Proxy Market Research 2024

Proxy Market Research is the most comprehensive public report on the proxy server industry, released annually since 2019. It covers the market trends, provides large-scale performance benchmarks, and compares leading proxy server providers.

You’ll find this report useful whether you’re a proxy vendor looking to improve your product, a customer shopping around for proxies, or simply someone interested to see where the industry stands and how it’s changed throughout the years.

This year’s report:

- Includes 13 proxy providers, from familiar names like Bright Data and Oxylabs to newcomers like Dataimpulse and Nimbleway.

- Investigates three proxy server types: residential, mobile, and rotating datacenter proxies.

- Draws insights from a questionnaire sent to all participants, as well as our own know-how.

- Provides performance data based on millions of connection requests, made even more accurate thanks to our improved infrastructure.

Changes and improvements

- Residential and mobile proxies:

- Added Brazil to tested country pools.

- Replaced individual country pools of Germany and France with the European Union (combines France, Germany, Italy, Spain, and the Netherlands).

- In addition to Germany, added two new servers in the US and Singapore. This should provide more accurate response time metrics for relevant country pools.

- Residential proxies:

- New benchmark – IP fraud score based on IPQualityScore data.

The majority of data were collected in February and March of 2024, with minor updates made until early May.

Participants

2024’s research includes 13 proxy service providers. Below is their list with applicable proxy types, while the adjacent tabs provide brief summaries of each participant.

We decided to categorize the companies based on their target market segment:

- Entry-level providers work best for individual or small-scale projects;

- Mid-market providers cater to a wide range of scraping, account management, and similar tasks;

- Enterprise providers focus on an integrated experience that accommodates large-scale use by teams.

Note: Throughout this research, we’ll be listing the participants either alphabetically or, where possible, in order of their performance.

| Provider | Segment | Residential | Mobile | Rotating Datacenter |

|---|---|---|---|---|

| Bright Data | Enterprise | ✅ | ✅ | ✅ |

| NetNut | Enterprise | ✅ | ✅ | ✅ |

| Nimbleway | Enterprise | ✅ | ❌ | ❌ |

| Oxylabs | Enterprise | ✅ | ✅ | ✅ |

| Infatica | Mid-market | ✅ | ✅ | ❌ |

| IPRoyal | Mid-market | ✅ | Dongle-based, not tested | ❌ |

| Nodemaven | Mid-market | ✅ | ❌ | ❌ |

| Rayobyte | Mid-market | ✅ | ✅ | ✅ |

| Smartproxy | Mid-market | ✅ | ✅ | ✅ |

| SOAX | Mid-market | ✅ | ✅ | ✅ |

| Webshare | Entry/mid-market | ✅ | ❌ | ✅ |

| Dataimpulse | Entry-level | ✅ | Not available during testing | Not available during testing |

| PacketStream | Entry-level | ✅ | ❌ | ❌ |

Backed by the equity fund EMK Capital, Bright Data is one of leaders in the proxy server space. During the last few years, it has expanded the product portfolio and now positions as a data collection platform. Still, proxies remain Bright Data’s forte, with an emphasis on reliability and flexibility. The company’s lawyers are no less fierce than its engineers.

- Country: Israel

- Founded: 2014

- Segment: Enterprise

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: proxy APIs, scraping browser, cloud web scraping IDE, datasets, e-commerce insights

A newcomer to the proxy server market, Dataimpulse embraced PacketStream’s playbook: it sources part of the IPs through an in-house proxyware app and sells them at bottom rates. Behind the provider stands Softoria, a Ukrainian software development company, which also maintains a popular SERP API and several other services.

- Country: Estonia

- Segment: Entry-level

- Founded: 2022

- Proxy networks: datacenter, residential, mobile

- Other services: –

A Singapore-based company with Eastern European roots, Infatica focuses on selling proxies to mid-range and enterprise clients. The provider sources IPs via an SDK and offers a competitive package at scale. Lately, it has been trying to attract investment for growth and seems to have found it in a venture capital fund that also backs SOAX.

- Country: Singapore

- Founded: 2019

- Segment: Mid-market

- Proxy networks: datacenter, residential, mobile

- Other services: web scraping APIs

IPRoyal made a name for itself with a range of affordable proxy services and non-expiring plans. The strategy proved successful, and the provider has grown significantly since 2021. Nowadays, it boasts thousands of clients, with a marketing budget that rivals top providers. IPRoyal maintains its own residential proxy pool through an app called Pawns.

- Country: Lithuania

- Founded: 2021

- Segment: Mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: –

A company from Israel that belongs to Alarum. Originally the major provider of ISP proxies, the company now sells four rotating proxy networks and several data collection products. NetNut primarily targets enterprises with data collection needs and proxy resellers. It’s been doing well lately, as the public revenue figures show.

- Country: Israel

- Founded: 2018

- Segment: Enterprise

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: proxy API, web scraping API, professional datasets

- Country: Israel (HQ in the US)

- Founded: 2022

- Segment: Enterprise

- Proxy networks: residential

- Other services: proxy API, web scraping APIs

Launched less than a year ago, Nodemaven puts a twist on residential proxies: it has introduced a multi-tiered IP quality filter and promises very stable sessions. In short, the service was made with multi-account managers in mind. The provider most likely resells; but that’s not necessarily a drawback as long as Nodemaven’s feature layer adds value.

- Country: Estonia

- Founded: 2023

- Segment: Mid-market

- Proxy networks: residential

- Other services: –

One of the market leaders, Oxylabs controls some of the largest proxy pools today. The provider targets enterprise customers, though lately it’s been making the platform more accessible through reduced pricing and improved self-service. We consider Oxylabs’ proxy infrastructure to be among the best in the market and have it given multiple awards for strong performance.

- Country: Lithuania

- Founded: 2015

- Segment: Enterprise

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: proxy API, web scraping APIs, datasets

One of the first bandwidth-sharing marketplaces, PacketStream positions as a strong budget option and a reseller’s choice. However, its services remain functionally unchanged since 2019, and they’ve even gotten worse in real use. As a result, it seems like the provider is being kept on life support, propped up only by the incredibly low rates and word-of-mouth recommendations.

- Country: United States

- Founded: 2018

- Segment: Entry-level

- Proxy networks: residential

- Other services: –

A self-proclaimed largest US datacenter proxy provider, Rayobyte now sells all proxy types. The company started as Blazing SEO and rebranded in 2022 to show the extended scope of its services. Rayobyte controls most of its datacenter infrastructure in-house. It tries to do the same with the residential network through an app called Cashraven; for now though, the majority of these IPs likely come from other sources.

- Country: United States

- Founded: 2015

- Segment: Mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: web scraping API

For years now, Smartproxy has been a value choice for small to mid-range customers. It rose on the back of affordable rotating proxies and a low barrier to entry; nowadays, the provider has become an all-rounder that tries to retain these winning qualities. Smartproxy can be considered of the major industry players, following Bright Data and Oxylabs.

- Country: International

- Founded: 2018

- Segment: Mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: proxy API, web scraping APIs, antidetect browser

A provider with Eastern-European roots and international presence, SOAX has entrenched itself as a major proxy vendor. The provider offers some of the best starting packages in terms of features. In 2023, it launched more proxy types, a line of scrapers, and adopted an aggressive pricing strategy, positioning to further compete with the leaders.

- Country: UK

- Founded: 2019

- Segment: Mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: proxy API, web scraping APIs, AI scraper

Based in the US, Webshare mainly targets individuals and SMBs with affordable proxy servers. Its main strength lies in flexibility and highly developed self-service features, which few competitors can match. For a few years now, Webshare has been a very popular destination with over 50,000 customers around the globe. The company was acquired by Oxylabs in 2022, which likely supplies it with residential IPs.

- Country: US

- Founded: 2018

- Segment: Entry/mid-market

- Proxy networks: datacenter, residential, ISP

- Other services: –

Methodology

This section details the methodology used for our performance benchmarks. All participants were introduced to it prior to testing.

| Proxy location | Days | Total requests | Testing server |

| Global | 21 | 1.2 million | DE |

| EU (DE, ES, FR, IT, NL) | 14 | 1.2 million | DE |

| US | 14 | 560,000 | US |

| UK | 14 | 560,000 | DE |

| India | 14 | 560,000 | SG |

| Brazil | 14 | 560,000 | US |

| Australia | 7 | 140,000 | SG |

| Proxy location | Days | Total requests | Testing server |

| Random | 14 | 280,000 | DE |

| EU (DE, ES, FR, IT, NL) | 14 | 280,000 | DE |

| US | 14 | 280,000 | US |

| UK | 14 | 280,000 | DE |

| India | 14 | 280,000 | SG |

| Brazil | 14 | 280,000 | US |

| Australia | 7 | 140,000 | SG |

| Proxy location | Days | Total requests | Testing server |

| US | 7 | 70,000 | US |

We ran requests using a custom HTTPX script for Google, Amazon, and Homedepot, and a custom Puppeteer script with a stealth plug-in for the social media network.

To deem if a request was successful, we checked: 1) the response code (200), 2) the HTML size, and 3) the page title.

Residential & mobile proxies

| Targets | Proxy location | Testing server | Requests |

| Amazon Social media network | US | US | ~2,600 each |

Rotating datacenter proxies

| Targets | Proxy location | Testing server | Requests |

| Amazon Homedepot | US | US | ~2,600 each |

Market Trends

This section provides an overview of the proxy server market. It’s based on our own market knowledge, as well as responses from a survey we sent to all participating providers. You’ll learn about the current state of the industry, popular proxy types and use cases, and possible directions for the future.

2023 Report: Despite Turbulence in Tech, Most Providers Had a Good Year

- Last year saw over 260,000 layoffs in tech, which sent companies into cost optimization mode.

- Despite that, our interviewees reported a good year, with multi-digit revenue growth and up to a 19x increase in proxy use.

- The majority still have proxies as their main products and consider them central to business – for now.

Full version

In our last year’s interviews, providers had a broadly positive outlook toward the future. You could feel an undertone of anxiety, but the majority believed their services to be an important part of business operations or even a cost optimization measure by themselves.

Today, our products power many companies' products or internal data, so fortunately we're one of the last resources to cut.

A survey response from 2023.

- Bright Data and Oxylabs experienced significant and healthy growth, respectively.

- SOAX grew its usage by 64%, IPRoyal’s rose by 2.57 times, and Nimbleway’s by a staggering 19 times.

- Infatica made 60% more revenue, while NodeMaven scaled to five figures within less than a year in business.

- NetNut had an amazing year, too – public figures show that its revenue in 2023 exceeded 20 million, bringing in profits to the company.

Web data acquisition is becoming more challenging since some public data sources have implemented robust anti-scraping measures. This raises the importance of the quality of data collection infrastructure and constant innovation to build next-generation solutions.

A survey response.

For Bright Data, Nimbleway, and SOAX, proxy-based tools were already the main product drivers in 2023. The latter provider’s APIs found particular success in e-commerce and real estate verticals.

For others, proxy servers still dominate. At the lowest, their use is balanced with non-proxy services, as in the case of Oxylabs and SOAX. At the highest, the ratio can reach 95% to 5%, as reported by Rayobyte.

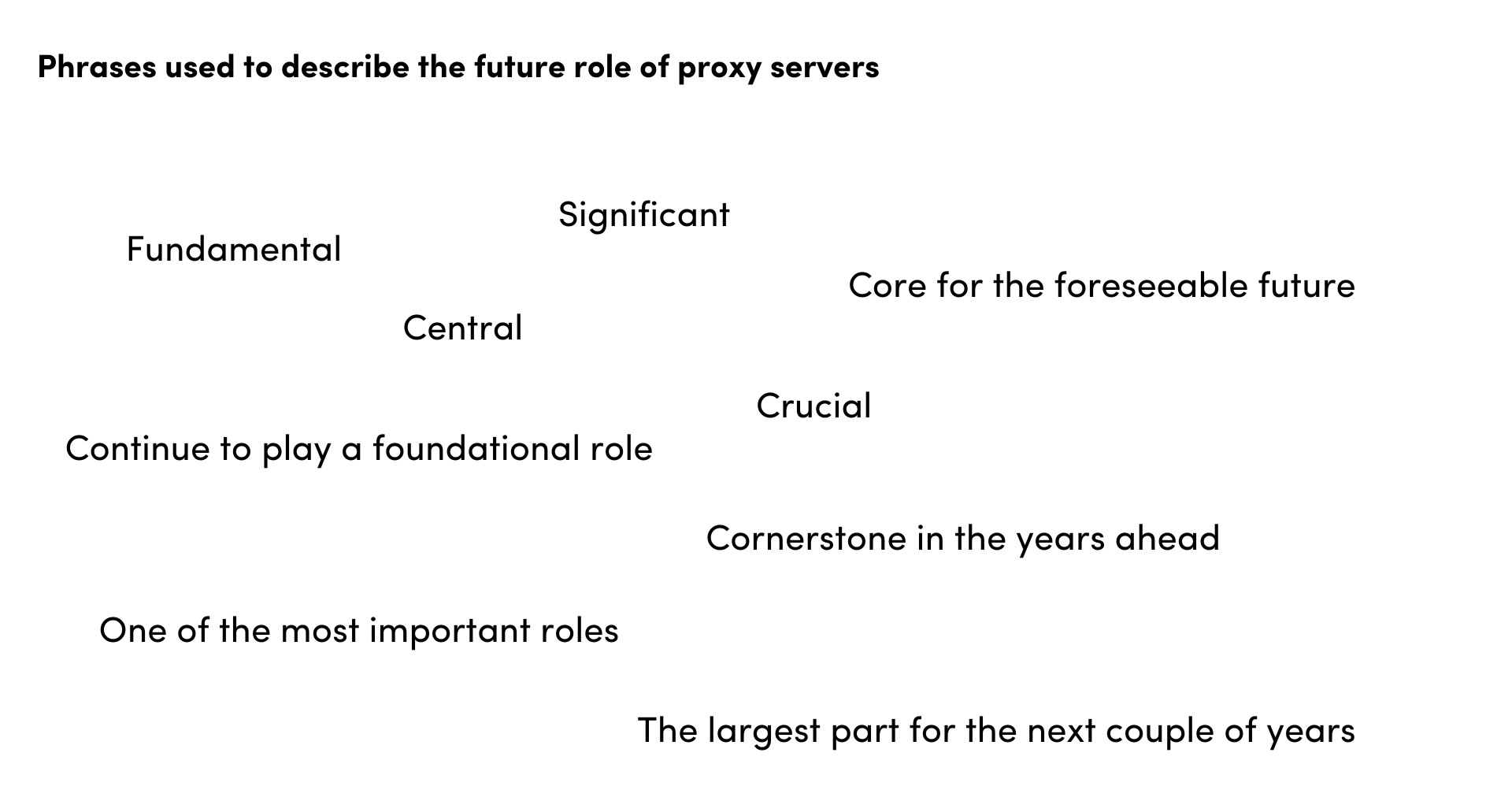

Of course, providers with tools invariably expected them to take a bigger role in 2024. However, proxies aren’t going anywhere: all respondents considered them a central piece of their business – at least for now.

What about 2024? The answers differed:

- Market leaders Bright Data and Oxylabs emphasized tech-related aims like product reliability and innovation.

- Nimbleway, which seemingly prizes R&D above all, planned to further perfect its AI-based functionality, while SOAX put high hopes on AI-powered scrapers and other integrated experiences for data collection.

- Providers with a strong market traction like NetNut and IPRoyal expected to continue course.

- Established contenders Rayobyte and Infatica had aggressive projections to double and triple their revenue.

- The newcomer Dataimpulse planned to catch up on product variety, while Nodemaven boldly estimated to 4x its revenue and 5x the user base.

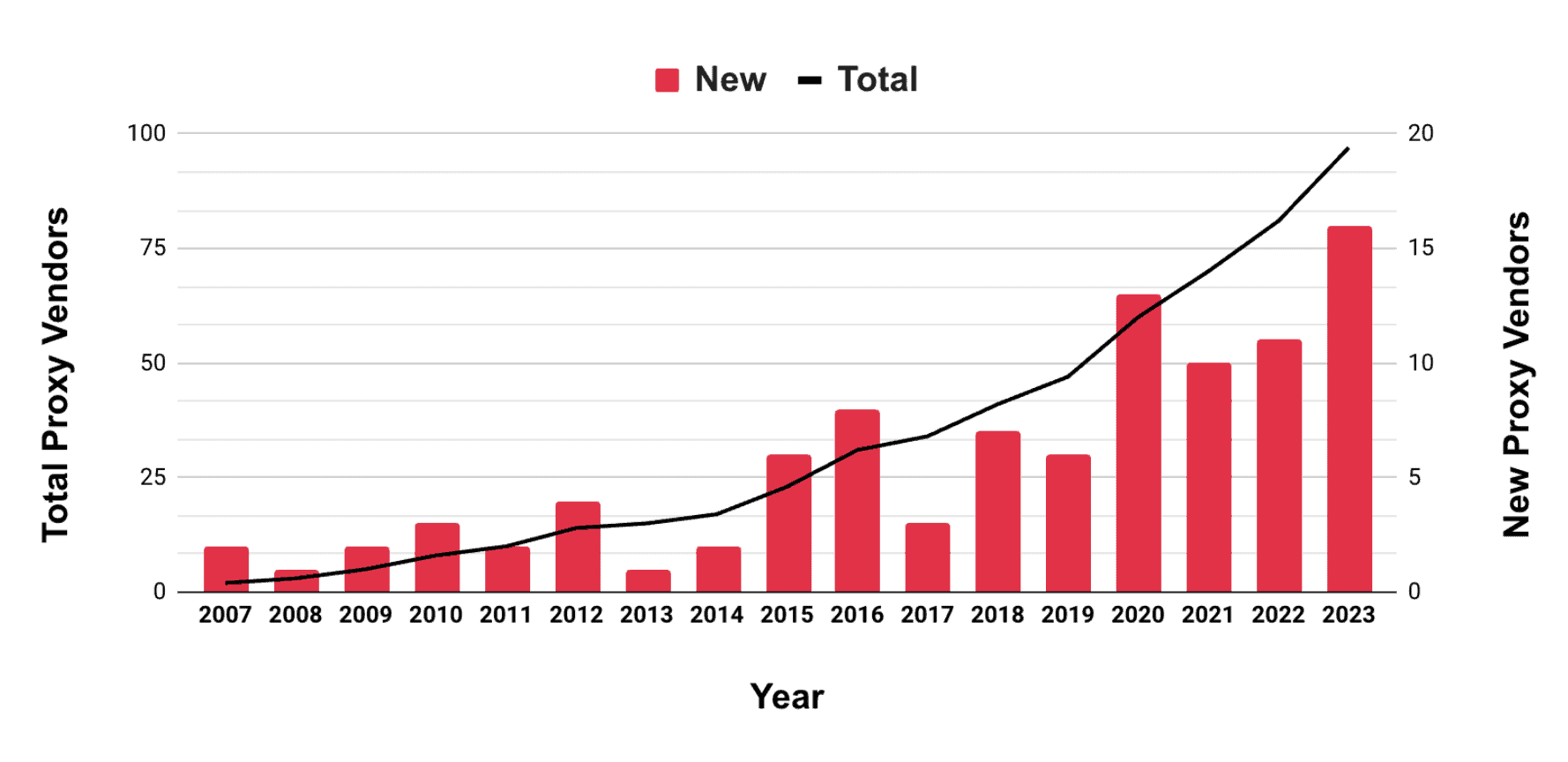

Competition: Subjectively (and Objectively) Increasing

- Major providers are growing fast; but the market is still easy to get into, partly due to generous reselling policies.

- Most interviewees believed that the competition has increased, particularly among new entrants.

- Providers still manage to build their own residential proxy infrastructure in 2024 through VPNs and traffic-sharing apps.

Full version

The proxy server market is starting to enter maturity. This is characterized by past acquisitions (for example, Oxylabs acquiring Webshare), together with the sheer scale the industry has reached. To give you some context, the number of people associated with Bright Data on LinkedIn has surpassed a thousand. This is huge!

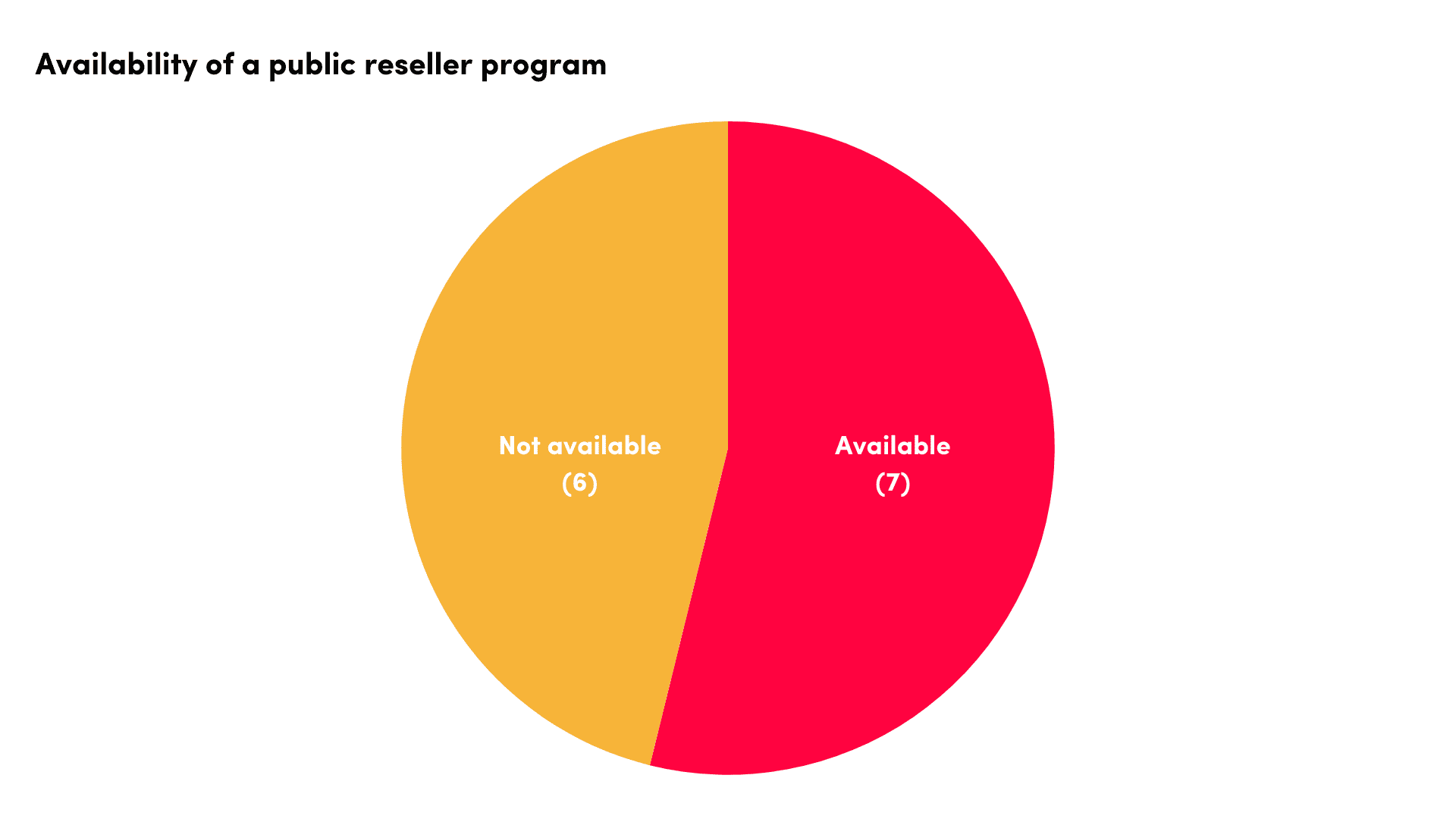

Despite this, the market is still easy to get into. Aspiring vendors can launch a mobile proxy service in days using streamlined solutions like Proxidize, iproxy.online, or Proxy-Seller. Or, they can simply resell one of the major residential proxy services using white-labeling programs. With some marketing budget, it’s then possible to get initial traction through platforms like Blackhatworld and Discord communities.

When we asked providers if they felt the competition had increased, all of them said yes. At the same time, most pointed out new entrants rather than established premium players as the cause. Nodemaven thought that the market was now twice as fierce compared to the year before – considering that the provider started in 2023, this gives us a good indication of what emerging proxy providers face these days.

We can’t help but see the irony in the situation, as more than a half of the participants offer white-labeling programs for resellers. This creates a delicate balancing act, where you have to root for a reseller’s success but also be prepared to shut down the operation before it becomes successful enough to threaten you. Such resellers are always at the mercy of the supplier, unlikely to go far in the long run.

Unless, of course, they manage to build their own infrastructure in the meantime. IPRoyal showed a great example several years ago by kicking off its own residential proxy network. But that was then. Can it still be done in 2024?

Certainly. InfiniteProxies and Geonode have both launched proxyware bandwidth-sharing apps to rely less on external pools. And it was owned infrastructure that allowed Ping Proxies to survive the sneaker market crash while many others were forced out. Nowadays, the company runs a free VPN to source IPs and has big plans to compete with the incumbents. (You can read our interview with Ping Proxies here.)

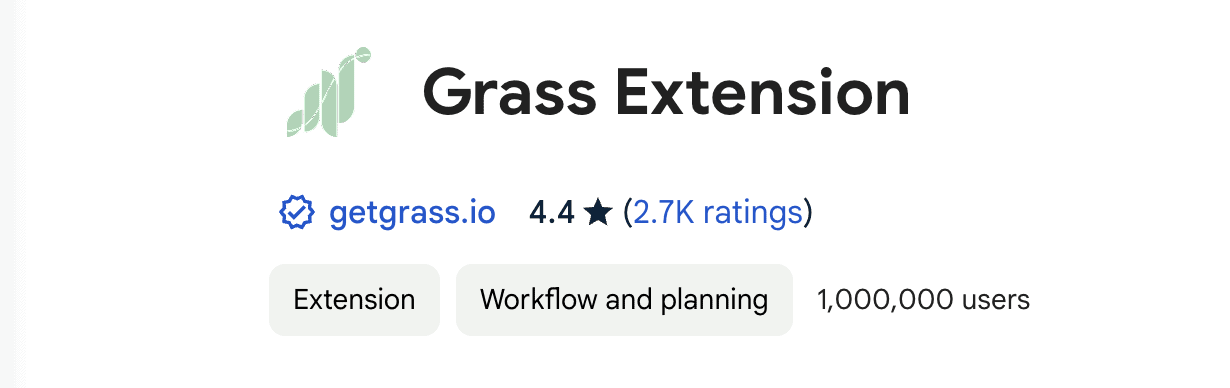

The examples don’t end here. Dataimpulse and GoProxies build upon TraffMonetizer and Mysterium.network, two Honeygain alternatives. ASocks, a young and aggressive peer-to-peer proxy vendor, owns an SDK. Nimbleway, in turn, has found a successful resource sharing platform called Salad to provide quality peers. Finally, we can see projects like Grass on the horizon, whose AI and Web3 fueled hype train is a sight to behold.

All in all, the proxy server industry these days is anything but boring.

New Challengers: Chinese Proxy Providers Are Taking on the West

- Since 2022, at least nine Chinese providers have entered the global market.

- Some of them have large marketing budgets and low prices to pressure the competition.

- Fighting takes place not only over customers but also trademarks.

Full version

On top of growing competition in the lower market segments, we’re seeing something that stirs the pot even more: Chinese proxy providers are taking an increasing interest in the global market.

The process wasn’t gradual. Quite the opposite: we can count at least nine providers that appeared in the timespan of 18 months, beginning with 2022. The majority display similar characteristics: huge advertised proxy networks, an abundance of promotional pop-ups, and very cheap rates. Some specifically target 911 S5 holdouts with direct access to residential IPs through desktop software.

Some of the new Chinese proxy providers in the global market.

| 2022 | 2023 |

| Lunaproxy, PyProxy, PIAProxy, IP2World, Lumiproxy, 922Proxy | OmegaProxy, NAProxy, ABCProxy |

These Hong Kong-based vendors advertise in proxy-related communities, have started buying into affiliate websites, and compete for hundreds of paid Google keywords. Besides challenging competition directly, they also add to the secondary market – we’ve already seen some resellers set up shop on their proxy networks.

Have all the Chinese entrepreneurs had the same idea, all at once? It’s unlikely. In fact, some investigative work ties most of the newly sprung providers into two big conglomerates. So, it’s hardly a random torrent, but rather a coordinated effort by players with resources and ambition to claim their piece of the proxy pie.

Sometimes, the newcomers bring their own methods of competition, which aren’t exactly gentlemanly. Storm Proxies and Smartproxy both had to encounter brand squatters in the China web. It’s gotten to the point where a squatter is trying to challenge one of the providers in the west, with trademark claims and a similarly sounding domain. Here’s a lesson for you: if you run a proxy service, don’t forget to legally protect your assets.

Race to the Bottom: Residential and Mobile Proxy Price Cuts Continue in 2024

- From the start of 2023 until now, there have been over 10 price cuts for residential and mobile proxies among major providers.

- Mobile proxy networks are starting to lose their premium aura, fueled by the pricing approaches of newer entrants.

- It’s reasonable to expect even more price adjustments, but the situation looks hardly sustainable.

Full version

2023 was also characterized by significant price decreases, particularly for residential and mobile proxy networks. We dubbed this process the proxy provider price war (which may be a tad insensitive given the geopolitical context, but it seemed apt at the time).

Between May 2023 and March 2024, at least seven major proxy providers took price cuts ranging from 10% to as much as 80%.

Below is a timeline depicting the changes. Some are displayed in ranges, as the impact was usually highest at entry levels and tapered off with scale.

The timeline of residential and mobile proxy price cuts (2023-2024).

| Residential | Mobile | |

| May | Smartproxy (10-35%) | |

| June | Webshare (10-55%) | |

| July | Bright Data (40%) Oxylabs (30%) | |

| August | SOAX (25-45%) | Smartproxy (6-22%) Infatica (40-50%) SOAX (up to 80%) |

| September | Bright Data (30%) | |

| October | Oxylabs (22-33%) | |

| November | GeoSurf (22-35%) | |

| December | Smartproxy (5-53%) | |

| March | Smartproxy (12-25%) Bright Data (20%) Oxylabs (6.25-20%) Rayobyte (13-50%) | |

| April | Infatica (17-43%) | Bright Data (65%) |

| May | Oxylabs (53-59%) |

Notice that mobile proxy networks were also affected. This is the most obvious with SOAX, to the point where a reader may wonder if we made an error. No mistakes were made. In addition to reducing residential prices, SOAX equalized the rates of all its rotating proxy networks (at the time), resulting in that outrageous figure.

Are peer-to-peer mobile proxies losing their sheen? If SOAX’s example was the only one, we’d probably write it off as an eccentricity. However, we’ve been seeing more providers take the same approach. And these aren’t just small companies like AnyIP or ASocks – in April, Bright Data joined the fray by equalizing the rates of its mobile and residential proxy networks.

Besides straight off making things cheaper, providers have been introducing other changes to attract customers. Smartproxy now offers free trials for multiple products, and Bright Data has launched a Micro package that’s not quite a trial but offers the cheapest way to sample its proxy networks.

This raises two questions: are the current prices sustainable, and can we expect even more decreases? We believe the answers are no and yes. Providers are digging into their war chests, hoping that the competition will fold. According to SOAX, competing solely on price may lead to shortcuts on quality and ethics. The winners will either have the deepest pockets or break through in other ways, such as innovation.

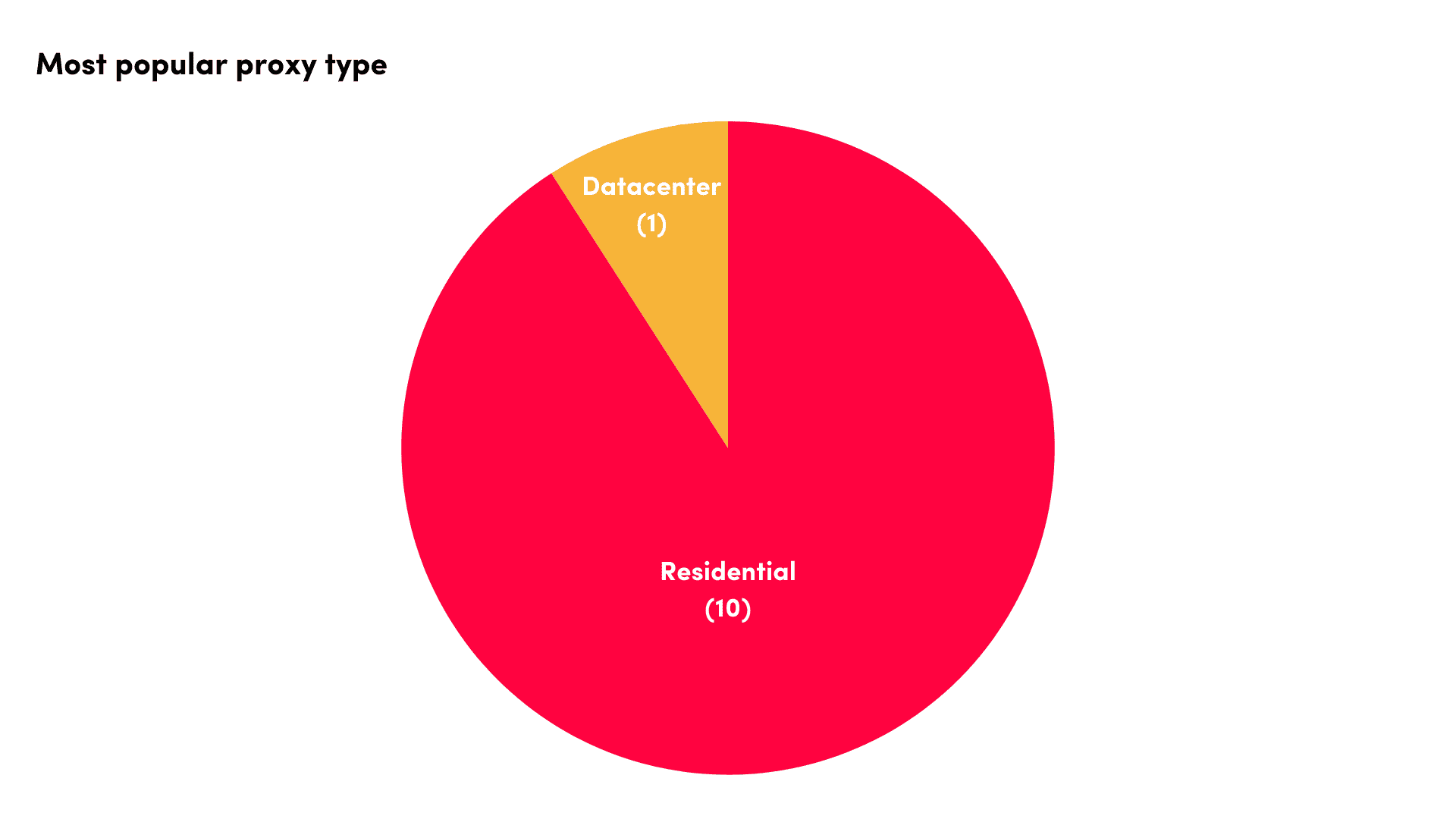

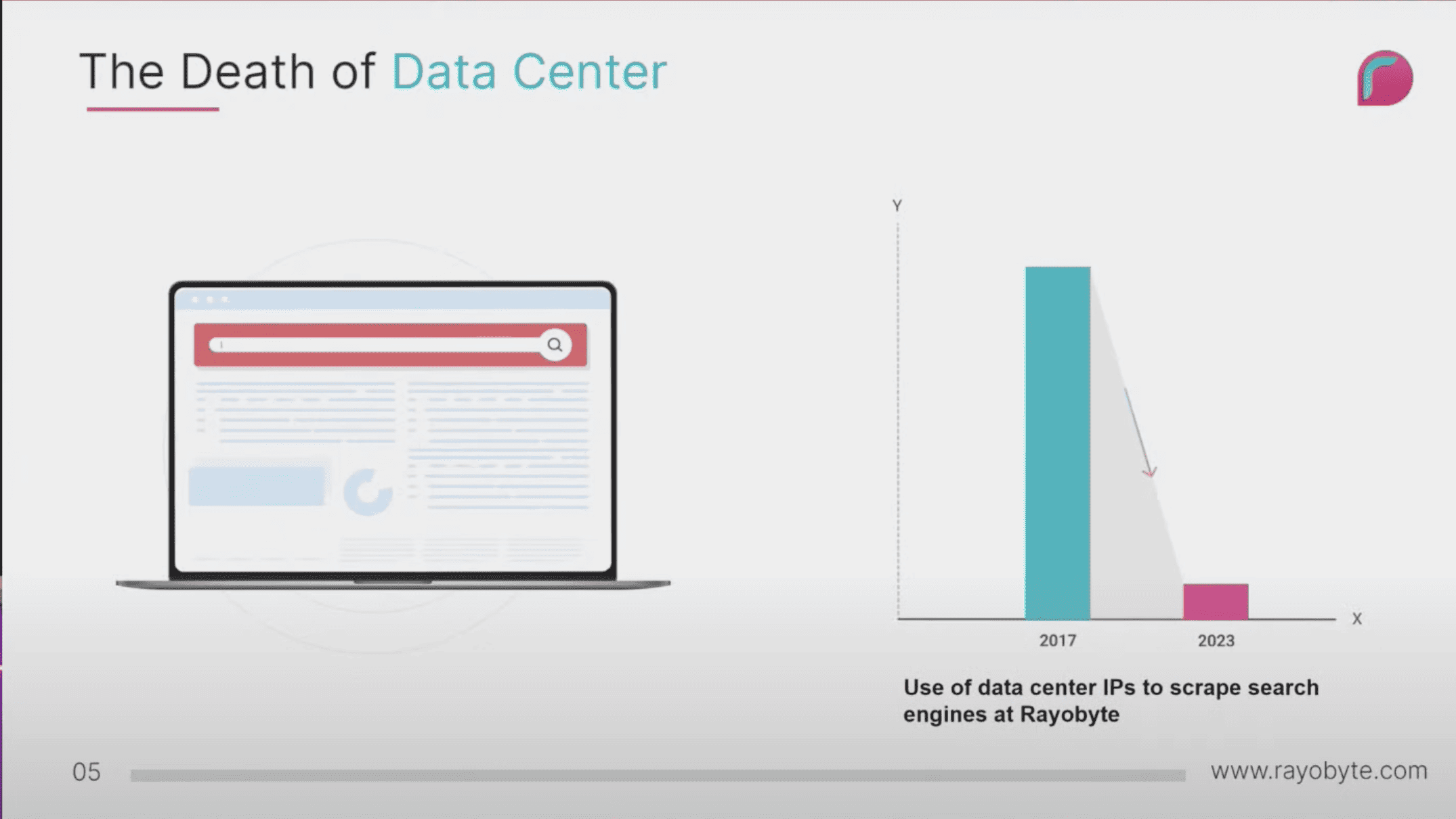

Proxy Types: Residential IPs Dominate, Datacenter Proxy Vendors Ring Warning Bells

- All but one interviewee chose residential proxies as their most popular IP type.

- The one that didn’t, Rayobyte, believes that datacenter proxy servers don’t have much time left.

- ISP and mobile proxies still occupy niche use cases, as major providers fail to make the best use of them.

Full version

Last year, when we asked survey participants which proxy type was their most popular option, the message couldn’t be clearer: residential proxies. Only two providers – Rayobyte and Webshare – indicated otherwise, and those were the companies that originally built their businesses around datacenter proxy servers.

There are no surprises this year – residential IPs continue to dominate. All but Rayobyte chose them as the most popular proxy type (Webshare failed to fill in the questionnaire). Nimbleway considers residential proxies as the most effective tool today, and according to Bright Data, they’re the preferred choice among serious data scrapers.

Why? Tightening bot protection, mostly. In Zyte’s Extract Summit conference, Rayobyte showed how datacenter proxies have been losing major use cases one by one: Google first, then Instagram, and now Amazon is starting to hide ads from server-based IPs.

The provider believes that once Amazon fully implements the anti-datacenter technology it already has demonstrated, this will end datacenter proxies as a viable revenue stream.

The demand for other proxy types, namely ISP and mobile proxy servers, seemed to be growing as well. But our impression is that they’re still relegated to situational roles.

ISP proxies, even though they inherit the best qualities of datacenter IPs, haven’t become a full-fledged replacement yet. The potential is there, but it’s hard to source quality IPs (associated with large ISPs and having consistent information in IP databases).

In addition, major providers tend to package them as an awkward cousin to residential proxies: rotating, traffic-based, and even more expensive. Thus for now, ISP addresses often find their best use in padding residential proxy pools.

Mobile proxy servers have their strengths as well, such as scraping smartphone apps or emulating mobile traffic for ads. But they’re not really a natural upsell for residential proxies. We don’t necessarily agree this to be the case, but Rayobyte has even found residential IPs to work as well or better than its mobile proxy network – and for less.

One truly major use case, account management, is well served by dedicated mobile devices, which few major providers offer aside from IPRoyal.

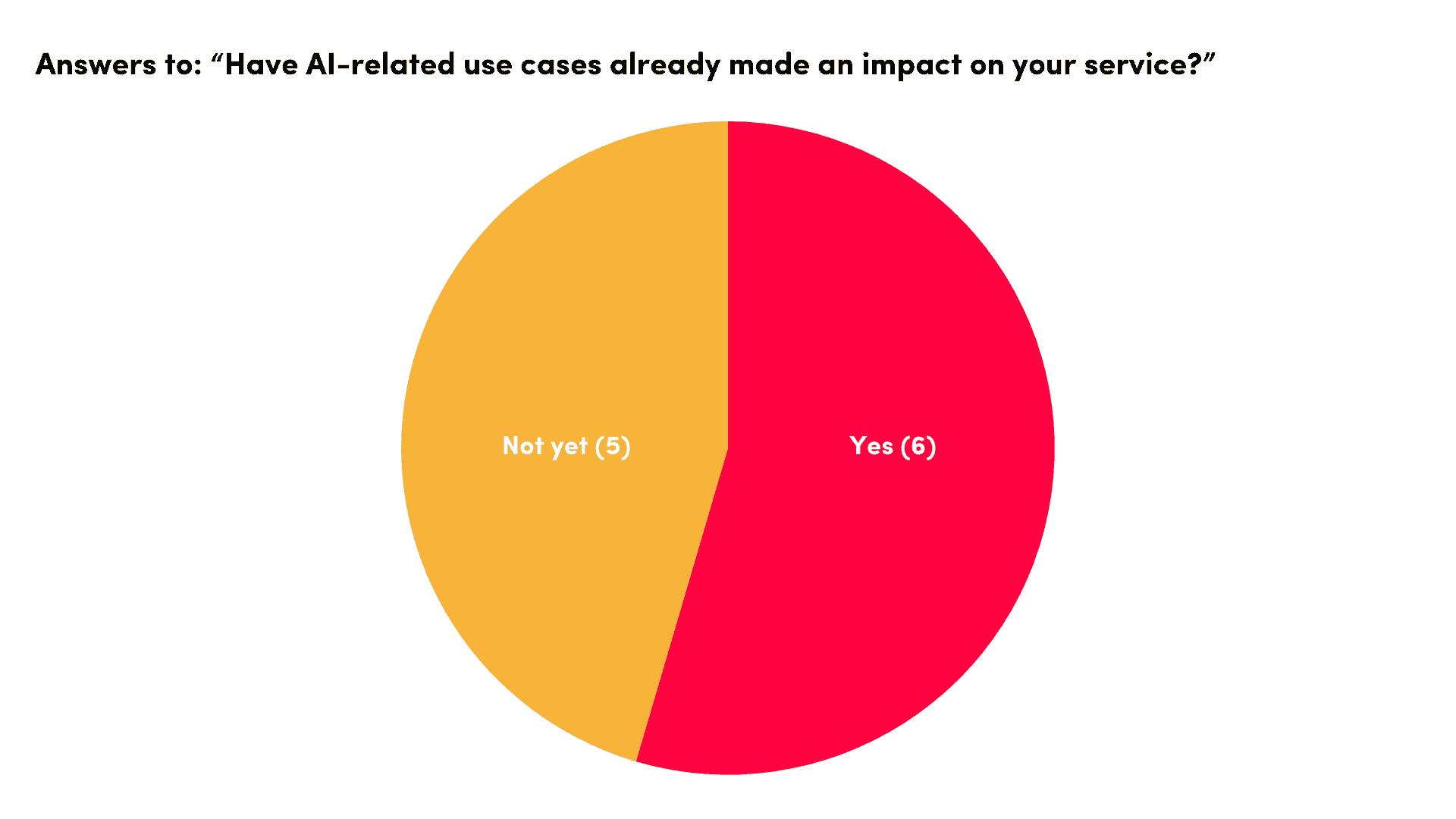

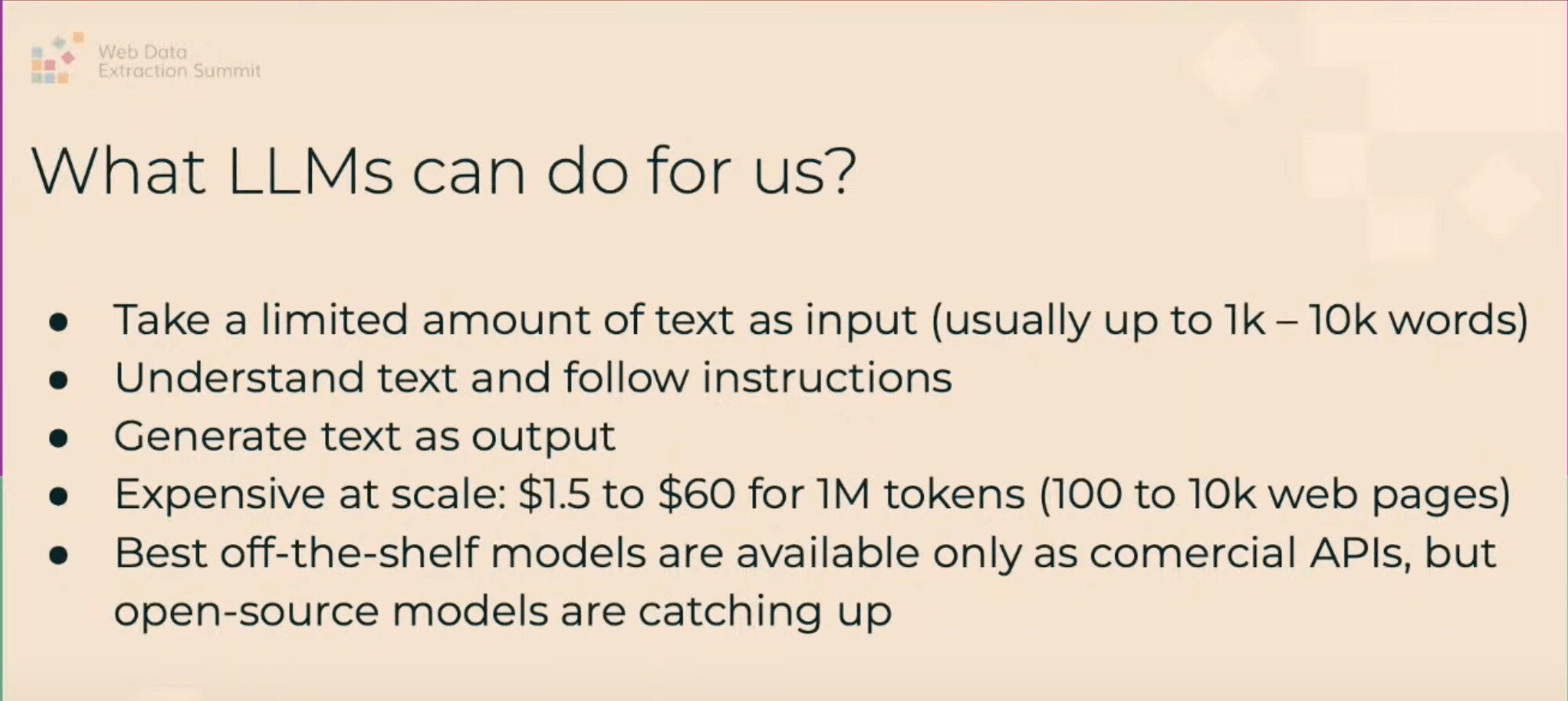

AI: It’s Definitely Coming, But Not Always in Ways We Expect

- AI-related use cases have already made an impact for half of the respondents, notably companies from Israel.

- AI startups expect high-quality data, which sometimes requires proxy-based products and pre-scraped datasets.

- Proxy providers are experimenting with AI-based scrapers, product enhancements, and external systems like chatbots.

Full version

In general, it was Israeli providers that experienced the biggest impact. Bright Data and Nimbleway reported it as significant, and both disclosed working with world’s leading AI companies. NetNut mentioned that AI-related use cases have started to become common, giving an AI-based fintech company and the retail AI market as examples.

For Nimbleway, AI has actually become the dominant sector: it grew by 430% and accounted for over 50% of the provider’s customer user base. We find this level of specialization particularly impressive, considering that some survey participants haven’t gotten on the AI train yet.

- AI-first products. Because the tech is so new, we haven’t seen many production-ready tools yet. The best example is probably Kadoa, a scraper that revolves around LLMs. From our participants, NetNut announced a line of AI products on its roadmap, and SOAX is testing an AI no-code scraper in closed beta as we speak.

- Existing product optimizations surface in various ways. Bright Data, Oxylabs, and Nimbleway all use machine learning models for response recognition and website unblocking in their proxy-based tools. Furthermore, AI parsers help Oxylabs to adaptively structure e-commerce pages and Nimbleway’s AI Browser to process HTML. Other uses include optimized proxy selection for the residential IP network (Nimbleway), as well as data enrichment and compliance monitoring (Bright Data).

- External systems. Nodemaven, SOAX, and Rayobyte are all experimenting with chatbots to help with customer support.

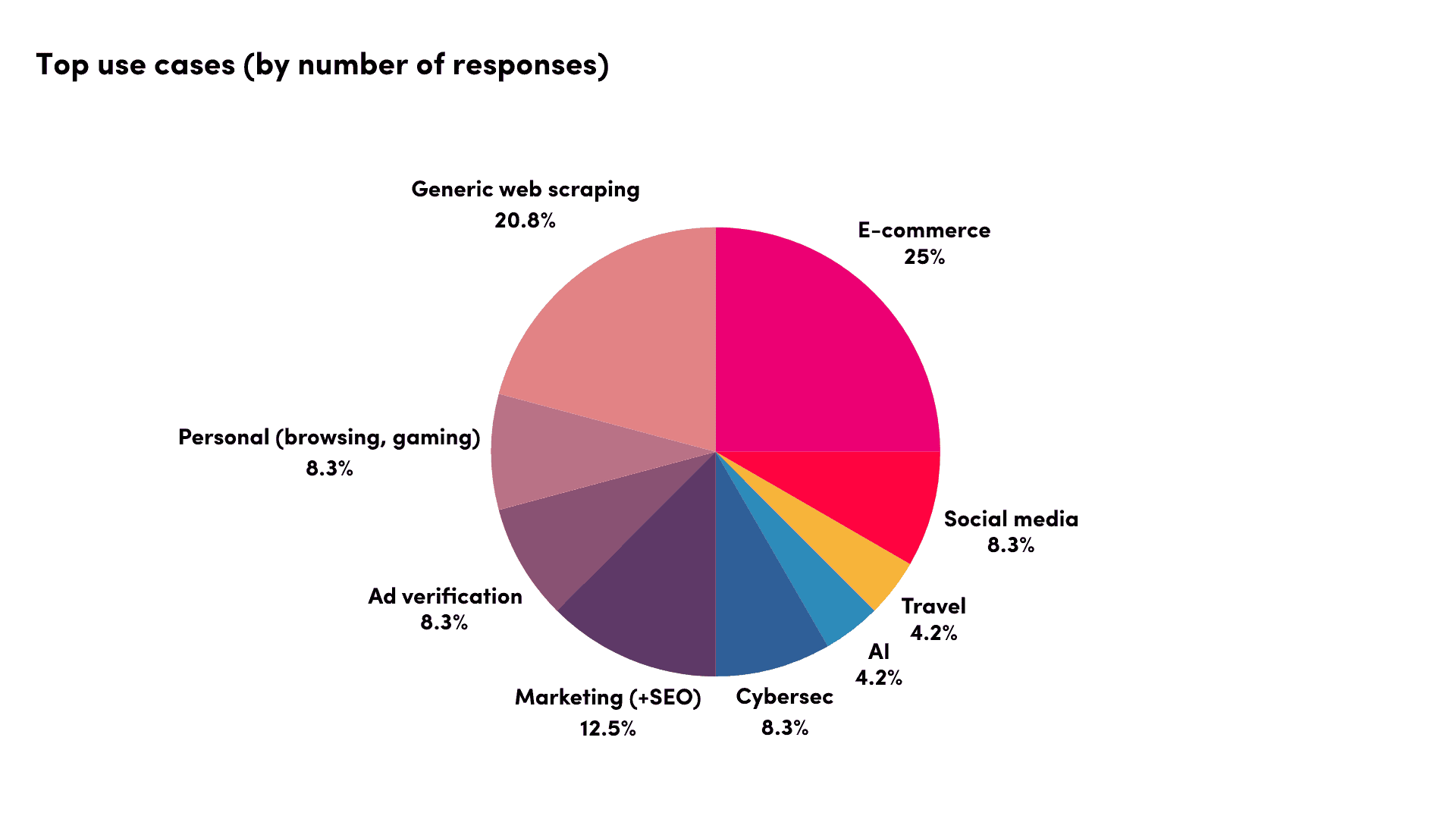

(More Traditional) Use Cases: Once Again, E-Commerce Dominates

- In our questionnaire, e-commerce was the most frequently mentioned industry, followed by generic web scraping.

- Otherwise, few major changes took place within a year.

- Some participants pointed out finance and cybersecurity as potentially big use cases.

Full version

Exciting as AI may be, it hasn’t eaten the world yet – tried and true use cases remain the real breadwinners remain. Last year, the star of the show was e-commerce – it alone brought up to 50% revenue for multiple providers. Have things changed since then?

According to our questionnaire, not really. E-commerce remained the most popular proxy server use case, without major shifts taking place in a year. The umbrella term of generic web scraping took the second place, followed by a poutpourri of answers that even included gaming. As a specialized provider, NodeMaven proved an exception – it pointed out social media management as its most significant use case.

The participants also shared some of their expectations. Like Bright Data last year, Oxylabs expected more investors to turn toward alternative data. In addition, both Oxylabs and SOAX pointed out cybersecurity (such as large-scale threat monitoring) as a vertical with a huge potential.

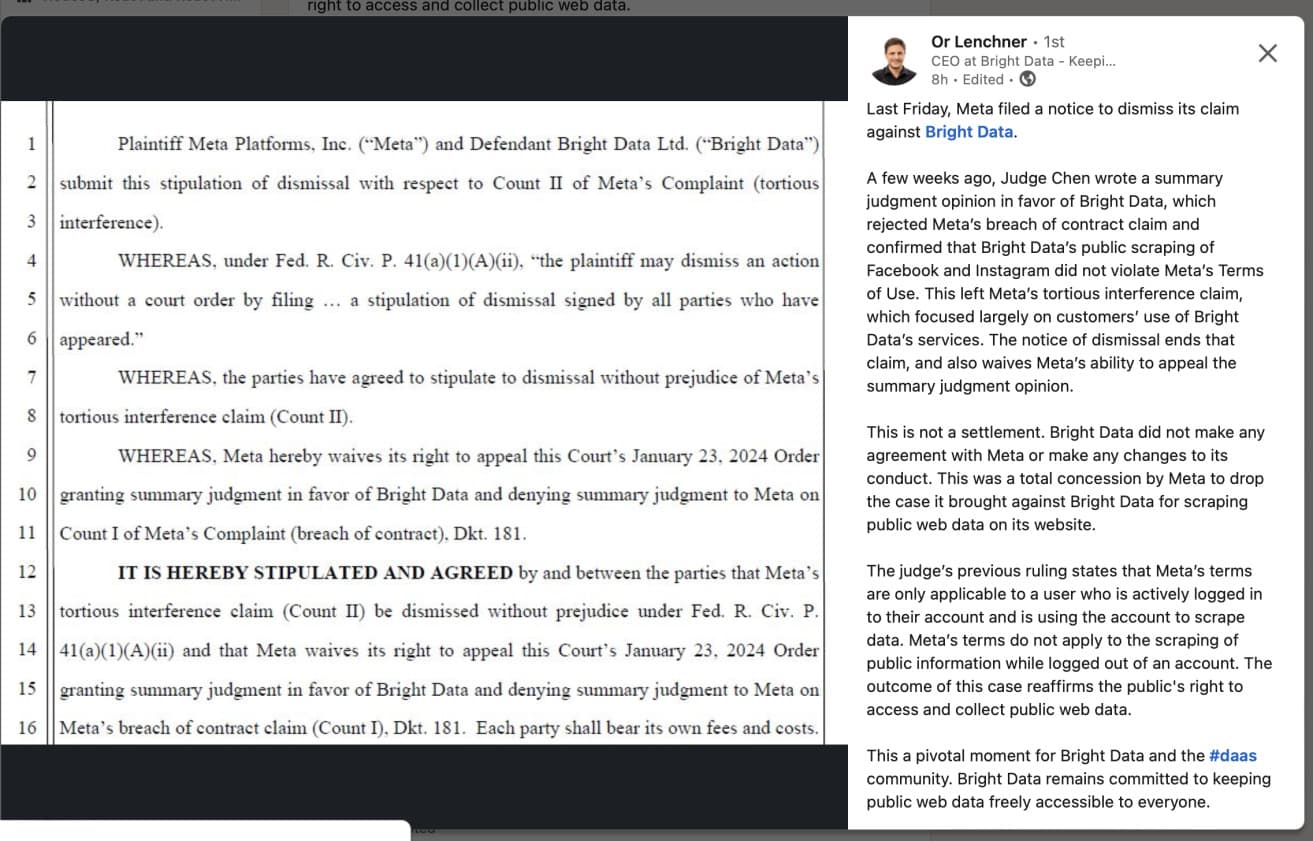

Legal: Social Media Platforms Face a Setback, Provider Disputes Claim Their First Victim

- In 2023, both Meta and Twitter engaged in lawsuits against Bright Data over breach of contact.

- Meta’s claim fell flat, and the social media giant folded in Febrary.

- Bright Data also consumed its Israeli competitor GeoSurf, which became the first victim of infighting in the industry.

Full version

We’re not as happy about this development. Intellectual property is of course important, but there’s a fine line between protecting what’s yours and using patents as a weapon to hamper competition. For now, Texas remains Bright Data’s stronghold for patent-related purposes, and we’ll probably continue seeing other proxy providers tip-toe around it.

Residential Proxies

Residential proxies are home devices (such as computers or phones) connected to landline consumer internet service providers like Comcast and Sky. They’re the prevalent proxy server type and the main business driver for most of our participants. Consequently, all offer access to a residential proxy network.

We’ll be looking at the advertised and actual pool sizes of these proxy networks, their performance in ideal conditions and with real targets, available features, and pricing strategies.

Evaluation Graphs

To give you a quick impression of how the participants compare, we’ve made evaluation graphs based on market segments. They use our weighted scoring algorithm – so, it’s not completely objective, but you can always view the raw data below.

(Hover on a provider’s name to highlight it, click to filter out.)

This year again Oxylabs remains one of the strongest enterprise choices. Bright Data too, though we feel like its attention has moved on to other things, and that our format doesn’t always capture the provider’s strengths.

NetNut is advancing in strides, and it’s poised to become a serious competitor for the first two. The first-timer, Nimbleway, has made a strong entrance, creating big expectations for its future growth.

(Hover on a provider’s name to highlight it, click to filter out.)

Smartproxy continues to prove a great value choice, even in the face of tough competition. Our freshman, NodeMaven, has shown that its approach has potential, especially for the provider’s focus use cases.

Infatica and IPRoyal have both improved. The latter is turning out to be a strong, albeit still imperfect choice, inching more upmarket every year. At the same time, third-party tools show that both providers’ pools have been suffering from their own success in terms of IP overuse.

SOAX and Rayobyte displayed mixed results that were sometimes worse than the year before. Still, they remain formidable options.

(Hover on a provider’s name to highlight it, click to filter out.)

Dataimpulse made a solid impression, especially at its price point. The provider has effectively replaced PacketStream, which has been in obvious decline for several years now. Webshare’s biggest virtue lies in its large and robust proxy pool, even if it’s not the cheapest entry choice.

Pool Size & Composition

- The biggest advertised proxy pool has grown from 100M to 155M, with providers like SOAX and IPRoyal increasing their IP counts by thousands of percent.

- In our benchmarks, NetNut had the most IPs in the Global pool, and Smartproxy in select country pools. IPRoyal and Infatica grew the most since 2023, whereas PacketStream has shrunk by 70% since 2022.

- Most providers had proxy pools that were country accurate and residential. However, 40% of Rayobyte’s IPs in the UK and 60% in Australia came from different locations, and around a quarter of Dataimpulse’s proxies weren’t on residential connections.

| Advertised pool size | Change YoY | Coverage | |

|---|---|---|---|

| SOAX | 155 million | +3,000% | Global |

| Oxylabs | 100 million | Global | |

| NetNut | 85 million | +325% | Global |

| Bright Data | 72 million | Global | |

| Smartproxy | 55 million | +38% | Global |

| IPRoyal | 32 million | +1,500% | ~180 countries |

| Webshare | 30 million | Global | |

| Infatica | 15 million | +50% | Global |

| PacketStream | 7 million | ~130 countries | |

| Nodemaven | 5 million | ~140 countries | |

| Dataimpulse | 5 million | Global | |

| Rayobyte | Not specified | ~180 countries | |

| Nimbleway | Not specified | Global |

Total and residential unique IPs in the Global pool:

Change compared to previous years (cutoff at 1M connection requests):

Unique IPs in select country pools:

(Hover on a country’s name to highlight it, click to filter out.)

Percentage of residential IPs (ISP, ISP/MOB, MOB categories, IP2Location):

| Provider average | US | UK | EU | Brazil | India | Australia | |

|---|---|---|---|---|---|---|---|

| NodeMaven | 99.00% | 99.59% | 99.64% | 99.53% | 97.82% | 97.94% | 99.45% |

| Bright Data | 98.78% | 99.05% | 99.81% | 98.79% | 97.58% | 98.10% | 99.36% |

| SOAX | 98.53% | 98.87% | 99.22% | 98.74% | 97.63% | 97.62% | 99.12% |

| IPRoyal | 98.17% | 93.83% | 99.16% | 99.57% | 99.67% | 99.94% | 96.83% |

| Webshare | 97.24% | 93.35% | 97.65% | 98.10% | 97.61% | 98.66% | 98.04% |

| Oxylabs | 97.22% | 93.77% | 97.71% | 98.00% | 97.76% | 98.24% | 97.85% |

| Smartproxy | 97.19% | 93.38% | 97.64% | 97.92% | 97.75% | 98.38% | 98.06% |

| Rayobyte | 95.87% | 96.47% | 94.96% | 94.81% | 96.97% | 97.58% | 94.43% |

| Netnut | 95.39% | 95.19% | 96.51% | 92.66% | 96.60% | 98.27% | 93.12% |

| Nimbleway | 92.89% | 90.77% | 89.31% | 93.98% | 96.85% | 96.86% | 89.56% |

| Infatica | 91.17% | 89.14% | 89.65% | 91.46% | 97.14% | 96.90% | 82.72% |

| Packetstream | 90.05% | 72.39% | 90.10% | 94.35% | 97.58% | 97.04% | 88.82% |

| DataImpulse | 69.52% | 78.66% | 90.76% | 74.33% | 43.09% | 98.54% | 31.72% |

| Country average | 91.88% | 95.55% | 94.79% | 93.39% | 98.01% | 89.93% |

Location accuracy (excluding EU, MaxMind data):

| Overall | Below 99.90% | |

|---|---|---|

| Webshare | 99.97% | – |

| Smartproxy | 99.97% | – |

| SOAX | 99.96% | – |

| Netnut | 99.95% | AU (99.89%) |

| Oxylabs | 99.94% | US (99.83%) |

| Bright Data | 99.93% | AU (99.71%) |

| Nimbleway | 99.86% | UK (99.73%), IN (99.83%), AU (99.87%) |

| Infatica | 99.86% | UK (99.87%), AU (99.61%) |

| NodeMaven | 99.85% | UK (99.88%), IN (99.61%), AU (99.61%) |

| IPRoyal | 98.99% | UK (99.51%), BR (99.88%), AU (99.65%) |

| Packetstream | 97.87% | US (96.21%), UK (96.67%), BR (99.48%), IN (99.23%), AU (97.76%) |

| DataImpulse | 95.39% | US (98.08%), UK (96.60%), BR (83.00%) |

| Rayobyte | 80.19% | US (99.43%), UK (61.53%), AU (41.61%) |

IP Quality

- The average fraud score in the Global pool was 45.57, with Smartproxy’s IPs being abused the least (32.72) and IPRoyal’s the most (72.55).

- The fraud score was generally higher in the US (58.52). NodeMaven performed the best (27.73); however, enabling its quality filter had the opposite effect – the results cratered (69.41). Once again, IPRoyal’s score was the worst, together with PacketStream and Infatica – all three had an average fraud rating of over 80.

IPQualityScore, 20,000 checks per provider:

| Provider | Fraud score (/100) | Proxy % | Frequent abuser |

|---|---|---|---|

| Smartproxy | 32.72 | 35.33% | 561 |

| SOAX | 33.96 | 36.64% | 925 |

| NodeMaven | 34.98 | 37.55% | 865 |

| Nimbleway | 36.81 | 40.54% | 1296 |

| Oxylabs | 38.98 | 42.03% | 674 |

| DataImpulse | 42.59 | 41.49% | 1478 |

| Netnut | 44.37 | 45.79% | 2548 |

| Bright Data | 44.52 | 47.52% | 1412 |

| Rayobyte | 47.39 | 50.49% | 1742 |

| Webshare | 47.94 | 50.51% | 1580 |

| Infatica | 55.21 | 57.38% | 2519 |

| Packetstream | 60.32 | 63.93% | 1696 |

| IPRoyal | 72.55 | 75.70% | 2309 |

| Average | 45.57 | 48.07% | 1508 |

IPQualityScore, 10,000 checks per provider:

| Provider | Fraud score (/100) | Proxy % | Frequent abuser |

|---|---|---|---|

| NodeMaven | 27.32 | 28.43% | 757 |

| DataImpulse | 33.05 | 33.49% | 1385 |

| SOAX | 40.88 | 42.45% | 1186 |

| Smartproxy | 42.97 | 44.88% | 1020 |

| Oxylabs | 43.32 | 45.23% | 1020 |

| Netnut | 45.28 | 46.44% | 1730 |

| Webshare | 57.51 | 59.68% | 1322 |

| Nimbleway | 58.11 | 64.05% | 770 |

| Rayobyte | 65.00 | 67.10% | 1792 |

| NodeMaven (Max quality filter) | 69.41 | 70.51% | 2467 |

| Bright Data | 71.76 | 75.81% | 1400 |

| Packetstream | 82.07 | 83.33% | 1975 |

| Infatica | 89.09 | 90.52% | 3625 |

| IPRoyal | 94.56 | 96.78% | 3374 |

| Average | 58.60 | 60.62% | 1702 |

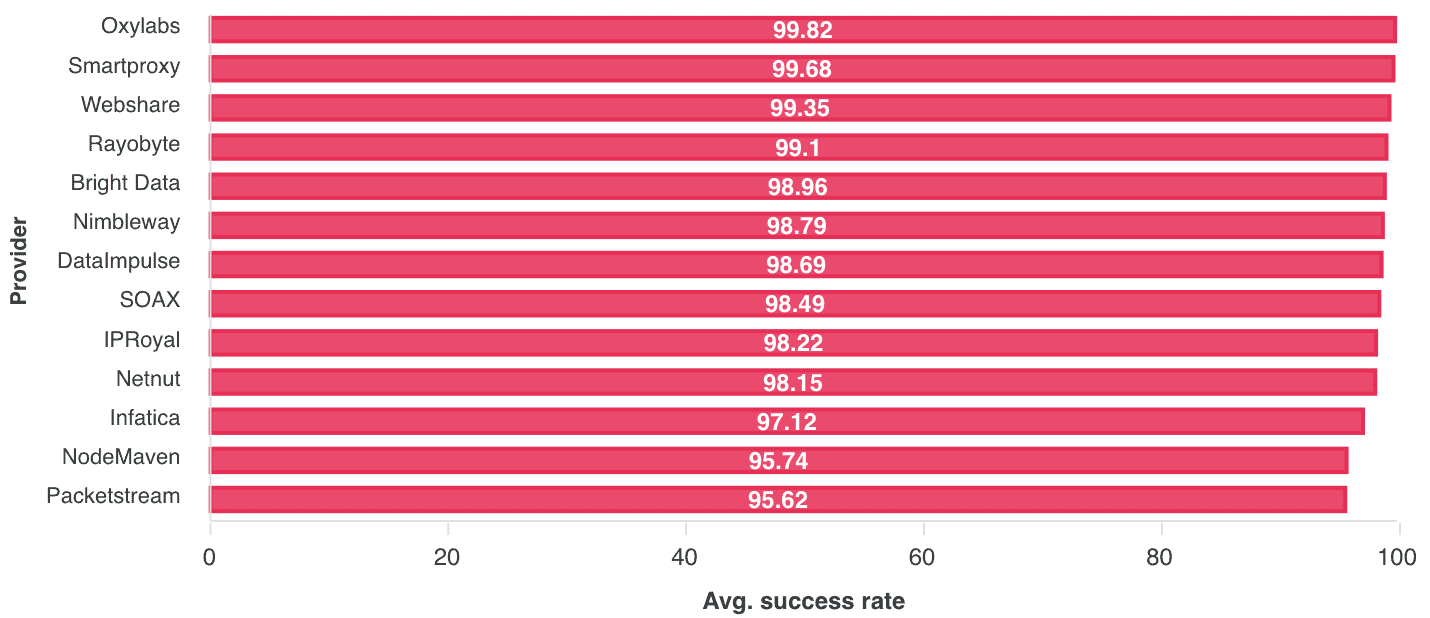

Performance Benchmarks

- Oxylabs had an amazing success rate overall, reaching 99.82% in the Global pool. The baseline has increased in general, with NetNut and IPRoyal making big yearly improvements (+8.66% and +4.63%, respectively). SOAX and PacketStream’s results, however, have declined, with the former experiencing a partial outage that lasted several days.

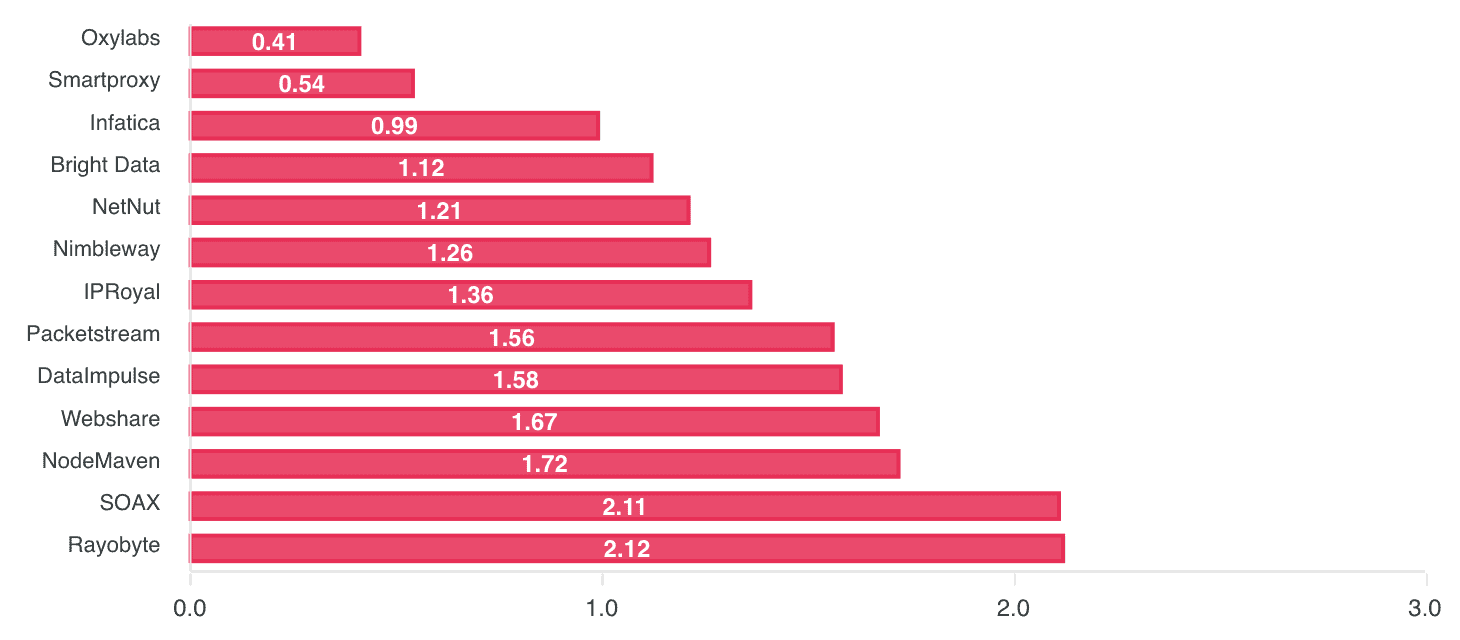

- Once again, Oxylabs had the fastest response time in the Global pool (0.41 s), outpacing the slowest participant, Rayobyte (2.12 s) by over five times. NetNut (-0.93 s) and IPRoyal (-2.37 s) had the biggest yearly improvements, while SOAX (+1.06 s) has declined the most, especially in the Australian pool.

- When accessing popular websites like Google and Amazon, Nimbleway and NodeMaven both performed very strongly (over 96% success rate). PacketStream, on the other hand, could barely open Google, and it failed completely with the social media network.

Average success rate, Global pool:

Change compared to previous years:

| 2024 | vs 2023 | vs 2022 | vs 2021 | |

|---|---|---|---|---|

| Oxylabs | 99.82% | 0.21% | 0.25% | 0.58% |

| Smartproxy | 99.68% | 0.25% | 0.99% | 0.42% |

| Rayobyte | 99.01% | 0.67% | 0.04% | |

| Bright Data | 98.96% | -0.21% | -0.51% | -0.53% |

| SOAX | 98.49% | -0.54% | -1.03% | -0.01% |

| IPRoyal | 98.22% | 8.66% | ||

| Netnut | 98.15% | 4.63% | 5.30% | 13.86% |

| Infatica | 97.12% | 1.17% | ||

| Packetstream | 95.62% | -2.15% | -1.79% | 0.48% |

| Average | 98.34% | 1.41% | 0.46% | 2.47% |

Average success rate, country pools:

(This table is sortable.)

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | Average | US | UK | EU | Brazil | India | AU |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Bright Data | 99.13 | 99.14 | 99.01 | 99.12 | 99.51 | 98.69 | 99.28 | ||||

| 2 | DataImpulse | 95.71 | 97.76 | 98.03 | 98.20 | 83.78 | 98.91 | 97.56 | ||||

| 3 | Infatica | 97.22 | 97.89 | 98.87 | 98.14 | 95.56 | 95.03 | 97.84 | ||||

| 4 | Smartproxy | 99.20 | 99.67 | 99.71 | 99.64 | 98.13 | 98.30 | 99.72 | ||||

| 5 | Netnut | 95.24 | 98.45 | 99.30 | 98.97 | 83.23 | 93.15 | 98.34 | ||||

| 6 | Nimbleway | 98.80 | 97.18 | 99.13 | 99.31 | 99.60 | 99.09 | 98.48 | ||||

| 7 | NodeMaven | 96.68 | 98.45 | 95.19 | 96.91 | 98.68 | 97.76 | 93.11 | ||||

| 8 | Oxylabs | 99.53 | 99.68 | 99.75 | 99.70 | 99.17 | 99.06 | 99.79 | ||||

| 9 | Packetstream | 94.36 | 97.28 | 96.35 | 94.87 | 92.27 | 92.55 | 92.85 | ||||

| 10 | Rayobyte | 98.99 | 99.44 | 99.35 | 98.56 | 99.18 | 98.27 | 99.14 | ||||

| 11 | IPRoyal | 99.39 | 99.83 | 99.59 | 98.59 | 99.78 | 98.93 | 99.60 | ||||

| 12 | SOAX | 98.30 | 98.51 | 98.75 | 98.89 | 98.61 | 98.33 | 96.69 | ||||

| 13 | Webshare | 99.04 | 99.72 | 99.77 | 99.59 | 98.09 | 97.36 | 99.72 |

Average response time, Global pool:

Change compared to previous years:

| 2024 | vs 2023 | vs 2022 | vs 2021 | |

|---|---|---|---|---|

| Oxylabs | 0.41 | -0.16 | -0.45 | -0.57 |

| Smartproxy | 0.54 | -0.03 | -0.75 | -0.43 |

| Infatica | 0.99 | -0.21 | ||

| Bright Data | 1.12 | 0.1 | 0.04 | -0.06 |

| Netnut | 1.21 | -0.93 | -0.16 | -0.19 |

| IPRoyal | 1.36 | -2.37 | ||

| Packetstream | 1.56 | 0.41 | -0.9 | -0.34 |

| SOAX | 2.11 | 1.06 | -0.23 | -1.58 |

| Rayobyte | 2.12 | -0.05 | -0.01 | |

| Average | 1.27 | -0.24 | -0.35 | -0.53 |

Average response time, country pools:

(This table is sortable.)

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | Average | Global | US | UK | EU | Brazil | India | AU |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | IPRoyal | 1.09 | 1.36 | 1.03 | 0.53 | 0.63 | 1.59 | 1.67 | 1.06 | ||||

| 2 | Infatica | 1.38 | 0.99 | 1.28 | 0.44 | 0.49 | 1.54 | 1.99 | 2.52 | ||||

| 3 | Smartproxy | 0.75 | 0.54 | 0.49 | 0.39 | 0.43 | 1.28 | 1.23 | 0.65 | ||||

| 5 | Bright Data | 1.18 | 1.12 | 1.00 | 0.75 | 0.80 | 1.04 | 1.76 | 1.73 | ||||

| 6 | DataImpulse | 1.44 | 1.58 | 1.01 | 0.68 | 0.93 | 2.91 | 1.27 | 1.84 | ||||

| 7 | SOAX | 3.12 | 2.11 | 3.09 | 2.79 | 1.36 | 2.07 | 3.30 | 6.12 | ||||

| 8 | Oxylabs | 0.68 | 0.41 | 0.57 | 0.39 | 0.42 | 1.12 | 0.97 | 0.63 | ||||

| 9 | Webshare | 1.67 | 1.67 | 1.10 | 1.06 | 1.16 | 1.90 | 2.72 | 2.07 | ||||

| 10 | Packetstream | 1.82 | 1.56 | 1.02 | 1.69 | 1.72 | 1.55 | 2.40 | 2.56 | ||||

| 11 | Netnut | 1.22 | 1.21 | 0.83 | 0.64 | 0.85 | 1.89 | 1.95 | 1.17 | ||||

| 12 | Rayobyte | 2.53 | 2.25 | 1.67 | 2.15 | 2.40 | 2.70 | 3.29 | 2.97 | ||||

| 13 | Nimbleway | 1.63 | 1.26 | 0.70 | 1.21 | 1.26 | 1.02 | 2.69 | 2.89 | ||||

| 14 | NodeMaven | 3.67 | 1.72 | 3.36 | 3.90 | 1.44 | 2.19 | 3.78 | 7.34 |

Average success rate with major websites:

(Bright Data and Oxylabs block Google by default. Oxylabs enables it after a client review.)

Average response time with major websites:

Features

- City-level targeting has been commoditized, with 10 out of 13 providers offering this feature. However, ASN selection is rarer: only seven participants support it. Dataimpulse has taken an unorthodox approach that allows excluding rather than focusing a particular ASN.

- More providers have started implementing new filters, such as ZIP code and co-ordinate level targeting. Nimbleway & NodeMaven have taken things further: the former offers a use case-based AI optimization engine, while the latter has a three-level quality filter aimed at reputation-sensitive use cases.

- Providers have started innovating with IP rotation as well: in particular, the ability to establish long proven sessions to ensure residential IP stability.

- Generally, only the premium participants have HTTPS endpoints to meet corporate requirements. SOCKS5 is widely available (12/13), but in most cases it comes without the benefits of UDP or QUIC support.

| Country | State | City | ASN | Other filters | |

|---|---|---|---|---|---|

| Bright Data | ✅ | ✅ | ✅ | ✅ | ZIP, coordinates, OS |

| Dataimpulse | ✅ | ❌ | ❌ | Exclude ASN | |

| Infatica | ✅ | ✅ | ✅ | ✅ | Region |

| IPRoyal | ✅ | ✅ | ✅ | ❌ | Region, high quality pool |

| NetNut | ✅ | ✅ | ✅ | ✅ | |

| Nimbleway | ✅ | ✅ | ✅ | ❌ | Use case |

| Nodemaven | ✅ | ✅ | ✅ | ✅ | IP quality filter |

| Oxylabs | ✅ | ✅ | ✅ | ✅ | ZIP, coordinates |

| PacketStream | ✅ | ❌ | ❌ | ❌ | |

| Rayobyte | ✅ | ✅ | ✅ | ✅ | |

| Smartproxy | ✅ | ✅ | ✅ | ❌ | ZIP |

| SOAX | ✅ | ✅ | ✅ | ✅ | |

| Webshare | ✅ | ❌ | ❌ | ❌ |

| Every request | Sessions | Custom duration | Other | |

|---|---|---|---|---|

| Bright Data | ✅ | ✅ | Custom rules with Proxy Manager | Long session peers |

| Dataimpulse | ✅ | ✅ | Up to 120 mins | |

| Infatica | ✅ | ✅ | 5-60 mins | Manual rotation |

| IPRoyal | ✅ | ✅ | Freely customizable | Manual rotation |

| NetNut | ✅ | ✅ | ❌ | |

| Nimbleway | ✅ | ✅ | 5-30 mins | Extended geo-sessions |

| Nodemaven | ✅ | ✅ | Freely customizable | Super sticky sessions |

| Oxylabs | ✅ | ✅ | 1-30 mins | |

| PacketStream | ✅ | ✅ | ❌ | |

| Rayobyte | ✅ | ✅ | ❌ | |

| Smartproxy | ✅ | ✅ | 1, 10, 30 mins | |

| SOAX | ✅ | ✅ | Custom duration | |

| Webshare | ✅ | ✅ | Customizable session & idle timeout |

| HTTP | HTTPS | SOCKS5 | Authentication methods | Concurrency | |

|---|---|---|---|---|---|

| Bright Data | ✅ | ✅ | ✅ (requires extra software) | 2 | Unlimited |

| Dataimpulse | ✅ | ❌ | ✅ | 2 | Unlimited |

| Infatica | ✅ | ❌ | ✅ | 2 | Unlimited |

| IPRoyal | ✅ | ❌ | ✅ | 2 | Unlimited |

| NetNut | ✅ | ✅ | ✅ | 2 | Unlimited |

| Nimbleway | ✅ | ❌ | ❌ | 2 | Unlimited |

| Nodemaven | ✅ | ❌ | ✅ | Credentials | Unlimited |

| Oxylabs | ✅ | ✅ | ✅ | 2 | Unlimited |

| PacketStream | ✅ | ✅ | ✅ | Credentials | Unlimited |

| Rayobyte | ✅ | ❌ | ✅? | 2 | Unlimited |

| Smartproxy | ✅ | ✅ | ✅ | 2 | Unlimited |

| SOAX | ✅ | ❌ | ✅ | 2 | Unlimited |

| Webshare | ✅ | ❌ | ✅ | 2 | Unlimited |

Pricing

- Subscription remains the dominant pricing model, but 9/13 participants also offer paying as you go. Out of them, four have PAYG as the sole pricing model, often with scaling rates for bulk purchases.

- Residential proxies are more accesible than ever with the lowest entry price at $7 and the median at $8.4. Self-service has become universally available.

- The rates have dropped nearly 40% at 5 GB and around 20% at 1 TB compared to 2023. PacketStream and Dataimpulse have the lowest prices with $1/GB, though PacketStream still overcounts traffic use by multiple times.

| Structure | Model | Upsells | Self-service | Starting price | Trial | |

|---|---|---|---|---|---|---|

| Bright Data | Traffic | Subscription, PAYG | City, ASN, ZIP targeting, dedicated IPs, long session peers | ✅ | $8.4 | 7 days for companies |

| Dataimpulse | Traffic | Scaling PAYG | – | ✅ | $50 | 5 GB for $5 |

| Infatica | Traffic | Subscription, PAYG | – | ✅ | $8 | 100 MB for $199 |

| IPRoyal | Traffic | Scaling PAYG | – | ✅ | $7 | – |

| NetNut | Traffic | Subscription | – | ✅ | $100 | 7 days for companies |

| Nimbleway | Platform credits | Subscription | – | ✅ | $600 | 7 days |

| Nodemaven | Traffic | Scaling PAYG | – | ✅ | $35 | 500 MB for €3.99 |

| Oxylabs | Traffic | Subscription, PAYG | – | ✅ | $8 | 7 days for companies |

| PacketStream | Traffic | PAYG | – | ✅ | $50 | – |

| Rayobyte | Traffic | Subscription, PAYG | – | ✅ | $7.5 | 50 MB |

| Smartproxy | Traffic | Subscription, PAYG | More sub-users | ✅ | $7 | 3 days |

| SOAX | Traffic | Subscription | More ports | ✅ | $99 | 100 MB for $199 |

| Webshare | Traffic | Subscription | More threads | ✅ | $7 | – |

(This table is sortable.)

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | 5 GB | 20 GB | 50 GB | 100 GB | 250 GB | 500 GB | 1 TB |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Bright Data | 8.40 | 8.40 | 8.40 | 7.14 | 6.30 | 5.88 | |||||

| 125 | Dataimpulse | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | ||||||

| 126 | Infatica | 6.86 | 6.86 | 6.00 | 5.00 | 5.00 | 2.92 | |||||

| 127 | IPRoyal | 5.95 | 5.25 | 4.90 | 4.55 | 4.20 | 3.50 | 3.15 | ||||

| 128 | NetNut | 20.00 | 15.00 | 12.00 | 8.00 | 6.50 | 5.00 | 4.00 | ||||

| 129 | Nimbleway | 8.00 | 8.00 | 8.00 | 7.50 | 6.30 | 4.60 | 4.60 | ||||

| 130 | Nodemaven | 7.00 | 6.50 | 5.00 | 4.50 | 4.00 | 3.50 | |||||

| 131 | Oxylabs | 8.00 | 7.75 | 7.50 | 7.00 | 7.00 | 5.50 | 4.00 | ||||

| 132 | PacketStream | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | ||||||

| 133 | Rayobyte | 7.50 | 6.60 | 5.00 | 4.50 | 4.00 | 3.50 | 3.20 | ||||

| 134 | Smartproxy | 6.00 | 5.50 | 4.90 | 4.50 | 4.00 | 3.50 | 3.00 | ||||

| 135 | SOAX | 6.60 | 6.17 | 5.68 | 4.00 | 3.20 | 3.00 | |||||

| 136 | Webshare | 6.00 | 6.00 | 5.50 | 5.50 | 5.25 | 5.00 | 4.50 | ||||

| Avg = 8.54 | Avg = 7.50 | Avg = 5.86 | Avg = 5.14 | Avg = 4.50 | Avg = 3.86 | Avg = 3.12 |

Price changes since 2023’s research:

| Provider | 5 GB | 20 GB | 50 GB | 100 GB | 250 GB | 500 GB | 1 TB |

|---|---|---|---|---|---|---|---|

| Bright Data | -44% | -44% | -44% | -44% | -44% | -44% | Custom |

| Infatica | – | -43% | -24% | -14.50% | -28.50% | -16.50% | -16.50% |

| Oxylabs | -47% | -48.50% | -37.50% | -13% | – | -8% | – |

| Rayobyte | -50% | -47% | -29% | -25% | -20% | -12.5% | +7% |

| Smartproxy | -52% | -45% | -39% | -35.50% | -33% | -30% | -25% |

| SOAX | – | -45% | -44% | -19% | -43% | -36% | -25% |

| Average decrease | -48% | -45% | -36% | -25% | -34% | -27% | -14.88% |

Aggregated average price change compared to 2023’s research:

| All participants | Same participants | |

|---|---|---|

| 5 GB | -38.10% | -33% |

| 100 GB | -24.60% | -18.30% |

| 500 GB | -21.20% | -20% |

Mobile Proxies

Mobile proxies are home devices (most often phones or USB dongles) connected to the 3G/4G/5G networks of consumer mobile carriers like Verizon. They’re considered the most effective proxy type in terms of anonymity. But, being expensive and hard to source, mobile IPs aren’t an everyday choice like residential proxy servers.

We’re interested in peer-to-peer mobile proxies rather than dedicated device farms. This section follows a similar structure to the residential part, only on a smaller scale and with fewer benchmarks.

Evaluation Graphs

Below are our evaluation graphs separated by market segment. There weren’t any true entry level peer-to-peer mobile proxy providers, so two categories will have to suffice.

(Hover on a provider’s name to highlight it, click to filter out.)

Oxylabs and NetNut both had very strong showings. We’re only concerned that NetNut’s promise of mobile IPs clashes with our data, and that we’re seeing significantly fewer carrier-bound IPs than the pool size would suggest. But maybe that’s an imperfection in our methodology?

Bright Data’s pool is immaculate as always. However, it’s not as big, and like last year, we can’t get it to perform with popular targets. Otherwise, the proxy network is definitely worth attention, especially after Bright Data’s latest price revision.

(Hover on a provider’s name to highlight it, click to filter out.)

Smartproxy and SOAX more or less cover all the bases, making both excellent choices for mobile proxies. Faced against competitors this tough, Rayobyte and Infatica fell short, without the price tag to weigh the scales back in their favor.

Pool Size & Composition

- The largest advertised mobile proxy pool is now 30 million (up from 20M), thanks to SOAX increasing its count by over 700%.

- In our tests, NetNut had the most IPs in both Global and select country pools. However, we found the majority of them to be non-mobile (also an issue with Rayobyte & Infatica).

- Looking at mobile proxies only, Oxylabs and Smartproxy were the largest. On the contrary, SOAX’s proxy pool has shrunk by a half compared to 2023.

| Advertised pool size | Coverage | |

|---|---|---|

| SOAX | 30 million (+757% YoY) | Global |

| Oxylabs | 20 million | 140+ countries |

| Smartproxy | 10 million | 130+ countries |

| Bright Data | 7 million | Global |

| Infatica | 5 million | ~50 countries |

| NetNut | 250,000 | 100+ countries |

| Rayobyte | Not specified | Mainly the US |

Total and mobile unique IPs in the Global pool:

Change compared to previous years:

Unique IPs in select country pools:

(Hover on a country’s name to highlight it, click to filter out.)

Percentage of mobile IPs (ISP/MOB & MOB categories, IP2Location):

| Provider average | US | UK | EU | Brazil | India | Australia | |

|---|---|---|---|---|---|---|---|

| Bright Data | 97.75% | 96.74% | 99.61% | 98.23% | 97.74% | 99.65% | 94.51% |

| Smartproxy | 96.88% | 93.99% | 97.86% | 97.96% | 97.42% | 99.52% | 94.51% |

| Oxylabs | 96.86% | 94.11% | 97.92% | 97.97% | 97.35% | 99.52% | 94.31% |

| SOAX | 94.01% | 99.85% | 99.30% | 98.72% | 98.40% | 99.70% | 68.06% |

| NetNut | 54.02% | 26.08% | 66.58% | 66.50% | 40.41% | 94.17% | 30.36% |

| Rayobyte | 47.47% | 28.75% | 53.43% | 67.01% | 34.02% | 64.79% | 36.84% |

| Infatica | 42.95% | 20.92% | 50.63% | 32.21% | 40.79% | 92.61% | 20.51% |

| Country average | 65.78% | 80.76% | 78.80% | 72.30% | 92.85% | 62.73% |

Location accuracy (excluding EU, MaxMind data):

| Overall | Below 99.90% | |

|---|---|---|

| Bright Data | 99.93% | AU (99.82%) |

| Smartproxy | 99.93% | UK (99.80%) |

| Netnut | 99.93% | AU (99.85%) |

| Oxylabs | 99.92% | UK (99.76%) |

| SOAX | 99.91% | UK (99.77%) |

| Infatica | 99.76% | UK (99.67%), BR (99.34%), AU (99.83%) |

| Rayobyte | 88.02% | US (99.74%), UK (94.88%), BR (87.91%), IN (95.68%), AU (61.90%) |

Performance Benchmarks

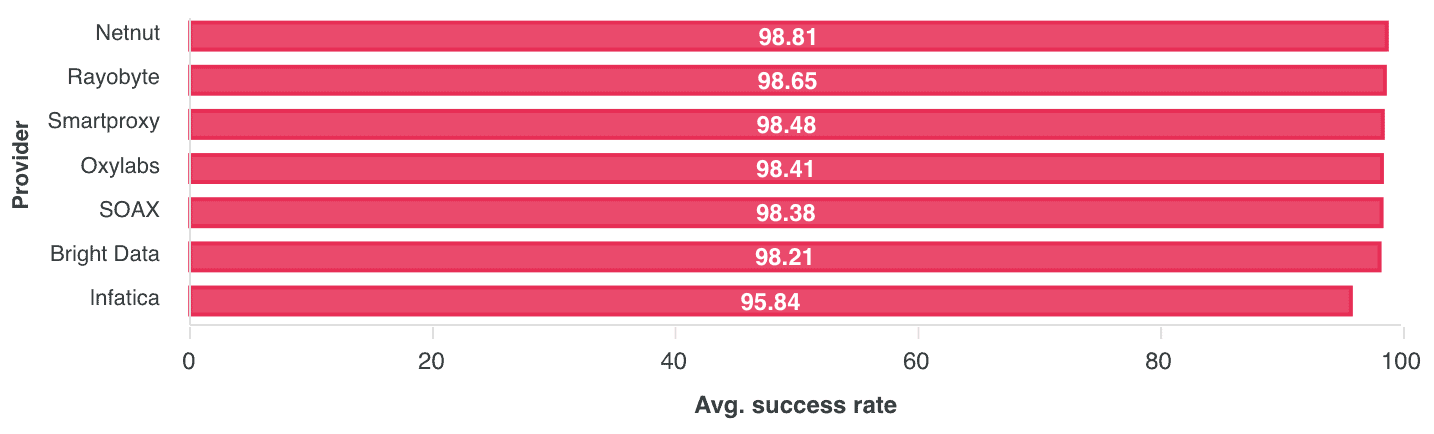

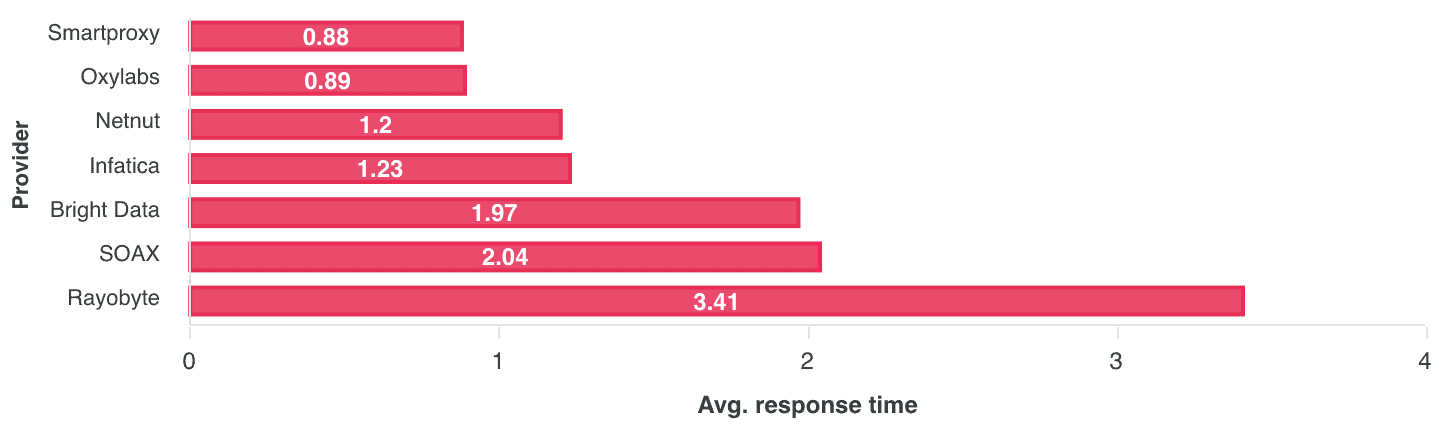

- All providers had an average infrastructure success rate of around 98% in the Global pool, save for Infatica with 95%. Overall, NetNut narrowly performed the best, and it has improved significantly since 2023.

- Smartproxy (0.88 s) and Oxylabs (0.89 s) were notably faster than the competition, especially compared to Rayobyte’s 3.41 s average response time.

- The benchmarks with popular websites looked very similar across the board (90-92% success rate). Bright Data’s mobile proxies underperformed – we saw a similar issue in 2023.

Average success rate, Global pool:

Change compared to previous years:

| 2024 | vs 2023 | vs 2022 | |

|---|---|---|---|

| Netnut | 98.81% | 3.13% | |

| Rayobyte | 98.65% | 1.18% | 10.39% |

| Smartproxy | 98.48% | 1.11% | |

| Oxylabs | 98.41% | 0.53% | 0.54% |

| SOAX | 98.38% | 0.16% | -0.48% |

| Bright Data | 98.21% | 0.15% | -0.2% |

| Average | 98.49% | 1.04% | 2.56% |

Average success rate, country pools:

(This table is sortable.)

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | Average | Random | US | UK | EU | Brazil | India | AU |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Bright Data | 95.34 | 98.21 | 95.38 | 93.21 | 97.44 | 90.63 | 97.68 | 97.70 | ||||

| 2 | Infatica | 97.83 | 95.84 | 97.88 | 99.31 | 98.54 | 98.94 | 93.38 | 98.90 | ||||

| 3 | Netnut | 93.14 | 98.81 | 98.87 | 98.94 | 98.72 | 98.00 | 72.72 | 91.60 | ||||

| 4 | Oxylabs | 95.42 | 98.41 | 95.44 | 97.54 | 97.12 | 92.09 | 92.60 | 97.75 | ||||

| 5 | Rayobyte | 95.95 | 98.65 | 99.67 | 99.54 | 79.60 | 99.19 | 98.87 | 98.81 | ||||

| 6 | Smartproxy | 94.98 | 98.48 | 94.98 | 97.53 | 97.19 | 91.32 | 91.75 | 97.13 | ||||

| 7 | SOAX | 96.63 | 98.38 | 94.06 | 95.03 | 98.32 | 98.17 | 98.42 | 95.75 | ||||

Average response time, Global pool:

Change compared to previous years:

| 2024 | vs 2023 | vs 2022 | |

|---|---|---|---|

| Smartproxy | 0.88 | -0.24 | |

| Oxylabs | 0.89 | -0.21 | -0.71 |

| Netnut | 1.20 | -1.07 | |

| Bright Data | 1.97 | 0.16 | -0.59 |

| SOAX | 2.04 | 0.32 | -1.48 |

| Rayobyte | 3.41 | 0.58 | -3.72 |

| Average | 1.73 | -0.08 | -1.63 |

Average response time, country pools:

(This table is sortable.)

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | Average | Random | US | UK | EU | Brazil | India | AU |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Bright Data | 1.86 | 1.97 | 1.47 | 1.36 | 1.28 | 2.27 | 2.74 | 2.06 | ||||

| 2 | Infatica | 1.48 | 1.23 | 1.21 | 0.39 | 0.56 | 1.80 | 2.47 | 2.47 | ||||

| 3 | Netnut | 1.25 | 1.20 | 0.85 | 0.64 | 0.79 | 1.45 | 2.29 | 1.46 | ||||

| 4 | Oxylabs | 1.57 | 0.89 | 1.43 | 1.13 | 1.16 | 2.54 | 1.89 | 1.29 | ||||

| 5 | Rayobyte | 2.66 | 3.41 | 1.99 | 2.24 | 2.49 | 2.64 | 3.52 | 3.05 | ||||

| 6 | Smartproxy | 2.27 | 0.88 | 2.14 | 1.11 | 1.15 | 3.23 | 3.33 | 2.66 | ||||

| 7 | SOAX | 5.00 | 2.04 | 6.63 | 6.22 | 3.26 | 3.34 | 3.43 | 7.14 | ||||

Average success rate (%):

(Bright Data blocks Google for this proxy type.)

Average response time (s):

Features

- Nearly all participants support city-level filtering, and the same applies to ASN targeting – the latter feature is more frequent compared to residential proxy networks. On the other hand, we don’t see features like optimization by use case or IP quality filters yet.

- 4/7 providers offer HTTPS gateways, and all seven support SOCKS5. Once again, the protocol’s functionality is often severely restricted.

| Country | State | City | Extra | ASN | Other filters | |

|---|---|---|---|---|---|---|

| Bright Data | ✅ | ✅ | ✅ | ZIP code | ✅ | OS |

| Infatica | ✅ | ✅ | ✅ | ✅ | ||

| NetNut | ✅ | ✅ | ✅ | ✅ | ||

| Oxylabs | ✅ | ✅ | ✅ | Coordinates | ✅ | |

| Rayobyte | ✅ | ? | ? | ❌ | ||

| Smartproxy | ✅ | ✅ | ✅ | ✅ | OS | |

| SOAX | ✅ | ✅ | ✅ | ✅ |

| Every request | Sessions | Custom duration | Other | |

|---|---|---|---|---|

| Bright Data | ✅ | ✅ | With Proxy Manager | Long session peers |

| Infatica | ✅ | ✅ | 5-60 mins | |

| NetNut | ✅ | ✅ | ❌ | |

| Oxylabs | ✅ | ✅ | 1-30 mins | |

| Rayobyte | ✅ | ✅ | ❌ | |

| Smartproxy | ✅ | ✅ | 1, 10, 30 mins | |

| SOAX | ✅ | ✅ | 1-60 mins, custom length |

| HTTP | HTTPS | SOCKS5 | Authentication methods | Concurrency | |

|---|---|---|---|---|---|

| Bright Data | ✅ | ✅ | ✅ (requires extra software) | 2 | Unlimited |

| Infatica | ✅ | ❌ | ✅ | 2 | Unlimited |

| NetNut | ✅ | ✅ | ✅ | 2 | Unlimited |

| Oxylabs | ✅ | ✅ | ✅ | 2 | Unlimited |

| Rayobyte | ✅ | ❌ | ✅? | Credentials | Unlimited |

| Smartproxy | ✅ | ✅ | ✅ | 2 | Unlimited |

| SOAX | ✅ | ❌ | ✅ (with UDP) | 2 | Unlimited |

Pricing

- 4/7 participants allow paying as you go, but it’s never the primary pricing model and doesn’t scale compared to subscription plans. Still, the situation is much better than last year, when only Bright Data offered PAYG.

- The smallest entry price ($8.4) is not much higher compared to residential proxies. The median starting price ($20) is nearly thrice higher , showing that mobile proxies are still considered a premium product.

- At the same time, mobile proxies have experienced significant price cuts, in some cases reaching nearly 80%. In general, mobile proxy networks cost around 50% cheaper on average compared to 2023.

| Structure | Model | Upsells | Self-service | Starting price | Trial | |

|---|---|---|---|---|---|---|

| Bright Data | Traffic | Subscription, PAYG | City, ASN, ZIP targeting, dedicated IPs, long session peers | ✅ | $8.4 | 7 days for companies |

| Infatica | Traffic | Subscription, PAYG | – | ✅ | $18 | 100 MB for $199 |

| NetNut | Traffic | Subscription | – | ✅ | $300 | 7 days for companies |

| Oxylabs | Traffic | Subscription, PAYG | – | ✅ | $9 | Demo |

| Rayobyte | Traffic | Subscription | – | ❌ | $50 | ❌ |

| Smartproxy | Traffic | Subscription, PAYG | More sub-users | ✅ | $20 | 14-day refund |

| SOAX | Traffic | Subscription | – | ✅ | $99 | 100 MB for $199 |

(This table is sortable.)

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | 5 GB | 10 GB | 20 GB | 50 GB | 100 GB |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Bright Data | 8.40 | 8.40 | 8.40 | 8.40 | 7.14 | ||||

| 2 | Infatica | 15.00 | 13.00 | 12.00 | 10.00 | 8.00 | ||||

| 3 | NetNut | 30.00 | 19.00 | |||||||

| 4 | Oxylabs | 9.00 | 9.00 | 8.50 | 8.00 | 7.50 | ||||

| 5 | Rayobyte | 25.00 | 25.00 | 20.00 | 20.00 | 15.00 | ||||

| 6 | Smartproxy | 15.00 | 8.50 | 8.50 | 7.50 | 7.00 | ||||

| 7 | SOAX | 6.60 | 6.10 | 5.60 | ||||||

| Avg = 14.48 | Avg = 12.78 | Avg = 13.43 | Avg = 10.00 | Avg = 9.89 |

Price changes since 2023’s research:

| Provider | 5 GB | 10 GB | 20 GB | 50 GB | 100 GB |

|---|---|---|---|---|---|

| Bright Data | -79% | -79% | -75% | -72% | -74.50% |

| NetNut | – | – | – | – | – |

| Oxylabs | -59% | -64% | -61% | -58% | -56% |

| Rayobyte | – | – | – | – | – |

| Smartproxy | -40% | -63% | -57% | -57% | -56% |

| SOAX | – | – | -74.50% | -76.50% | -77.50% |

| Average decrease | -59.3% | -68.7% | -66.9% | -65.9% | -66% |

Aggregated average price change compared to 2023’s research:

| All participants | |

|---|---|

| 5 GB | -53% |

| 20 GB | -44% |

| 100 GB | -49.5% |

Rotating Datacenter Proxies

Datacenter proxies are servers associated with cloud hosting providers. They’re the cheapest and most performant proxy type but also one that’s easiest to detect. Providers historically sold access to static datacenter proxies, but nowadays they often come in rotating clusters for easier management and more variety.

Considering that datacenter-based proxies are nearly always online, we’ll pay less attention to measuring their pools and rather focus on evaluating how well these servers perform. The sub-sections on features and pricing follow the same structure as the other proxy types.

Evaluation Graph

Below is our interpretation of the results. Instead of Proxy pools, we evaluate Location coverage – the other aspects remain unchanged.

Note: We decided to exclude SOAX from the evaluation. It gave us proxies associated with consumer ISPs like Sprint and AT&T – it’s unlikely that these IPs are available to regular users.

(Hover on a provider’s name to highlight it, click to filter out.)

Bright Data and Webshare stand out, especially in their breadth of features and location coverage. We’d be hard pressed to pick the better option, but Webshare’s pricing might just make it a more compelling choice. Granted, that’s if you don’t find the extra destinations and targeting options a necessity.

The rest mostly blended together. They’re all excellent options in their own right, simply not as fleshed out for the broad strokes we’re making.

Pool Size & Composition

- Despite being comparatively smaller, the pools of rotating datacenter proxies can reach hundreds of thousands of IPs.

- The available formats have also become more elaborate: Bright Data, Smartproxy, and Webshare all sell static lists with an optional rotating layer on top, in addition to regular rotating endpoints.

- Overall, Bright Data and Webshare have the best developed rotating datacenter proxy services, both in size and location coverage (40+ countries).

| Advertised pool size | Details | Coverage | |

|---|---|---|---|

| Bright Data | 770,000 | Regular pool (20,000 IPs), Premium pool, and pay/IP formats available* | 90+ countries |

| NetNut | 150,000 | US | |

| Smartproxy | 100,000 | Pool-based and pay/IP formats available | 8 countries |

| Oxylabs | 22,000 | 8 countries | |

| Webshare | Not specified | Pool-based (up to 200,000 IPs/month) and pay/IP formats available** | ~40 countries |

| Rayobyte | Not specified | ~27,200 IPs assigned to us | US |

| SOAX | Not specified | ~4,500 IPs assigned to us *** | US |

* Bright Data’s pool format randomly assigns 20,000 IPs from all locations. We bought 50,000 IPs in the US instead, with 230,000 available for purchase in total.

** We used the pool format, which assigned 10 endpoints with 5-minute rotation.

*** SOAX actually gave us ISP proxies associated with consumer networks like Sprint, AT&T, and Verizon. We really doubt that this is what regular customers get.

Performance Benchmarks

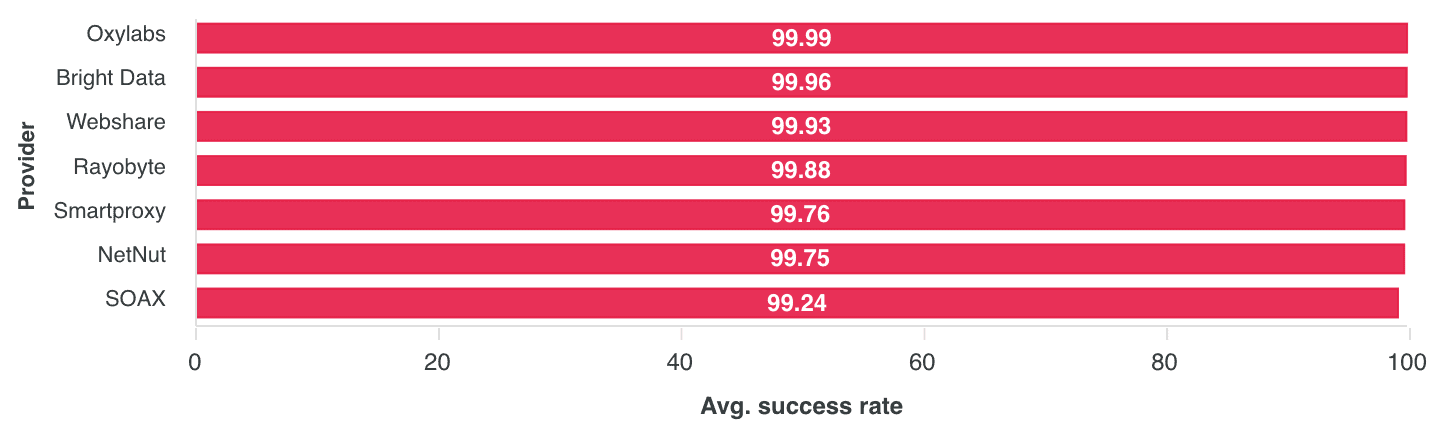

- With a median success rate of 99.88%, rotating datacenter proxies very rarely fail on their own. Oxylabs‘s results stood out (99.99%).

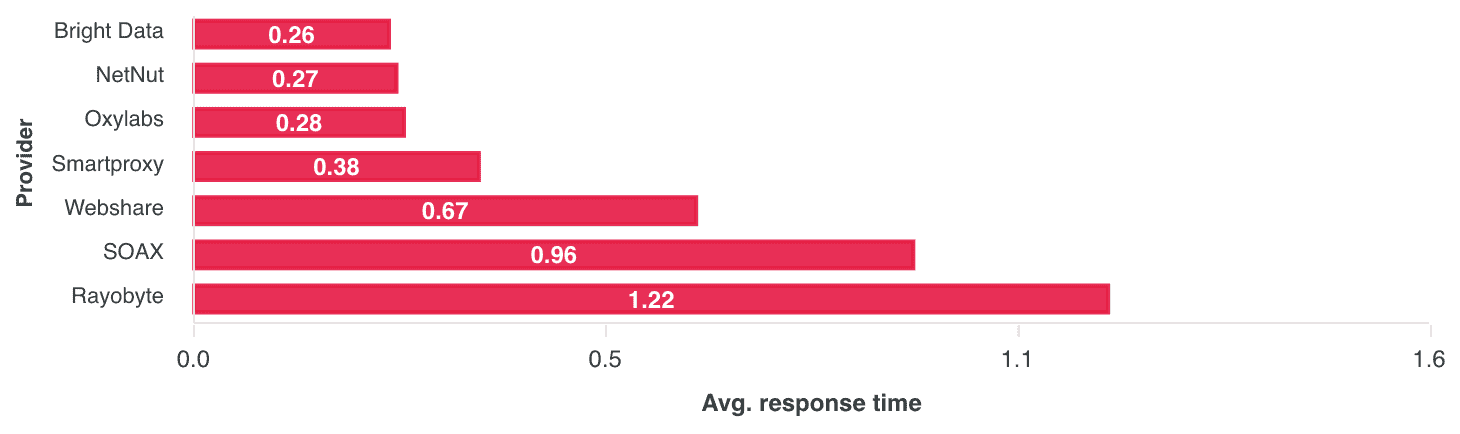

- The median response time (0.38 s) was also very low compared to the other proxy types. The fastest participant (Bright Data, 0.26 s) completed requests over four times quicker than the slowest proxy network (Rayobyte, 1.22 s).

- We saw big differences in throughoutput. Smartproxy‘s proxy servers (30.27 MB/s) downloaded 100MB packets over 30 times faster on average compared to SOAX (0.73 MB/s).

- Most providers performed better with Google than we expected (60-100% success rate), while the results with Amazon varied (6-100%). SOAX‘s results were flawless, thanks to the provider using ISP-registered IPs instead of hosting companies.

Average success rate, US:

Average response time, US:

Average download speed of 10 IPs (baseline – 32.56 MB/s):

Average success rate with major websites:

(Bright Data blocks Google for this proxy type.)

Average response time with major websites:

Features

- With rotating datacenter proxies, city-level targeting is rare (2/7 participants), and ASN targeting is even rarer (1/7).

- SOCKS5 support is a hit-or-miss (4/7), and the majority only have one authentication method available (credentials).

| Country | State | City | ASN | |

|---|---|---|---|---|

| Bright Data | ✅ | ❌ | ✅ | ❌ |

| NetNut | ✅ | ❌ | ❌ | ❌ |

| Oxylabs | ✅ | ❌ | ❌ | ❌ |

| Rayobyte | ✅ | ❌ | ❌ | ❌ |

| Smartproxy | ✅ | ❌ | ❌ | ❌ |

| SOAX | ✅ | ❌ | ✅ | ✅ |

| Webshare | ✅ | ❌ | ❌ | ❌ |

| Every request | Sessions | Custom duration | |

|---|---|---|---|

| Bright Data | ✅ | ✅ | With Proxy Manager |

| NetNut | ✅ | ✅ | ❌ |

| Oxylabs | ✅ | ✅ | ❌ |

| Rayobyte | ✅ | ✅ | ❌ |

| Smartproxy | ✅ | ✅ | 30 mins |

| SOAX | ✅ | ✅ | Custom duration |

| Webshare | ✅ | ✅ | ❌ |

| HTTP | HTTPS | SOCKS5 | Authentication methods | Concurrency | |

|---|---|---|---|---|---|

| Bright Data | ✅ | ✅ | ✅ (requires extra software) | 2 | Unlimited |

| NetNut | ✅ | ✅ | ✅ | Credentials | Unlimited |

| Oxylabs | ✅ | ❌ | ❌ | Credentials | Unlimited |

| Rayobyte | ✅ | ❌ | ❌ | Credentials | Unlimited |

| Smartproxy | ✅ | ❌ | ❌ | Credentials | Unlimited |

| SOAX | ✅ | ❌ | ✅ | 2 | Unlimited |

| Webshare | ✅ | ❌ | ✅ | 2 | 500+ threads |

Pricing

- Pay-as-you-go is still rare, with only two participants offering this option. However, self-service is widely available.

- The entry point ranges between less than a dollar and $100, showing very different approaches. For some, it’s still an enterprise product, albeit less effective than the other proxy types.

- Rotating datacenter proxies cost $0.7 on average at 100 GB of data – seven times cheaper than residential and over 14 times cheaper than mobile proxy networks.

| Structure | Model | Upsells | Self-service | Starting price | Trial | |

|---|---|---|---|---|---|---|

| Bright Data | Traffic / IP + traffic | Subscription, PAYG | Premium pool, city targeting, unlimited traffic | ✅ | $0.65 | 7 days for companies |

| NetNut | Traffic | Subscription | – | ✅ | $100 | 7 days for companies |

| Oxylabs | Traffic | Subscription | – | ✅ | $50 | 3-day refund |

| Rayobyte | Traffic | PAYG | – | ❌ | $0.65 | 2-day refund |

| Smartproxy | Traffic / IP + traffic | Subscription | More traffic | ✅ | $10 | 3-day refund |

| SOAX | Traffic | Subscription | – | ✅ | $99 | 100 MB for $199 |

| Webshare | Pay per IP + traffic | Subscription | More traffic, threads, network priority, verified proxies | ✅ | $1 | Free plan with 10 IPs |

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | 50 GB | 100 GB | 250 GB | 500 GB | 1,000 GB | 2,000 GB |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Bright Data* | 0.65 | 0.65 | 0.65 | 0.57 | 0.55 | 0.55 | ||||

| 2 | NetNut | 1.00 | 0.74 | 0.70 | 0.50 | 0.50 | |||||

| 3 | Oxylabs | 0.65 | 0.60 | 0.55 | 0.50 | 0.46 | |||||

| 4 | Rayobyte** | 0.67 | 0.60 | 0.55 | 0.53 | 0.50 | 0.50 | ||||

| 5 | Smartproxy | 0.70 | 0.65 | 0.55 | 0.53 | 0.50 | 0.48 | ||||

| 6 | SOAX | 0.65 | 0.65 | 0.60 | 0.60 | 0.50 | |||||

| 7 | Webshare*** | 0.52 | 0.39 | 0.19 | 0.13 | ||||||

| Avg = 0.67 | Avg = 0.70 | Avg = 0.61 | Avg = 0.55 | Avg = 0.48 | Avg = 0.45 |

* Bright Data’s per-gigabyte pricing.

** Rayobyte still has this product in beta. We used the provider’s supplied pricing.

*** Webshare’s Up to 200,000 IPs/month product.

User Experience

The final section explores the usage experience of the participants. It covers areas like budget and access management, monitoring tools, compliance measures, and customer service.

Knowing how varied customer requirements can be, we’ll be taking a descriptive rather than prescriptive approach, documenting available features but not evaluating their merits.

Budget Management

- Most participants have the building blocks for financial flexibility: a wallet and some form of paying as you go. However, only two, Bright Data and Nimbleway, offer commitment-based plans that affect the whole platform rather than a single product.

- A half have an option to impose spending limits, usually in the scope of a sub-user.

- Budget analytics tools are primarily available with the enterprise providers like Bright Data, Nimbleway, and Oxylabs.

(PAYG refers to pay-as-you-go)

| Wallet | Subscription type | Flexible commitment | Spend limits | Spending analysis | |

|---|---|---|---|---|---|

| Bright Data | ✅ | Platform | Unlimited PAYG, commitment based pricing | ✅ (per zone) | ✅ (Cost explorer) |

| Dataimpulse | ✅ | Product | Scaling PAYG | ✅ (namable plans per account) | ✅ (Basic) |

| Infatica | ✅ | Product | PAYG | ❌ | ❌ |

| IPRoyal | ✅ | Product | Scaling PAYG | ✅ (per sub-user) | ❌ |

| NetNut | ❌ | Product | ❌ | ✅ (per sub-user) | ❌ |

| Nimbleway | PAYG accounts | Platform | PAYG, commitment based plans | ✅ | ✅ |

| Nodemaven | ❌ | Product | Non-expiring traffic | ❌ | ❌ |

| Oxylabs | ✅ | Product | Limited PAYG, top-up functionality | ✅ (per sub-user) | ✅ |

| PacketStream | ✅ | Product | Unlimited PAYG | ❌ | ✅ (Basic) |

| Rayobyte | ❌ | Product | Unlimited PAYG, top-up functionality | ❌ | ❌ |

| Smartproxy | ✅ | Product | Limited PAYG, top-up functionality | ✅ | ❌ |

| SOAX | ✅ | Product | Limited top-up functionality | ❌ | ❌ |

| Webshare | ✅ | Product (one plan per account) | ❌ | ✅ (per sub-user) | ❌ |

Access Management

- Single-sign on is relatively common (9/13 providers), independent of the market segment. Google is, of course, the preferred option among providers, but you can also find LinkedIn and even Okta. Infatica’s additions of Twitter and Facebook are unusual given its target audience.

- Shared access is mostly available in the form of sub-users (8/13 participants), though enterprise providers are also able to assign roles with permissioned access to the platform. This is very useful when several departments need to interact with the service.

- Proxy setup widgets surprise no one in 2024. However, a third of the providers still restrict or fail to offer programmatic access through an API. It’s relevant not only for managing users but also fetching data about proxy endpoints and available IPs.

- Supporting tools aren’t very popular, with four browser extensions, three proxy checkers, and two proxy managers. For the first two, it’s relatively simple to find third-party tools; proxy managers bring real value, though providers likely prefer to upsell their scraping APIs at this point.

| Single sign-on | Shared access | Proxy setup widget | API Access | Supporting tools | |

|---|---|---|---|---|---|

| Bright Data | Google, GitHub, Okta, Azure | Team roles, sub-users | ✅ | ✅ | Browser extension, proxy manager |

| Dataimpulse | Google, LinkedIn | Subuser-like plans | ✅ | ✅ | ❌ |

| Infatica | Facebook, Twitter | Team roles | ✅ | ❌ | Proxy checker |

| IPRoyal | Google, LinkedIn | Sub-users | ✅ | ✅ | Browser extension, proxy checker |

| NetNut | ❌ | Sub-users | Limited functionality | ✅ | ❌ |

| Nimbleway | Team roles, subuser-like pipelines | ✅ | ✅ | ❌ | |

| Nodemaven | ❌ | ❌ | ✅ | ❌ | ❌ |

| Oxylabs | Team roles, sub-users | ✅ | ✅ | Browser extension | |

| PacketStream | ❌ | ❌ | ✅ | Resellers | ❌ |

| Rayobyte | ❌ | ❌ | Limited functionality | Datacenter proxies | Proxy manager |

| Smartproxy | Team roles, sub-users | ✅ | ✅ | Browser extension, proxy checker, antidetect browser | |

| SOAX | ❌ | ✅ | ✅ (statistics) | ❌ | |

| Webshare | Sub-users | Limited functionality | ✅ | ❌ |

Monitoring Tools

- The available data points and timeframes for usage monitoring vary significantly. Enterprise providers generally have the most advanced statistics, with not only traffic expenditure but also success rate, latency, and errors (see NetNut).

- For entry-level providers, traffic usually suffices, while mid-market participants introduce more dimensions, such as domain or country. Webshare is an exception with very detailed monitoring tools.

- 6/13 participants offer network status pages for monitoring downtime and incidents.

| Metrics | Scope | Time periods | |

|---|---|---|---|

| Bright Data | Traffic, requests (+ more with Proxy Manager) | Total, per zone, per product | Day, week, month, quarter, year, custom, comparison |

| Dataimpulse | Traffic, requests | Per plan, country | Custom |

| Infatica | Traffic | Per product, generated list | Day, week, month |

| IPRoyal | Traffic, requests | Per product, domain, sub-user | Custom, real-time |

| NetNut | Traffic, requests, success rate, errors, session duration | Per product, country, domain | Day, week, month, custom |

| Nimbleway | Traffic, requests, success rate | Total, per pipeline, country, domain | Day, week, month, quarter, year, custom, comparison |

| Nodemaven | Traffic, requests | Total, per domain | Day, week, month, custom |

| Oxylabs | Traffic, requests | Per product, domain, country, sub-user | Day, custom |

| PacketStream | Traffic | Total | Last 14 days |

| Rayobyte | Traffic | Per country | 30-180 days |

| Smartproxy | Traffic, requests | Per product, domain, sub-user | Day, week, month, custom |

| SOAX | Traffic | Per product | Day, custom |

| Webshare | Traffic, requests, errors, concurrency | Total, per domain, protocol | Hour, day, week, billing cycle, custom |

| Network status | Alerts | |

|---|---|---|

| Bright Data | ✅ | Downtime, subscription |

| Dataimpulse | ❌ | ❌ |

| Infatica | ❌ | Subscription |

| IPRoyal | ✅ | Downtime, subscription |

| NetNut | ❌ | ❌ |

| Nimbleway | ✅ | Downtime, subscription |

| Nodemaven | ❌ | Subscription |

| Oxylabs | ✅ | Downtime |

| PacketStream | ❌ | ❌ |

| Rayobyte | ❌ | ❌ |

| Smartproxy | ❌ | Subscription |

| SOAX | ✅ | Downtime, subscription |

| Webshare | ✅ | Downtime, subscription |

Security & Compliance

- Relatively few participants (3/13) protect accounts with two-factor authentication, and only Bright Data provides additional functionality, such as a login event log.

- All but PacketStream have implemented a know-your-customer procedure in one form or another.

- The majority claim to procure IPs ethically, but only two thirds mention concrete sources – the others use generic terms like vetted partners, legitimate proxies, whitelisted IPs.

- 7/13 participants have earned some kind of certification – the most common is Ethical Web Data Collection Initiative, while enterprise-minded providers also sport ISO certifications and have sometimes undergone SOC audits. We also see a tendency to present GDPR & CCPA compliance as a certification, while there aren’t really any.

Abbreviations:

2FA – two-factor authentication

KYC – know-your-customer procedure

EWDCI – Ethical Web Data Collection Initiative

| Security features | KYC | Ethical proxy sourcing | Certifications | |

|---|---|---|---|---|

| Bright Data | 2FA, event log, alerts | ✅ | ✅ (SDK, VPN, EarnApp) | CSA Star, ISO 27001; SOC 2, 3 audits |

| Dataimpulse | ❌ | ✅ | ✅ (TraffMonetizer) | ❌ |

| Infatica | ❌ | ✅ | ✅ (SDK) | ❌ |

| IPRoyal | 2FA | ✅ | ✅ (Pawns.app) | SOC 2 |

| NetNut | 2FA | ✅ | ~ (Sources not specified) | ISO 27001, EWDCI |

| Nimbleway | ❌ | ✅ | ~ (Sources not specified) | SOC2 audit; ISO 27001 compliant |

| Nodemaven | ❌ | ✅ | ~ (Sources not specified) | ❌ |

| Oxylabs | ❌ | ✅ | ✅ (Honeygain, partnerships with ISPs) | ISO 27001, EWDCI |

| PacketStream | ❌ | ❌ | ✅ (PacketStream app) | ❌ |

| Rayobyte | ❌ | ✅ | ✅ (CashRaven, vetted partners) | EWDCI |

| Smartproxy | ❌ | ✅ | ~ (Vetted partners) | EWDCI |

| SOAX | ❌ | ✅ | ~ (Sources not specified) | ❌ |

| Webshare | ❌ | ✅ | ✅ (Oxylabs) | ❌ |

Customer Service

- The participants have various channels for contacting support, the most prevalent being live chat and email.

- 24/7 customer service isn’t a given, especially if the issue is less than urgent. Bright Data has devised a detailed policy that segments and monetized service tiers (including 24/7 support).

- Dedicated account managers are available effectively everywhere, as long as you spend a sufficient amount of money (which can range between $140 and $1,600 or more per month).

| Channels | 24/7? | Dedicated account manager | Documentation | |

|---|---|---|---|---|