | ✅ | ❌ | ❌ | ✅ | ✅ | 1, 10, 30 mins | ❌ | 2 | ✅ |

| SOAX | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | 90-600 sec, custom | ✅ | 2 | ✅ |

A side-by-side comparison reveals that Bright Data’s residential proxies are feature-richest overall, while Infatica and SOAX offer the most out of the box.

On the other end, there’re Shifter, NetNut, and PacketStream, which have fallen behind in terms of features.

Pricing

As usual, most providers base their pricing on traffic as the main metric. Shifter is the only exception. This pricing structure reflects the broader market, though, in reality, it’s not that hard to find providers with different pricing formats.

Compared to 2022, more participants now offer the ability to use proxies without commitment, and we expect this trend to continue. It’s also relatively simple to try out the service without risk, though free trials are mostly paid or available for companies. In any case, this has reduced the barrier to entry significantly.

One more thing: notice how the graph with pay as you go doesn’t align perfectly with the entry price below $50? That’s because PacketStream requires depositing at least $50 – and there are more tricks to come.

| Pricing structure | Subscription | Pay as you go | Modifiers/ upsells | Self-service | Starting price | Trial | |

| Bright Data | Traffic | ✅ | ✅ | City/ASN/ZIP targeting, exclusive proxies | ✅ | $15 | 7 days for companies |

| GeoSurf | ✅ | ❌ | City, ASN targeting | ❌ | $300 | ❌ | |

| Infatica | ✅ | ❌ | ✅ | $96 | 100 MB for $1.99 | ||

| IPRoyal | ❌ | ✅ | ✅ | $7 | ❌ | ||

| NetNut | ✅ | ❌ | City targeting, IP whitelist | ✅ | $100 | 7 days for companies | |

| Oxylabs | ✅ | ✅ | ✅ | $15 | 7 days for companies | ||

| PacketStream | ❌ | ✅ | ✅ | $50 | ❌ | ||

| Rayobyte | ❌ | ✅ | ✅ | $15 | 50 MB no KYC | ||

| Shifter | Ports | ✅ | ❌ | Country, state targeting | ✅ | $100 | 3-day refund |

| Smartproxy | Traffic | ✅ | ✅ | ✅ | $12.5 | 3-day refund | |

| SOAX | Traffic + ports | ✅ | ❌ | ✅ | $99 | 100 MB for $1.99 |

Cost per gigabyte for different amounts of traffic (with pay as you go or a monthly subscription):

| 5 GB | 20 GB | 50 GB | 100 GB | 250 GB | 500 GB | 1,000 GB | |

|---|---|---|---|---|---|---|---|

| Bright Data | $15 | $15 | $11.48 | $10.13 | $9.45 | $9.45 | Custom |

| Bright Data (+city/ASN) | $30 | $30 | $22.96 | $20.26 | $18.90 | $18.90 | Custom |

| GeoSurf | - | $12 | $8 | $7 | Custom | Custom | Custom |

| Infatica | - | $12 | $9 | $7 | $7 | $6 | $3.5 |

| IPRoyal | $5.95 | $5.25 | $4.90 | $4.55 | $4.20 | $3.50 | $3.15 |

| NetNut | $20 | $15 | $12 | $8 | $6.5 | $5 | $4 |

| Oxylabs | $15 | $15 | $12 | $8 | $7 | $6 | $4 |

| PacketStream | - | - | $1 | $1 | $1 | $1 | $1 |

| Rayobyte | $15 | $12.50 | $7 | $6 | $5 | $4 | $3 |

| Smartproxy | $12.5 | $10 | $8 | $7 | $6 | $5 | $4 |

| SOAX | - | $12 | $11 | $7 | $7 | $5 | $4 |

| Average (excl. Bright Data's premium) | $13.90 | $11.75 | $8.34 | $6.57 | $5.91 | $4.99 | $3.33 |

Residential proxies are pretty expensive at the beginning, but they tend to scale well. At one terabyte, you’ll be paying a quarter of the price per unit.

Compared to the year before, we can see several changes. First, Bright Data has significantly reduced its prices at the entry level. IPRoyal, on the other hand, more than doubled its rates along the full pricing range.

| 5 GB | 20 GB | 50 GB | 100 GB | 250 GB | 500 GB | 1,000 GB | |

|---|---|---|---|---|---|---|---|

| Bright Data | -40% | -40% | -8.16% | +1.30% | -5.5% | ||

| IPRoyal | +105% | +95% | +95% | +117% | +95% | +133% | +163% |

| NetNut | +11% | ||||||

| Oxylabs | -11% | -20% | |||||

| Smartproxy | -16.7% | ||||||

| SOAX | +22% |

Despite the huge price hike, IPRoyal remains among the cheapest options until enterprise-level scale, and Bright Data costs the most. PacketStream is the undisputed price leader on paper, but there’s a huge catch: during our tests, its system overcounted traffic use by 8 to 10 times. This is not only deceptive but also pricey!

Here’s our evaluation based on the covered aspects. Hover on provider names to highlight, click to filter.

Mobile Proxies

Mobile proxies are less popular than residential addresses – especially networks that are based on peer-to-peer infrastructure and not mobile device farms. They have a specialist role for mobile-related uses or fringe cases where even residential proxies can’t cut it. 6 out of 12 participants sell mobile proxy servers publicly, and GeoSurf does custom setups for enterprise clients.

| Bright Data | GeoSurf | Infatica | IPRoyal | NetNut | Oxylabs |

|---|---|---|---|---|---|

| ✅ | ✅ | ❌ | Device farm, not tested | ✅ | ✅ |

| PacketStream | Rayobyte | Shifter | Smartproxy | SOAX | Webshare |

| ❌ | ✅ | ❌ | ✅ | ✅ | ❌ |

This section follows the same structure as the residential part, only on a smaller scale.

Proxy Pool

Oxylabs has by far the biggest advertised proxy network. NetNut and Smartproxy launched their product within a year, but the latter provider already boasts 10 million IPs. Otherwise, the numbers haven’t changed since 2022.

Testing conditions: 280,000 requests over 14 days, made from Germany, using the provider’s unfiltered proxy pool, to the nearest server of a global CDN (in relation to the proxy IP).

Surprisingly, SOAX had more unique IPs than its larger competitors. Even more surprisingly, NetNut beat everyone with its smallest proxy network on paper. However, let’s suspend our judgements until we see country-specific results and the pool’s composition.

GeoSurf failed to make the graph because it gave us only US IPs.

Testing conditions: 280,000 requests over 14 days (or 140,000 over 7 days in Australia), made from Germany, using the provider’s country gateways, to the nearest server of a global CDN (in relation to the proxy IP).

The test with country gateways paints a different picture. Oxylabs and Smartproxy dominate with large and balanced proxy networks. SOAX too manages to impress.

NetNut’s proxies were predominantly concentrated in the UK. The provider didn’t want us to test its US pool. On the other hand, American IPs were all that GeoSurf had. They obviously came from dedicated devices and didn’t even rotate. This is a strange decision – last year Rayobyte showed us that a limited number of devices can generate a lot of IPs over longer periods.

Bright Data, unfortunately, disappointed. Its EarnApp and BrightVPN bandwidth-sharing apps weren’t on app stores at the time of testing, which could’ve affected the numbers. In any case, we can easily see the network overloaded by demand.

Percentage of proxies that the IP2Location database recognized as mobile (ISP/MOB and MOB categories).

| Unfiltered | US | UK | DE | FR | IN | AU | Provider average | |

|---|---|---|---|---|---|---|---|---|

| Rayobyte | 96.87% | 99.87% | 99.87% | 100% | 98.37% | 99.63% | 100% | 99.23% |

| Smartproxy | 96.33% | 97.45% | 98.86% | 99.01% | 98.34% | 99.29% | 94.53% | 97.69% |

| Oxylabs | 95.68% | 99.73% | 99.80% | 99.69% | 97.02% | 99.85% | 88.96% | 97.25% |

| Bright Data | 97.67% | 94.61% | 98.58% | 96.41% | 94.96% | 99.63% | 94.19% | 96.58% |

| SOAX | 98.02% | 99.70% | 99.72% | 99.11% | 98.06% | 99.91% | 81.07% | 96.51% |

| NetNut | 26.87% | - | 62.52% | 50.45% | 66.54% | 91.93% | 34.11% | 55.40% |

| GeoSurf | - | 99.61% | - | - | - | - | - | 99.61% |

| Category average | 85.24% | 98.50% | 93.23% | 90.78% | 92.22% | 98.37% | 82.14% |

Compared to residential IPs, the mobile proxy networks were either very truthful to their claims, or not at all. Thankfully, most participants didn’t lie about the nature of their IPs.

The one provider that did was NetNut. Three in four of its proxies in the unfiltered pool weren’t actually mobile, and India turned out to be the only accurately represented locations. Not great.

Infrastructure Performance

Testing conditions: same as the pool test.

Once again, we had the benefit of testing most participants for several years in a row. Let’s graph their results, beginning with infrastructure success rate:

There’s not much to comment: all providers maintained a success rate of over 95%, which is good. Rayobyte has made the biggest improvements year over year, but its starting point wasn’t exactly impressive.

What the graph fails to show is that some providers had huge deviations in particular locations: Bright Data in the US and Rayobyte in Australia. You’ll find performance tables in the country-coded tabs next to this one.

The response time graph is more interesting. All participants managed to significantly decrease it – SOAX effectively doubled in speed! Once again, Rayobyte has made the biggest improvement, but it remains much slower than the fastest competitors.

| Unfiltered | US | UK | DE | FR | IN | AU | |

|---|---|---|---|---|---|---|---|

| Bright Data | 98.06% | 54.62% | 94.17% | 91.80% | 98.88% | 97.95% | 97.33% |

| GeoSurf | - | 96.89% | - | - | - | - | - |

| NetNut | 95.68% | - | 81.44% | 80.88% | 80.43% | 95.69% | 98.10% |

| Oxylabs | 97.88% | 98.31% | 97.89% | 97.95% | 97.72% | 97.30% | 97.91% |

| Rayobyte | 97.47% | 97.82% | 97.97% | 98.24% | 96.55% | 96.75% | 21.83% |

| Smartproxy | 97.37% | 98.28% | 97.80% | 99.05% | 98.73% | 98.47% | 97.32% |

| SOAX | 98.22% | 98.50% | 98.31% | 98.16% | 98.13% | 96.98% | 98.73% |

| Average | 97.45% | 90.73% | 94.60% | 94.35% | 95.07% | 97.19% | 85.20% |

| Unfiltered | US | UK | DE | FR | IN | AU | |

|---|---|---|---|---|---|---|---|

| Bright Data | 1.81 | 4.79 | 1.34 | 2.05 | 1.19 | 2.46 | 2.21 |

| GeoSurf | - | 1.28 | - | - | - | - | - |

| NetNut | 2.27 | - | 1.80 | 1.68 | 1.89 | 2.48 | 3.39 |

| Oxylabs | 1.10 | 1.47 | 0.92 | 0.83 | 0.88 | 2.08 | 2.08 |

| Rayobyte | 2.83 | 2.38 | 3.05 | 2.11 | 2.18 | 3.63 | 3.16 |

| Smartproxy | 1.12 | 1.69 | 0.93 | 0.85 | 0.87 | 2.13 | 2.14 |

| SOAX | 1.72 | 1.60 | 1.40 | 1.33 | 1.37 | 2.33 | 2.02 |

| Average | 1.81 | 2.20 | 1.57 | 1.47 | 1.40 | 2.52 | 2.50 |

Performance with Popular Targets

Testing conditions: ~2,600 connection requests to each target, made from Germany, using the provider’s US proxies, fast rotation settings, and a custom non-headless script.

The target benchmarks didn’t cause many issues. One exception was Google – NetNut’s proxies failed to open it a quarter of the time. Other than that, most providers performed well.

Bright Data was an unfortunate exception. It’s not like the proxies were bad – quite the opposite. However, the infrastructure couldn’t assign them half of the time because there simply weren’t any free IPs left. The majority of the error codes were 502, or no peers.

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| GeoSurf | 97.30% | 2.70% | 0.00% | 4.78 |

| SOAX | 97.15% | 2.85% | 0.00% | 4.50 |

| Smartproxy | 96.27% | 3.73% | 0.00% | 4.42 |

| Rayobyte | 92.19% | 5.07% | 2.74% | 6.55 |

| NetNut | 90.68% | 2.88% | 6.44% | 4.38 |

| Oxylabs | 89.09% | 4.51% | 6.40% | 4.45 |

| Bright Data | 45.89% | 54.11% | 0.00% | 4.88 |

| Average | 86.94% | 10.83% | 2.23% | 4.85 |

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| SOAX | 95.78% | 4.22% | 0.00% | 2.67 |

| Smartproxy | 94.95% | 5.05% | 0.00% | 2.66 |

| Rayobyte | 92.19% | 5.07% | 2.74% | 6.55 |

| GeoSurf | 89.39% | 10.61% | 0.00% | 2.27 |

| NetNut | 72.65% | 27.35% | 0.00% | 2.72 |

| Bright Data | Blocked | |||

| Oxylabs | Blocked | |||

| Average | 87.17% | 12.83% | 0.00% | 2.44 |

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| GeoSurf | 98.39% | 1.61% | 0.00% | 1.97 |

| NetNut | 98.25% | 1.75% | 0.00% | 2.29 |

| SOAX | 98.11% | 1.89% | 0.00% | 2.40 |

| Smartproxy | 97.57% | 2.43% | 0.00% | 2.38 |

| Oxylabs | 97.02% | 2.98% | 0.00% | 2.32 |

| Rayobyte | 96.09% | 3.91% | 0.00% | 4.51 |

| Bright Data | 46.99% | 53.01% | 0.00% | 4.53 |

| Average | 90.35% | 9.65% | 0.00% | 2.92 |

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| SOAX | 98.44% | 1.56% | 0.00% | 3.26 |

| GeoSurf | 97.69% | 2.31% | 0.00% | 2.97 |

| NetNut | 97.58% | 2.42% | 0.00% | 3.57 |

| Rayobyte | 95.92% | 4.08% | 0.00% | 6.04 |

| Oxylabs | 95.52% | 4.48% | 0.00% | 3.02 |

| Smartproxy | 92.28% | 7.72% | 0.00% | 3.14 |

| Bright Data | 33.05% | 66.95% | 0.00% | 5.54 |

| Average | 85.41% | 14.59% | 0.00% | 4.07 |

Features

Mobile proxies are often used for work with localized content and social media management, so they need to have flexible filtering options. Over half of the participants allow selecting a city or ASN. Only Bright Data offers ZIP-level targeting with mobile proxies for now, which is a novel feature among major providers.

Everyone supports quick IP rotation, which is a distinguishing feature of peer-to-peer mobile proxies. Alternatively, there’s a way to establish sticky sessions, but they won’t be as durable or predictable as when using a mobile device farm.

That said, very few providers have SOCKS5 as an option. That may be due to traffic limitations and the sensitive nature of sourcing mobile addresses.

* – extra cost. Scroll to see all columns.

| Location targeting | Rotation | SOCKS5 support | Authentication methods | Unlimited threads? | |||||||

| Country | City | ASN | ZIP code | OS | Every request | Sessions | Custom duration | ||||

| Bright Data | ✅ | ✅* | ✅* | ✅* | ❌ | ✅ | ✅ | With Proxy Manager | ✅ | 2 | ✅ |

| GeoSurf | ❌ | ❌ | ❌ | ❌ | ❌ | ✅ | ❌ | ❌ | ❌ | Credentials | ✅ |

| NetNut | ✅ | ❌ | ❌ | ❌ | ❌ | ✅ | ✅ | ❌ | ✅ | 2* | ✅ |

| Oxylabs | ✅ | ❌ | ✅ | ❌ | ❌ | ✅ | ✅ | 1-30 mins | ❌ | 2 | ✅ |

| Rayobyte | ✅ | ✅ | ❌ | ❌ | ❌ | ✅ | ✅ | ❌ | ❌ | Credentials | ✅ |

| Smartproxy | ✅ | ❌ | ✅ | ❌ | ✅ | ✅ | ✅ | 1, 10, 30 mins | ❌ | 2 | ✅ |

| SOAX | ✅ | ✅ | ✅ | ❌ | ❌ | ✅ | ✅ | 90-600 sec, custom | ✅ | 2 | ✅ |

Bright Data checks all the boxes, even if some of its features come as upsells. SOAX is the second in line, and it offers everything without reservations.

For some reason, Oxylabs and Smartproxy have ASN but not city-level targeting. The latter provider is also the only one to allow specifying a particular operating system (either Android or iOS). It may be possible to replicate with Bright Data, but you’d need to use extra software (Proxy Manager).

Pricing

Like residential proxies, mobile proxy networks charge for traffic use. However, they’re obviously oriented more toward companies than individual users.

One giveaway is the lack of paying as you go. Then, there’s the fact that only one service starts below $50. And finally, most providers offer a way to test their service risk-free.

| Pricing structure | Subscription | Pay as you go | Modifiers/upsells | Starting price | Self-service | Trial | |

|---|---|---|---|---|---|---|---|

| Bright Data | Traffic | ✅ | ✅ | City/ASN/ZIP targeting, exclusive proxies | $40 | ✅ | 7 days for companies |

| GeoSurf | ✅ | ❌ | Custom | ❌ | ❌ | ||

| NetNut | ✅ | ❌ | State/city targeting, whitelisted IPs | $300 | ✅ | 7 days for companies | |

| Oxylabs | ✅ | ❌ | $250 | ❌ | 7 days for companies | ||

| Rayobyte | ✅ | ❌ | $50 | ❌ | ❌ | ||

| Smartproxy | ✅ | ❌ | $50 | ✅ | 3-day refund | ||

| SOAX | Traffic + ports | ✅ | ❌ | $99 | ✅ | 100 MB for $1.99 |

Cost per gigabyte for different amounts of traffic (with pay as you go or a monthly subscription):

| 5 GB | 10 GB | 20 GB | 50 GB | 100 GB | |

|---|---|---|---|---|---|

| Bright Data | $40/GB | $40/GB | $34/GB | $30/GB | $28/GB |

| Bright Data (+city/ASN) | $80/GB | $80/GB | $68/GB | $60/GB | $56/GB |

| GeoSurf | Custom | Custom | Custom | Custom | Custom |

| NetNut | - | $30/GB | - | $19/GB | - |

| Oxylabs | - | $25/GB | $22/GB | $19/GB | $17/GB |

| Rayobyte | $25/GB | $25/GB | $20/GB | $20/GB | $15/GB |

| Smartproxy | $25/GB | $23/GB | $20/GB | $18/GB | $16/GB |

| SOAX | $33/GB | $30/GB | $26/GB | $26/GB | $25/GB |

| Average (excl. Bright Data's premium) | $30.75/GB | $28.83/GB | $24.4/GB | $22/GB | $20.2/GB |

When reviewing the table, two things spring to mind: 1) mobile proxies still cost a lot, and 2) they scale worse than residential proxies. The 100 GB plans all cost above 1,000 dollars, and providers don’t bother putting terabyte-sized plans on public display.

Bright Data is obviously the most expensive, especially if you get the premium features. SOAX has also become among the pricier options, while NetNut’s pricing is strongly biased toward bulk purchases. Smartproxy offers probably the best cost-to-value ratio.

The providers have also made some pricing changes throughout the year. Bright Data has become significantly cheaper at the lower end (imagine how much it used to cost!), and Oxylabs reduced the rates further up the pricing range:

| 5 GB | 10 GB | 20 GB | 50 GB | 100 GB | |

|---|---|---|---|---|---|

| Bright Data | -33.3% | -33.3% | +13.3% | +7% | |

| Oxylabs | -12% | -13.5% | -15% |

Here’s our evaluation based on the covered aspects. Hover on provider names to highlight, click to filter.

Rotating Datacenter Proxies

Rotating datacenter proxies are the thrifty man’s choice for web scraping. They provide access to a large pool of IPs – while not exactly top-class, they can still open the majority of webpages. The number of such pages grows smaller every year, but rotating datacenter proxies aren’t going anywhere yet. On the opposite: they appeared in the line-ups of Oxylabs and Rayobyte, and Smartproxy gave its product welcome improvements in 2022.

| Bright Data | GeoSurf | Infatica | IPRoyal | NetNut | Oxylabs |

|---|---|---|---|---|---|

| ✅ | ❌ | ❌ | ❌ | ✅ | ✅ |

| PacketStream | Rayobyte | Shifter | Smartproxy | SOAX | Webshare |

| ❌ | ✅ | ❌ | ✅ | ❌ | ✅ |

A few notes: Rayobyte’s product is still in beta, so we can expect things to change. And Webshare doesn’t really sell pool-based datacenter proxies. However, you can buy any number of IPs and easily generate a rotating endpoint using the dashboard.

Proxy Pool

Datacenter proxy networks are generally much smaller than their residential or mobile counterparts. But it’s not really a fair comparison: datacenter IPs are nearly always online, so you can expect the advertised numbers to better represent reality.

Even then, it’s not always easy to see how many proxies you’ll get in a specific location. For example, Smartproxy doesn’t specify the number of US IPs in its pool. Bright Data generates a pool with 20,000 IPs from dozens of locations chosen randomly.

The situation is clearer with Rayobyte – the provider only sells US proxies for now. NetNut also offers American IPs, but its communication is all over the place. The marketing page advertises 150,000 proxies, while the dashboard only mentions 50,000. It’s frankly confusing.

Oxylabs takes a neat middle path: its US pool comprises 20,000 IPs, while the other 14 locations have either 1,000 or 2,000 proxies in them.

Infrastructure Performance

Testing conditions: 50,000 connection requests over 5 days, made from Germany, using the provider’s US proxy pool, to the nearest server of a global CDN (in relation to the proxy IP).

| Provider | Success rate | Avg. response time |

|---|---|---|

| Bright Data | 99.95% | 0.80 |

| NetNut | 49.30% | 2.66 |

| Oxylabs | 99.98% | 0.63 |

| Rayobyte | 99.89% | 0.93 |

| Smartproxy | 99.93% | 0.80 |

| Webshare | 99.95% | 1.31 |

Good datacenter proxies rarely fail on their own. We’re happy to see that most providers have quality infrastructure. Only NetNut faced serious issues during the testing period, which caused every second request to fail.

The response time metrics were more varied; let’s visualize them with a graph:

Overall, Oxylabs was around twice faster than Webshare, and four times if we compared it to NetNut. The three other providers had very similar response times.

Testing conditions: 10 random US proxies tested on DigitalOcean’s NYC 100 MB speed benchmark. Baseline – download speed without proxies.

| Avg. download speed | Percentage of baseline | |

|---|---|---|

| Bright Data | 131.60 Mbps | 94.04% |

| Webshare | 124.48 Mbps | 88.89% |

| Smartproxy | 102.96 Mbps | 73.59% |

| Oxylabs | 98.96 Mbps | 70.74% |

| Rayobyte | 52.08 Mbps | 37.19% |

| NetNut | 6.16 Mbps | 4.38% |

The shared rotating proxies were no slouches on average, even if most providers had a slow IP or two in their selections. To be fair, the sample size was pretty small. But based on this data, we wouldn’t use NetNut for traffic-intensive tasks – Bright Data or Webshare would be a better fit.

Performance with Popular Targets

Testing conditions: ~2,600 connection requests to each target, made from Germany, using the provider’s US proxies and a custom non-headless script.

Bright Data, Rayobyte, and Webshare had a tough time accessing Amazon. This is partially understandable – the proxies are cheap, recycled, and Amazon is a desirable target. That said, the other three providers could scrape it with a relatively high success rate.

Homedepot gave fewer problems to all but Smartproxy. Walmart proved an easy target to all. Overall, Oxylabs and NetNut showed the best and most consistent results.

| Provider | Success rate | Errors | Blocks | Avg. response time |

|---|---|---|---|---|

| Smartproxy | 91.94% | 3.65% | 4.41% | 3.11 |

| NetNut | 90.27% | 0.48% | 9.26% | 3.60 |

| Oxylabs | 89.92% | 2.66% | 7.42% | 2.98 |

| Bright Data | 52.46% | 3.80% | 43.74% | 2.85 |

| Webshare | 42.59% | 11.13% | 46.28% | 3.21 |

| Rayobyte | 32.67% | 17.05% | 50.28% | 2.57 |

| Average | 66.64% | 6.46% | 26.90% | 3.05 |

| Provider | Success rate | Errors | Blocks | Avg. response time |

|---|---|---|---|---|

| Rayobyte | 96.72% | 3.28% | 0.00% | 1.97 |

| Oxylabs | 92.01% | 7.99% | 0.00% | 1.27 |

| NetNut | 89.21% | 10.79% | 0.00% | 1.75 |

| Bright Data | 80.33% | 19.67% | 0.00% | 1.45 |

| Webshare | 78.64% | 21.36% | 0.00% | 2.11 |

| Smartproxy | 27.42% | 72.58% | 0.00% | 1.51 |

| Average | 77.38% | 22.61% | 0.00% | 1.68 |

| Provider | Success rate | Errors | Blocks | Avg. response time |

|---|---|---|---|---|

| Smartproxy | 100.00% | 0.00% | 0.00% | 1.62 |

| Bright Data | 99.97% | 0.03% | 0.00% | 1.82 |

| Rayobyte | 99.92% | 0.08% | 0.00% | 2.34 |

| Oxylabs | 99.61% | 0.39% | 0.00% | 1.47 |

| NetNut | 99.27% | 0.73% | 0.00% | 2.65 |

| Webshare | 95.88% | 4.12% | 0.00% | 3.10 |

| Average | 99.11% | 0.89% | 0.00% | 2.17 |

Features

Rotating datacenter proxies are straightforward when it comes to features. Their essence is to provide quickly switching IPs (rotation every request) to send a large number of requests (unlimited threads) to targets that don’t serve hyper-localized content (no city targeting) and have no strong protection (datacenter IPs).

Scroll to see all columns.

| Countries | Location targeting | Rotation | SOCKS5 support | Authentication methods | Unlimited threads? | ||||

| Country | City | Every request | Sessions | Custom duration | |||||

| Bright Data | 100 | ✅ | ❌ | ✅ | ✅ | With Proxy Manager | ✅ | 2 | ✅ |

| NetNut | US | ✅ | ❌ | ✅ | ✅ | ❌ | ✅ | Credentials | ✅ |

| Oxylabs | 15 | ✅ | ❌ | ✅ | ✅ | 30 mins | ❌ | Credentials | ✅ |

| Rayobyte | US | ❌ | ❌ | ✅ | ❌ | ❌ | ❌ | 2 | ✅ |

| Smartproxy | 5 | ✅ | ❌ | ✅ | ✅ | 30 mins | ❌ | Credentials | ✅ |

| Webshare | 40 | ✅ | ❌ | ✅ | ✅ | ❌ | ✅ | 2 | Extra fee |

All participants have similar baseline features, so it’s probably wise to compare them by available locations and IPs there.

Some may care about SOCKS5 availability or supported authentication methods. If these are dealbreakers to you, Bright Data or Webshare will probably be the best options.

Pricing

Surprisingly few providers offer the ability to pay as you go. You’d think that would be a given with budget-conscious datacenter proxies, but maybe it makes more financial sense to offer subscriptions instead. There’s self-service to compensate.

Some providers have plans that cost over $50. This is a lot considering the product. In this context, the wide availability of a trial or refund option is understandable. Webshare’s version of a trial is actually a free plan with 10 IPs that you can use without time limits.

| Pricing structure | Subscription | Pay as you go | Price modifiers/ upsells | Starting price | Self-service | Trial | |

|---|---|---|---|---|---|---|---|

| Bright Data | Traffic | ✅ | ✅ | $0.65 | ✅ | 7 days for companies | |

| NetNut | ✅ | ❌ | $100 | ✅ | 7 days for companies | ||

| Oxylabs | ✅ | ❌ | $50 | ✅ | ❌ | ||

| Rayobyte | ❌ | ✅ | $0.65 | ❌ | 2-day refund | ||

| Smartproxy | ✅ | ❌ | $30 | ✅ | 3-day refund | ||

| Webshare | Pay per IP | ✅ | ❌ | More traffic, IP replacements, threads, network priority | $1 | ✅ | Free plan |

* 5,000 IPs, 500 threads, one refresh

| 50 GB | 100 GB | 250 GB | 500 GB | 1,000 GB | |

|---|---|---|---|---|---|

| Bright Data | $0.65/GB | $0.65/GB | $0.65/GB | $0.57/GB | $0.55/GB |

| NetNut | - | $1/GB | $0.74/GB | $0.70/GB | $0.50/GB |

| Oxylabs | - | $0.65/GB | $0.6GB | $0.55/GB | $0.50/GB |

| Rayobyte | $0.67/GB | $0.60/GB | $0.55/GB | $0.50/GB | $0.40/GB |

| Smartproxy | $0.7/GB | $0.65/GB | $0.55/GB | $0.53/GB | $0.50/GB |

| Webshare* | - | - | $0.57/GB | $0.57/GB | $0.20/GB |

| Average | $0.67/GB | $0.71/GB | $0.61/GB | $0.57/GB | $0.44/GB |

Rotating datacenter proxies are cheap compared to other proxy types. 50 GBs of traffic will cost you $34 on average.

NetNut is the most expensive choice; it only catches up at terabytes of data. With its current pricing, Rayobyte undercuts everyone across the board. The others offer similar rates.

Webshare’s pricing model is based primarily on IPs and doesn’t value traffic much, which is why the price decrease between 500 GBs and 1 TB is so stark.

Here’s our evaluation based on the covered aspects. Hover on provider names to highlight, click to filter.

Dedicated Datacenter Proxies

Dedicated datacenter proxies are underrepresented in our research compared to the broader market. That’s because of our bias towards residential proxy services – to this day, many companies tend to sell one or the other. Still, 6 out of 12 providers offer dedicated IPs publicly, and NetNut does custom setups for its clients (which seems to be a trend with Israeli providers).

| Bright Data | GeoSurf | Infatica | IPRoyal | NetNut | Oxylabs |

|---|---|---|---|---|---|

| ✅ | ❌ | ❌ | ✅ | ✅ | ✅ |

| PacketStream | Rayobyte | Shifter | Smartproxy | SOAX | Webshare |

| ❌ | ✅ | Not tested | ✅ | ❌ | ✅ |

It’s hard to authoritatively evaluate IP-based proxy services because so much depends on the servers you get. We tested 100 US proxies, which translates to what – 1% or maybe even 0.1% percent of the provider’s stock? But even this scale can give us useful insights, while aspects like features or pricing apply more universally.

Infrastructure Performance

Testing conditions: 10 random proxies tested on DigitalOcean’s NYC 100 MB speed benchmark. Baseline – download speed without proxies.

| Avg. download speed | Percentage of baseline | |

|---|---|---|

| Bright Data | 123.44 Mbps | 88.22% |

| Webshare | 80.80 Mbps | 57.73% |

| Rayobyte | 62.96 Mbps | 44.98% |

| Oxylabs | 53.20 Mbps | 38.03% |

| IPRoyal | 43.28 Mbps | 30.95% |

| Smartproxy | 32.88 Mbps | 23.47% |

| NetNut | 4.96 Mbps | 3.54% |

Some of the proxies were very fast. The 10 Bright Data’s proxy servers we tested barely slowed down our connection.

The others – not so much. NetNut’s infrastructure performed especially poorly. The slowest proxy server had a download speed of 0.16 MB/s, and we simply had to quit the test to protect our sanity.

Performance with Popular Targets

Testing conditions: ~2,600 connection requests to each target, made from Germany, using the provider’s US proxies and a custom non-headless script.

As expected, Amazon gave the dedicated proxies the most trouble. Bright Data performed poorly, meaning that someone had already used (and maybe abused) these IPs on the website before. Webshare’s proxies faced some challenges, too.

On the other hand, Oxylabs, Rayobyte, and Smartproxy achieved over 90% success with all targets, which speaks well for the quality of their proxies.

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| Smartproxy | 94.95% | 1.83% | 3.22% | 2.93 |

| NetNut | 93.92% | 0.06% | 6.03% | 3.42 |

| Oxylabs | 92.32% | 3.62% | 4.06% | 2.75 |

| Rayobyte | 91.28% | 0.43% | 8.29% | 3.09 |

| IPRoyal | 82.63% | 0.78% | 16.59% | 2.51 |

| Webshare | 74.17% | 5.77% | 20.06% | 3.02 |

| Bright Data | 56.19% | 8.69% | 35.12% | 2.48 |

| Average | 83.64% | 3.03% | 13.34% | 2.88 |

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| Oxylabs | 100.00% | 0.00% | 0.00% | 1.01 |

| IPRoyal | 99.37% | 0.63% | 0.00% | 0.88 |

| Rayobyte | 98.97% | 1.03% | 0.00% | 1.32 |

| Smartproxy | 98.91% | 1.09% | 0.00% | 1.18 |

| Bright Data | 94.62% | 5.38% | 0.00% | 1.22 |

| NetNut | 87.06% | 12.91% | 0.00% | 1.44 |

| Webshare | 74.39% | 25.61% | 0.00% | 1.53 |

| Average | 93.33% | 6.66% | 0.00% | 1.23 |

| Success rate | Errors | Blocks | Response time | |

|---|---|---|---|---|

| Rayobyte | 100.00% | 0.00% | 0.00% | 1.43 |

| Oxylabs | 99.97% | 0.03% | 0.00% | 1.15 |

| Bright Data | 99.87% | 0.13% | 0.00% | 1.48 |

| Smartproxy | 99.81% | 0.19% | 0.00% | 1.33 |

| NetNut | 99.75% | 0.25% | 0.00% | 2.28 |

| Webshare | 99.41% | 0.59% | 0.00% | 1.63 |

| IPRoyal | 99.14% | 0.86% | 0.00% | 1.06 |

| Average | 99.71% | 0.29% | 0.00% | 1.48 |

Features

The beauty of dedicated datacenter proxies lies in the few limitations they have. You get unlimited traffic and threads to make use of it. And it’s easy to enable the SOCKS5 protocol due to fewer ethical and technical constraints.

You can also refresh your IP list – in some cases, without paying anything. City-targeted proxies are the only thing that’s harder to get, with or without paying. Even then, finding IPs in non-capital cities of smaller countries like Belgium is nearly impossible.

Scroll to see all columns.

| Countries | Country distribution | Targeting level | Unlimited traffic? | Unlimited targets? | Unlimited threads? | Authentication methods | IP refresh | SOCKS5 support | |

|---|---|---|---|---|---|---|---|---|---|

| Bright Data | 98 | Free to choose | City | Optionally | One, more paid | ✅ | 2 | Individual IPs | ✅ |

| IPRoyal | ~30 | One per plan | Country | ✅ | ✅ | ✅ | 2 | Full list | ✅ |

| NetNut | U.S. | - | Country | ✅ | ✅ | ✅ | 2 | ||

| Oxylabs | 188 | As agreed with support | City | ✅ | ✅ | ✅ | 2 | As agreed | ✅ |

| Rayobyte | 26 | One per plan | City (some locations) | ✅ | ✅ | ✅ | 2 | Full list, individual IPs | ✅ |

| Smartproxy | U.S. | - | Country | ✅ | ✅ | ✅ | 2 | Full list | ✅ |

| Webshare | ~30 | Free to choose | Country | Optionally | ✅ | 500-3,000 | 2 | Full list (auto, manual), individual IPs | ✅ |

Oxylabs and Bright Data have datacenter IPs in a staggering number of locations. We’re not sure how it’s possible (and whether it’s necessary) to maintain a presence in 188 countries, but maybe there’s a business need aside from bragging rights.

IPRoyal, Webshare, and Rayobyte all gravitate around 30 countries, which is also impressive in the broader context. NetNut and Smartproxy focus on the US for now.

If you need proxies from several locations at once, it’s easier if the provider lets you get them with one plan. Some don’t, and we question whether that’s a business decision or simply an outdated tech stack.

Approaches to refreshing proxies also differ. Smartproxy and IPRoyal simply let you get a new list after the billing period. Bright Data and Rayobyte offer the ability to change individual proxies whenever you wish. Webshare’s system supports individual refreshes, on-demand full refreshes, and even automatic refreshes where you can choose the frequency – up to every five minutes!

Pricing

Nowadays, it’s easy to buy datacenter proxies through self-service. It’s also easy to get a trial or refund – but mostly if you register with a company account. Otherwise, you’ll have to make do with a limited refund option. Finally, most providers offer plans starting below $50. These three features make it easy to get going.

Half of the providers allow replacing proxies without paying extra. This feature is important with dedicated datacenter addresses, as you can’t simply rotate a busted proxy away when you buy an IP list.

Some providers still discriminate by IP location. Usually, US proxies cost the least, and the rate grows if you need proxies from a less popular country.

Scroll to see all columns.

| Pricing model | Price modifiers | Location pricing | IP refresh | Self-service | Starting price | Trial | |

|---|---|---|---|---|---|---|---|

| Bright Data | Pay per IP + traffic | More domains, unlimited traffic, city targeting | Same for all | Paid | ✅ | $2 | 7 days for companies |

| IPRoyal | Pay per IP | - | Same for all | Free once a month | ✅ | $9 | ❌ |

| NetNut | - | - | - | ❌ | Custom | 7 days for companies | |

| Oxylabs | Targets, non-US locations | Up to 66% more for non-US | 20% free per quarter | ❌ | $180 | 7 days for companies | |

| Rayobyte | - | Up to 75% more for non-US | Free once a month | ✅ | $12.50 | 2-day refund | |

| Smartproxy | Non-sequential IPs | Same for all | Free once a month | ✅ | $7.5 | 3-day refund | |

| Webshare | Pay per IP + traffic | More threads, IP replacements, network priority | Same for all | Paid | ✅ | $1.75 | 10 free IPs |

Dedicated datacenter proxies usually have simple pricing models – buy IPs and use them without restrictions. But Bright Data and Webshare have made theirs more imaginative.

By default, the former gives you exclusive access to one domain only – this is obviously not ideal, as antibot systems share information between domains. Webshare lets you unlock more threads and better connectivity with its network priority feature. In any case, you also pay for traffic, which is unusual for datacenter proxies.

Oxylabs and Rayobyte charge a big premium for non-US IPs. Mind the up to; Rayobyte has several pricing tiers with country groups.

All in all, the table makes it obvious that Oxylabs still uses enterprise-oriented business practices –which may work perfectly for the provider but looks dated and restrictive in today’s flexible market.

| 10 IPs | 50 IPs | 100 IPs | 250 IPs | 500 IPs | 1,000 IPs | |

|---|---|---|---|---|---|---|

| Bright Data (1 domain, unlimited traffic) | $1.90/IP | $1.90/IP | $1.90/IP | $1.34/IP | $1.30/IP | $1.20/IP |

| Bright Data (all domains, unlimited traffic) | $3.80/IP | $3.80/IP | $3.24/IP | $3.20/IP | $3.10/IP | $3.00/IP |

| IPRoyal | $1.8/IP | $1.68/IP | $1.57/IP | $1.57/IP | $1.57/IP | $1.57/IP |

| NetNut | Custom | |||||

| Oxylabs (US) | - | - | $1.8/IP | $1.8/IP | $1.8/IP | $1.5/IP |

| Rayobyte (US) | $2.5/IP | $2.5/IP | $2.13/IP | $2.13/IP | $2.13/IP | $1.88/IP |

| Smartproxy (non-sequential) | $3.13/IP | $2.38/IP | $2.38/IP | $2.00/IP | $1.50/IP | $1.45/IP |

| Webshare (5 TB, high concurrency) | $3.48/IP | $2.32/IP | $2.19/IP | $1.99/IP | $1.93/IP | $1.77/IP |

| Average | $2.77/IP | $2.43/IP | $2.17/IP | $2.00/IP | $1.90/IP | $1.77/IP |

The pricing is highly influenced by scale and parameters. Bright Data’s “fat” configuration is significantly costlier compared to all competitors, but its “lean”, one domain plan outscales most. In the same way, you may not need 5 TBs of data and over 500 threads with Webshare; scaling these settings down notably cuts the rates.

All in all, IPRoyal costs the least initially but stops scaling quickly. We found it interesting that despite being a premium service, Oxylabs looks very good in the context. Rayobyte raised prices since last year, making it one of the more expensive options. It doesn’t help that the provider’s plans are very broad.

Here’s our evaluation based on the covered aspects. Hover on provider names to highlight, click to filter.

ISP Proxies

ISP proxies are datacenter addresses with some magic sprinkled on top – that magic, of course, relates to consumer internet service providers. This year, we’re interested in ISP addresses that come in IP lists and not rotating proxy pools. Five participants sell them publicly, NetNut made us a dedicated pool, and Shifter didn’t want to participate with this product. Oxylabs had another service that was reportedly better, but it didn’t suit our testing parameters.

| Bright Data | GeoSurf | Infatica | IPRoyal | NetNut | Oxylabs |

|---|---|---|---|---|---|

| ✅ | Not tested | ❌ | ✅ | ✅ | ✅ |

| PacketStream | Rayobyte | Shifter | Smartproxy | SOAX | Webshare |

| ❌ | ✅ | Not tested | ❌ | Not tested | ✅ |

We tested 100 proxies in the US. Once again, evaluating them raises many of the same challenges as dedicated datacenter proxies. Namely, we have to pretend that this sample size represents a provider’s full proxy network for all use cases. That’s hardly possible, but it still lets us extract useful insights in the process.

Infrastructure Performance

Percentage of proxies that the IP2Location database recognized as residential (ISP, ISP/MOB, and MOB categories).

The results aren’t pretty. In our case, IP2Location identified all Oxylabs’ IPs as datacenter, as they came from a business-oriented ISP.