Proxy Market Research 2025

Proxy Market Research is a report on the proxy server industry, published annually since 2019. It covers the market trends and thoroughly compares major proxy server providers.

You’ll find Proxy Market Research useful whether you’re shopping around for proxies, investigating the market, or evaluating where your service stands compared to household names.

This year’s report:

- Features 11 (plus one) companies that cover all segments of the market.

- Overviews four proxy server types: residential, mobile, shared datacenter, and dedicated ISP proxies.

- Relies on a questionnaire sent to all participants, as well as our own know-how.

- Provides large-scale performance benchmarks, enriched with years of historical data.

The majority of data were collected in February and March of 2025, with performance benchmarks reaching into April.

Participants

Below are this year’s participants with the proxy server types we tested for this report. Bright Data also took part but decided to withdraw at the last moment. Knowing how important this provider is, we’ll add it as a shadow participant, using 2024 performance data for some of the tests – purely for reference.

We categorize the providers based on the market segment they align with the most:

- Entry-level providers work best for individual or small-scale projects.

- Mid-market providers cater to a wide range of scraping, account management, and similar tasks.

- Enterprise providers focus on an integrated experience that accommodates large-scale use by teams.

| Segment | Provider | Residential | Mobile (peer to peer) | Datacenter (rotating) | ISP (dedicated) |

|---|---|---|---|---|---|

| Enterprise | Bright Data | ✅ | ✅ | ✅ | ❌ |

| NetNut | ✅ | ✅ | ✅ | ✅ | |

| Oxylabs | ✅ | ✅ | ✅ | ✅ | |

| Mid-market | Decodo (ex Smartproxy) | ✅ | ✅ | ✅ | ✅ |

| Infatica | ✅ | ✅ | ❌ | ✅ | |

| IPRoyal | ✅ | ❌ | ❌ | ✅ | |

| Massive | ✅ | ❌ | ❌ | ✅ | |

| SOAX | ✅ | ✅ | ✅ | ✅ | |

| Entry/mid-market | DataImpulse | ✅ | ✅ | ✅ | ❌ |

| Evomi | ✅ | ✅ | ✅ | ❌ | |

| Rayobyte | ✅ | ❌ | ✅ | ✅ | |

| Webshare | ✅ | ❌ | ✅ | ✅ |

Such classification is somewhat rigid: SOAX and Infatica are trying to position as enterprise providers, and DataImpulse has launched an enterprise-oriented residential proxy pool. But we’re focusing on the current state of affairs rather than intent.

Bright Data is one of the biggest players in the proxy server and web data collection industries. Owned by a venture capital fund, the provider is known for its robust platform and focus on ethical matters. Bright Data’s sources IPs through various methods, including an SDK, proxyware app, and more.

- Country: Israel

- Founded: 2014

- Employees (LinkedIn): 400+

- Segment: Enterprise

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: scraping APIs, scraping browser, IDE, datasets, e-commerce insights

DataImpulse is run by the Ukrainian dev house Softoria, which also owns a popular search engine scraping API. The provider sources proxies in-house and offers them in non-expiring packages, the rates of which are hard to beat.

- Country: US

- Founded: 2022

- Employees (LinkedIn): Up to 20

- Segment: Entry-level

- Proxy networks: datacenter, residential, mobile

- Other services: –

A long-running value choice and top five proxy provider which rebranded from Smartproxy in April 2025. Decodo positions itself as an easier and more affordable alternative to enterprise competitors – so far, to great success. The company acquires proxies through “reputable providers and a peer-to-peer network”.

- Country: Lithuania

- Founded: 2018

- Employees (LinkedIn): 100-150

- Segment: Mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: scraping APIs, antidetect browser

- Country: Switzerland

- Founded: 2024

- Employees (LinkedIn): Up to 20

- Segment: Entry/mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: –

A Singapore (and now UK) based company with Eastern European roots, Infatica can be considered a mid-sized proxy provider. It has expanded to sell all proxy types, scraping infrastructure, and even datasets, lately with an eye to enterprise clients. Infatica sources IPs through an openly-promoted SDK.

- Country: Singapore

- Founded: 2019

- Employees (LinkedIn): 25-50

- Segment: Mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: scraping APIs, datasets

Since its founding in 2021, IPRoyal has grown into a force among value-oriented providers. Its main value propositions are scaling pay-as-you-go traffic and approachable plans for small users. The provider still focuses on proxy servers, though we expect vertical expansion soon. IPRoyal maintains its own residential proxy pool through an app called Pawns.

- Country: Lithuania

- Founded: 2021

- Employees (LinkedIn): 50-100

- Segment: Mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: –

Originally a venture capital-backed resource sharing platform, Massive seriously entered the proxy server market only in 2024. As such, it has the manpower and expertise to threaten the entrenched providers, but there’s still a lot of groundwork to be laid. Massive openly sources IPs through its SDK.

- Country: US

- Founded: 2018

- Employees (LinkedIn): 25-50

- Segment: Mid-market

- Proxy networks: residential, ISP

- Other services: –

The only publicly traded company among our participants, NetNut probably makes it into top five proxy providers by size. It was one of the original suppliers of ISP proxies, now fueled by residential proxy servers like most. The provider gets IPs through its “proprietary reflection technology”, then sells them to companies with large data collection needs and whitelabels.

- Country: Israel

- Founded: 2018

- Employees (LinkedIn): 100-150

- Segment: Enterprise

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: scraping APIs, datasets

One of, and by now maybe the market leader for proxy servers in the enterprise segment. Oxylabs controls a large infrastructure of IPs sourced through its partner app Honeygain and an SDK. We often award this provider for strong performance.

- Country: Lithuania

- Founded: 2015

- Employees (LinkedIn): 300-400

- Segment: Enterprise

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: scraping APIs, scraping browser, datasets

A self-proclaimed largest US datacenter proxy vendor, Rayobyte is now embracing residential IPs. The company’s brand has pivoted several times throughout the years, looking for its ideal customer. Overall, Rayobyte emphasizes approachability and ethics as its main talking points.

- Country: United States

- Founded: 2015

- Employees (LinkedIn): 25-50

- Segment: Entry/mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: scraping API

An established mid-sized provider with Eastern European roots and international presence. SOAX is known for its wealth of features. Lately, the company has been shifting attention to web scraping tools. There’s no public information about how this provider gets its IPs.

- Country: UK

- Founded: 2020

- Employees (LinkedIn): 50-100

- Segment: Mid-market

- Proxy networks: datacenter, residential, ISP, mobile

- Other services: scraping APIs, AI scraper

Based in the US, Webshare has been a popular destination for small-time customers in need of proxies. Its killer duo is the customizable and developer-friendly platform, paired with highly affordable shared proxies. The company was acquired by Oxylabs in 2022, which likely supplies it with residential IPs.

- Country: US

- Founded: 2018

- Employees (LinkedIn): 25-50

- Segment: Entry/mid-market

- Proxy networks: datacenter, residential, ISP

- Other services: –

Methodology

This section describes the technical methodology used for this report.

All participants were introduced to it prior to testing. As a result, this data may sometimes represent their best rather than default configuration. That said, we used one configuration for all benchmarks, which hopefully prevents overoptimization.

This is our main benchmark. It serves a dual purpose. First, it aims to check how many unique IPs a provider’s proxy network contains. At the same time, it measures the speed and success rate when connecting to a small page that doesn’t block requests.

Parameters

- Scraper: custom Python script

- Target: endpoint of a global CDN. The page weighs ~6KB and accesses a data center nearest to the proxy server.

- Geolocation data: latest IP2Location & MaxMind databases.

- Residential/mobile IP percentage: IP2Location’s Usage type data point, ISP and/or MOB IPs.

Residential proxies

| Proxy location | Days | Total requests | Testing server |

| Global | 21 | 1.2 million | DE |

| EU (DE, ES, FR, IT, NL) | 14 | 1.2 million | DE |

| US | 14 | 560,000 | US |

| UK | 14 | 560,000 | DE |

| India | 14 | 560,000 | SG |

| Brazil | 14 | 560,000 | US |

| Australia | 7 | 140,000 | SG |

Mobile proxies

| Proxy location | Days | Total requests | Testing server |

| Random | 14 | 280,000 | DE |

| EU (DE, ES, FR, IT, NL) | 14 | 280,000 | DE |

| US | 14 | 280,000 | US |

| UK | 14 | 280,000 | DE |

| India | 14 | 280,000 | SG |

| Brazil | 14 | 280,000 | US |

| Australia | 7 | 140,000 | SG |

Datacenter & ISP proxies

| Proxy location | Days | Total requests | Testing server |

| US | 7 | 70,000 | US |

This benchmark aims to evaluate the proxy networks in more realistic conditions. It has too many variables (such as the scraper’s quality and changes in bot protection) to be reliable on its own. However, the test has value when comparing providers under the same conditions.

Parameters

- Scraper: custom HTTPX script for Amazon, Puppeteer script for Instagram, and Splash script for Google.

- Rate: 1 request per second.

- Request validation: Response code (200), HTML size, page title

All proxy types

| Targets | Proxy location | Testing server | Requests |

| Amazon | US | US | 5,200 (1,800 * 3 tests) |

We also run a collection of smaller benchmarks to test various aspects of the proxy networks. The brackets indicate which product the benchmark applies to.

UDP protocol support (all proxy types)

This test uses a third-party tool to check if the proxy network is able to route traffic through UDP.

Download speed (datacenter & ISP proxies)

| Tool | Testing server | IPs checked |

| Hetzner’s 100 MB & 1 GB speed tests | US | At least 10 |

IP quality (residential proxies)

This benchmark uses a popular third-party tool to measure how many IPs it’s flagged as potentially malicious.

| Tool | Checks (US) | Checks (Global) |

| IPQualityScore | ~10,000 | ~20,000 |

Infrastructure performance with larger pages (residential proxies)

This test targets an endpoint of a global CDN. It downloads a 2 MB package from a data center nearest to the proxy server.

| Proxy location | Requests | Testing server |

| Global | 15,000 | DE |

| US | 5,000 | US |

Session persistence (residential proxies)

This benchmark measures how long proxy peers remain online. We establish a sticky session and send requests every 20 seconds until 30 minutes pass or the IP changes.

| Target | Proxy location | Session count | Testing server |

| http://icanhazip.com | US | 250 | US |

Proxy operating system (residential proxies)

This test tries to determine which types of devices (Windows, Android, iOS, etc.) comprise a provider’s proxy pool. It’s based on zardaxt’s passive fingerprinting tool.

| Target | Proxy location | Proxies checked |

| Our own domain | Global | 500,000 |

Market Trends

This section provides an overview of the proxy server market. It’s based on our own observations, as well as responses from a survey sent to all participants.

2024 Report: A Year of Growth Fueled by AI

- Providers described 2024 as a strong year, with multiple reports of double digit growth.

- Their results were strongly impacted by AI, which received record venture capital funding.

- The emphasis in 2025 is on continuity – if the global environment will allow it.

Full version

After a cautious 2023, characterized by cost cutting and recession fears, 2024 seemingly returned things to normal. While the year wasn’t spectacular in numbers, GDPs rose, inflation shrank, and we experienced what the World Economic Forum called a soft landing. For our growing industry, this would’ve been enough to consider the year good – or at the very least, decent.

But that’s the general economy. At the same time, venture capital threw record amounts of money into artificial intelligence businesses, resulting in 30% more funding compared to 2023. Pressed for time, well financed, and extremely data hungry, AI companies were a huge boon to the proxy server and broader data collection industry. If, when we asked them in early 2024, half of the respondents had seen little impact from AI clients, now everyone reported the demand as significant. What’s more, all expected it to grow further.

So, how did our participants fare in 2024? The most frequent phrase in our questionnaire responses, which repeated four times, was strong year. The alternatives sounded similarly: considerable growth, steady growth, exceeded our expectations, reinforced our market position.

Some gave concrete numbers: Infatica’s monthly recurring revenue doubled, while IPRoyal’s and Webshare’s revenues increased by 50%. In its first full year offering proxies, the newcomer Massive grew usage and revenue by an impressive 375% and 400%, respectively. However, that doesn’t say much without knowing the baseline.

Almost all proxy server providers are privately held, making it hard to verify their claims. The one publicly traded company, NetNut, grew 20% year-over-year, with ~$32M revenue and $5.8M net profit in 2024. For context, NetNut probably makes it into the top 5 largest proxy server (though not necessarily public web data) providers. Compared to the self-reported figures, NetNut’s growth can be considered healthy, but it was mostly driven by the first half of 2024.

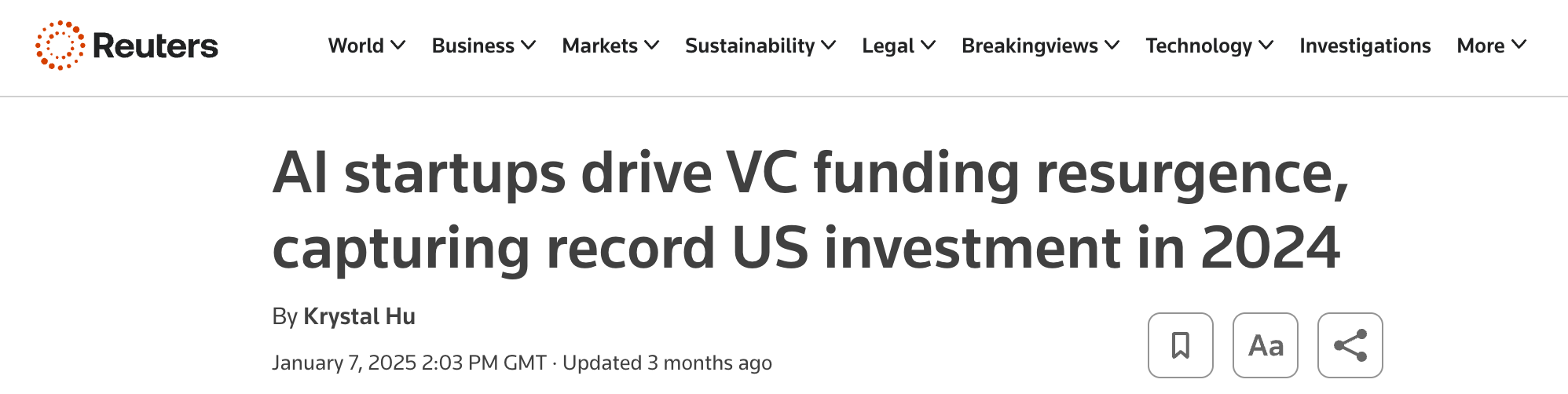

Another decent proxy for growth is headcount. This data is easier to procure, as reputable providers no longer hide their employees on LinkedIn. At the same time, it may not always be accurate: for example, Bright Data’s page is polluted with unrelated profiles which comprise over 50% of the company’s 1,300+ employees.

Bright Data and Oxylabs continue to hold the largest workforces among our participants, confirming their dominant positions in the market. Otherwise, the trend differs. On one side we have NetNut, IPRoyal, Massive, Webshare, and Infatica which significantly expanded their human resources over the year. Webshare even cited employee growth as a key metric in 2024, set to improve customer support and service reliability.

The other providers have mostly kept their headcount stable. This doesn’t necessarily spell trouble; they may have been trying to maintain operational efficiency, which until recently was a big concern. For example, Oxylabs mentioned that it resumed active growth this year. Rayobyte even cut the headcount on purpose for bigger profitability, reportedly achieving the highest profit year in company history. This is a viable short term strategy, but it may prove challenging in the longer run.

What about 2025? We saw a big emphasis on continuity: IPRoyal, Massive, and NetNut hope to continue their growth, Oxylabs will continue improving its platform, while Infatica and Rayobyte will strive to further grow their share of enterprise customers. Decodo and Webshare, in turn, will aim to perfect their convenience of use, and SOAX will shape its service to be more compatible with enterprise systems.

We’ll also see new scraping and data products from multiple participants, together with more emphasis on the scraper infrastructure already in place. All this, of course, will rely on governments letting us do our jobs. Let’s hope for the best.

Competitive Environment: Cut-Throat and Reseller Friendly

- The market holds over 250 proxy server providers, many established in 2024.

- The major players have warmed up toward reselling, even launching their own affordable brands.

- Tough competition in lower market segments is pushing providers toward enterprise.

Full version

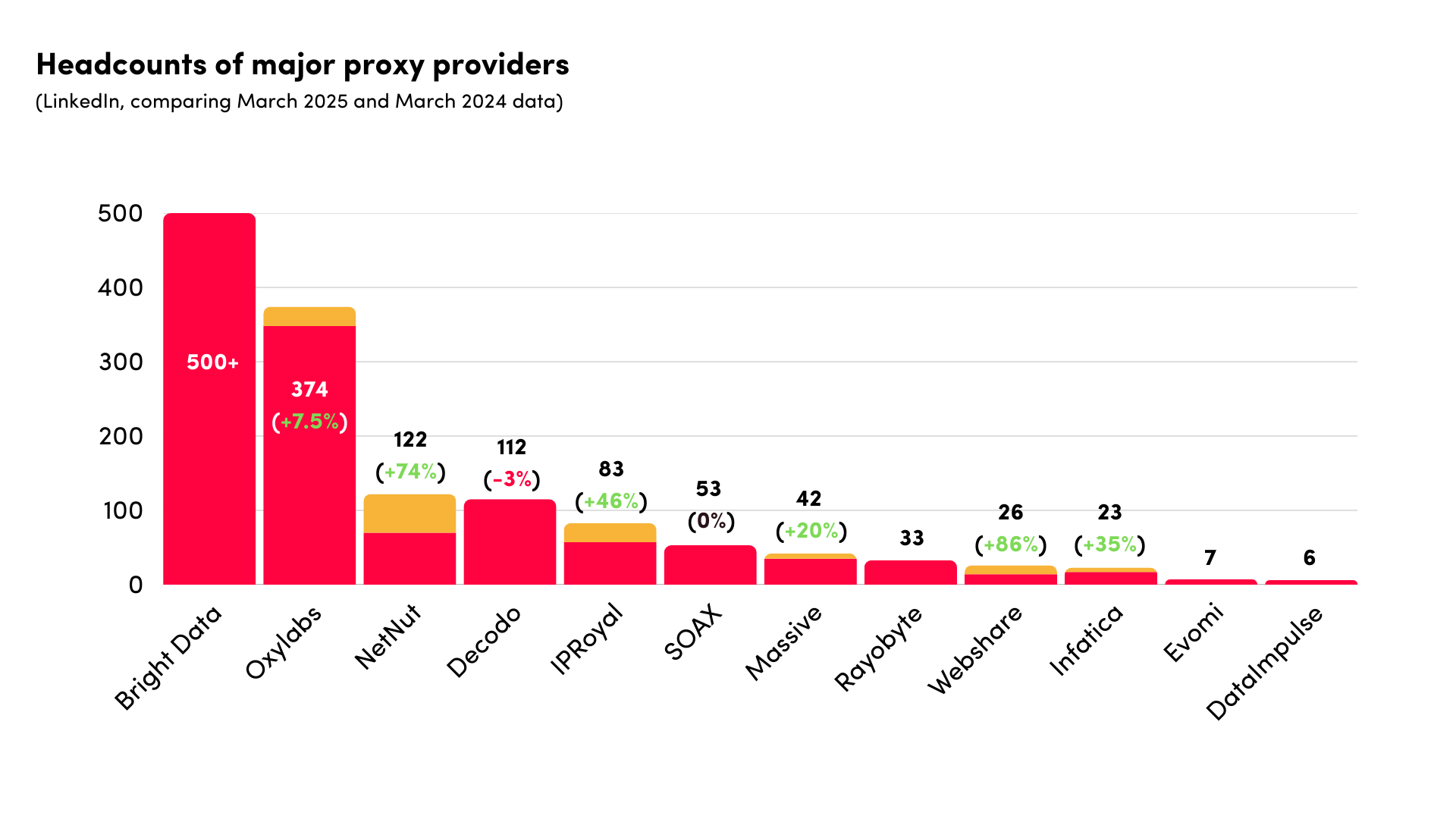

If you asked us how many vendors the proxy server market holds, our answer would be: who knows? Due to limited resources, here at Proxyway we tend to focus on major providers. But the broader market is vibrant, diverse, and spread throughout various corners of the web.

Using just Google and Blackhatworld, a popular community for gray-hat marketers, we collected over 250 vendors that sell – or at least claim to sell – proxy servers. Some white-label one of the major providers (now including the Chinese), others sell stocks of IPs they leased from major ISPs, and there were plenty of gigs offering home-made mobile proxy servers.

In 2024 alone, we found 67 new businesses without looking too hard. Few will grow to challenge the incumbents, and many will likely shutter within two years. However, we’re also seeing promising newcomers which manage to maintain their own infrastructure, such as Massive, Dataimpulse, or Evomi. In any case, this number shows that the market remains open and welcoming to new entrants.

It helps that the atmosphere towards reselling has warmed up (you can read more about this in our interview with Rampage Proxies). Infatica and Bright Data have changed their minds and no longer forbid it. NetNut and SOAX continue profiting from mid-sized white-label brands. And the newcomers become more attractive for reselling in their own right as they grow.

In addition, major vendors have started rolling out their own entry-level brands to compete for smaller customers. Bright Data runs ToolIP, Oxylabs sells residential IPs through Webshare, while NetNut and IPRoyal have downmarket brands in their own right. This trend both expands and threatens the reseller market, especially in light of the recent price drops (which we cover below).

It comes as little surprise, then, that most of our respondents identified the competition as growing, particularly due to resellers and aggressive price wars. Decodo even called the proxy server market of today the most competitive it’s ever been. We tend to agree.

There are two caveats, though. Out of the hundreds of providers, only ten or fifteen maintain their own residential IP pools – the most coveted proxy server type. As such, they hold the keys to growth and are able to gatekeep resellers from becoming a threat.

And secondly, the lucrative enterprise segment remains relatively unaffected by these developments, which is why providers like Infatica, DataImpulse, and Rayobyte are trying so hard to move up there. Their visible efforts take the shape of certifications, premium proxy pools, and overall brand positioning. However, as SOAX exclaimed, this market segment is challenging enough due to well-funded competitors with strong brand recognition and long-standing relationships.

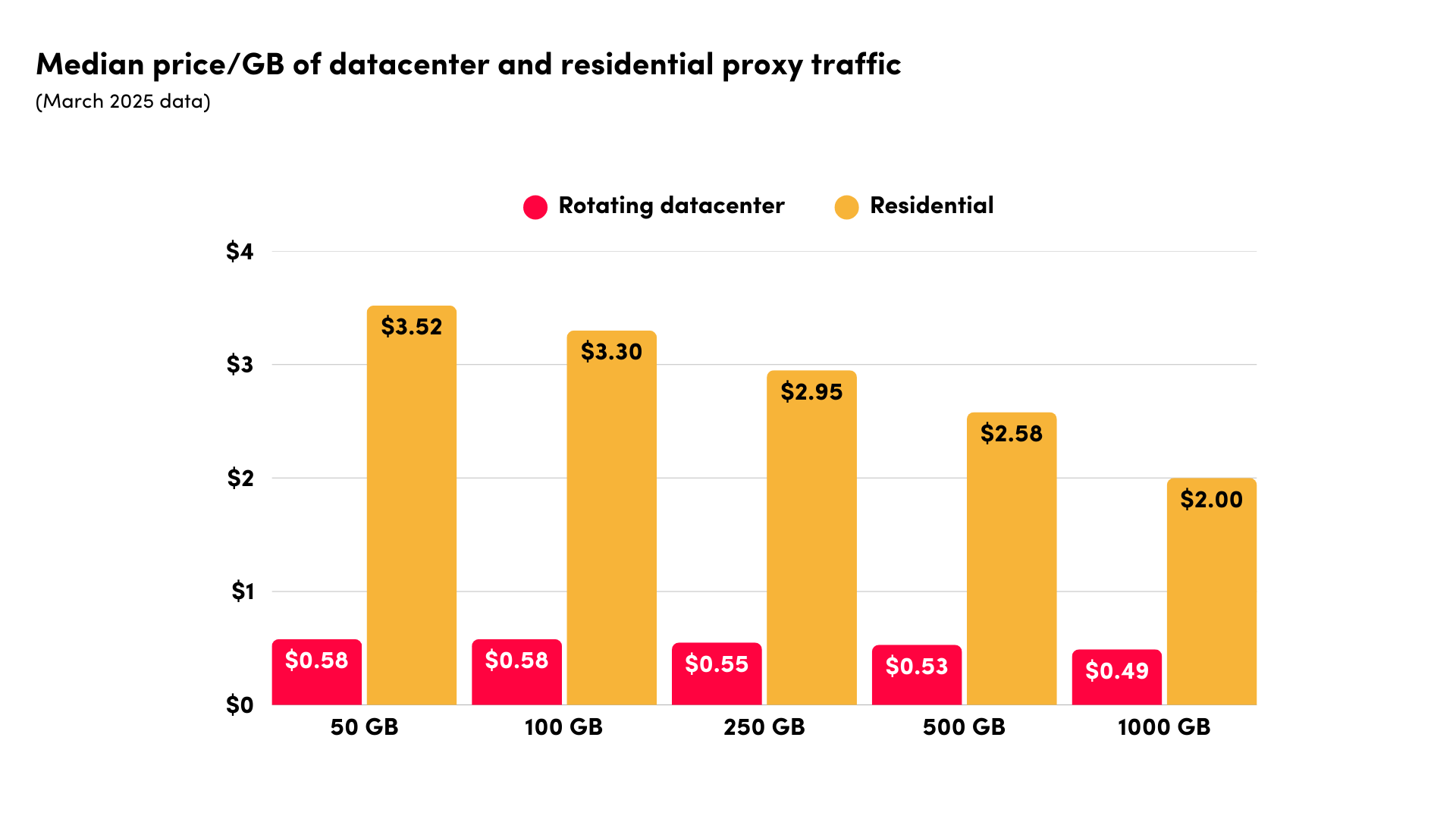

Proxies as a Product: Cheaper & More Commoditized Than Ever

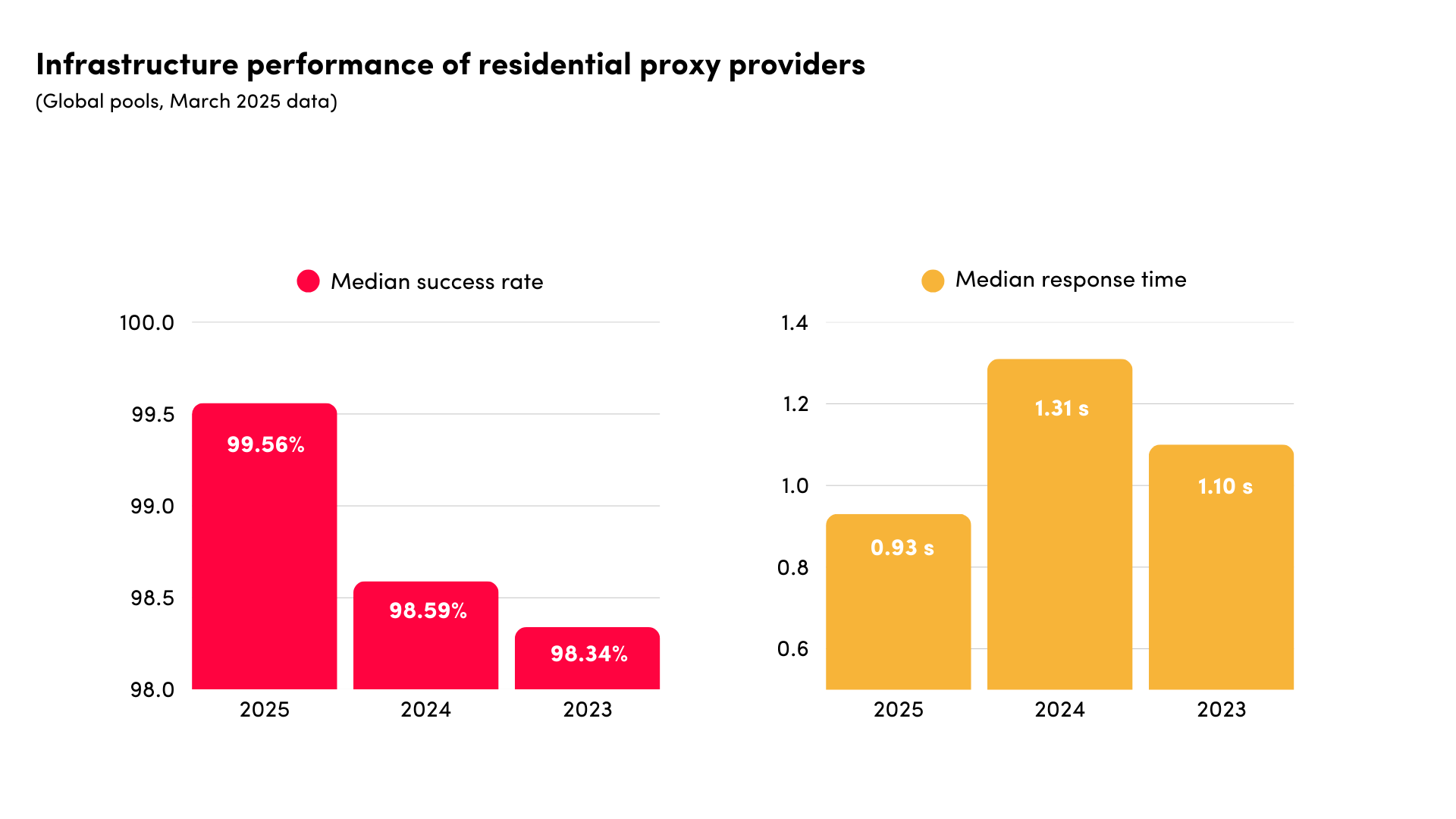

- Proxy networks are converging in key metrics, such as infrastructure performance, features, and cost.

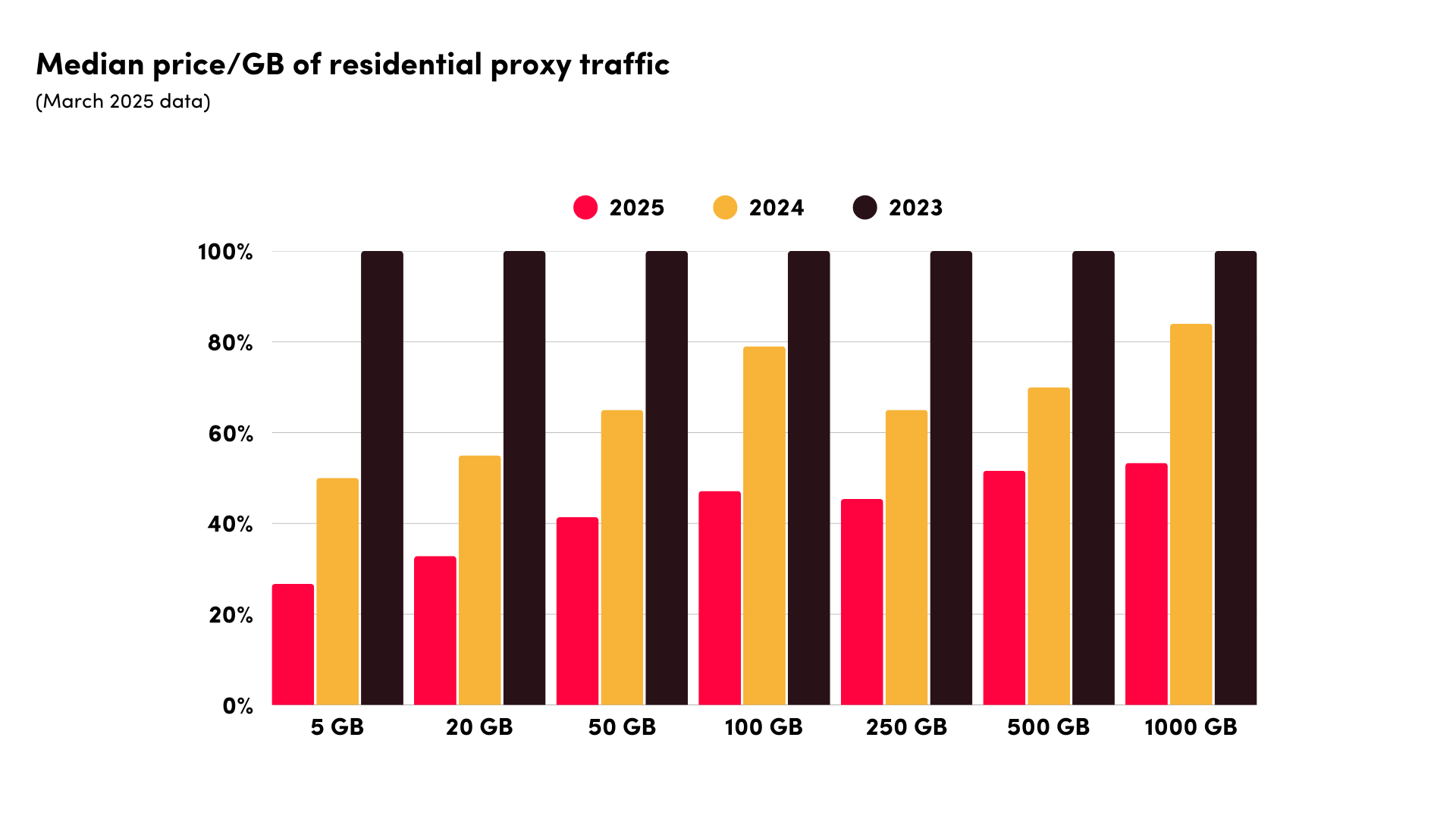

- Residential proxies experienced another round of price cuts and are up to 70% cheaper than two years ago.

- Providers still find ways to differentiate, though some have started turning to higher value-add services (such as scrapers) for growth.

Full version

Gone are the days when a gigabyte of residential traffic cost $15, or when differentiating between proxy networks was simple. It may sound silly, but our affiliate side of the project has started struggling to produce pithy one-liners for the providers we cover. The boundaries have thinned over the years, whether we consider features, performance, and lately – even cost.

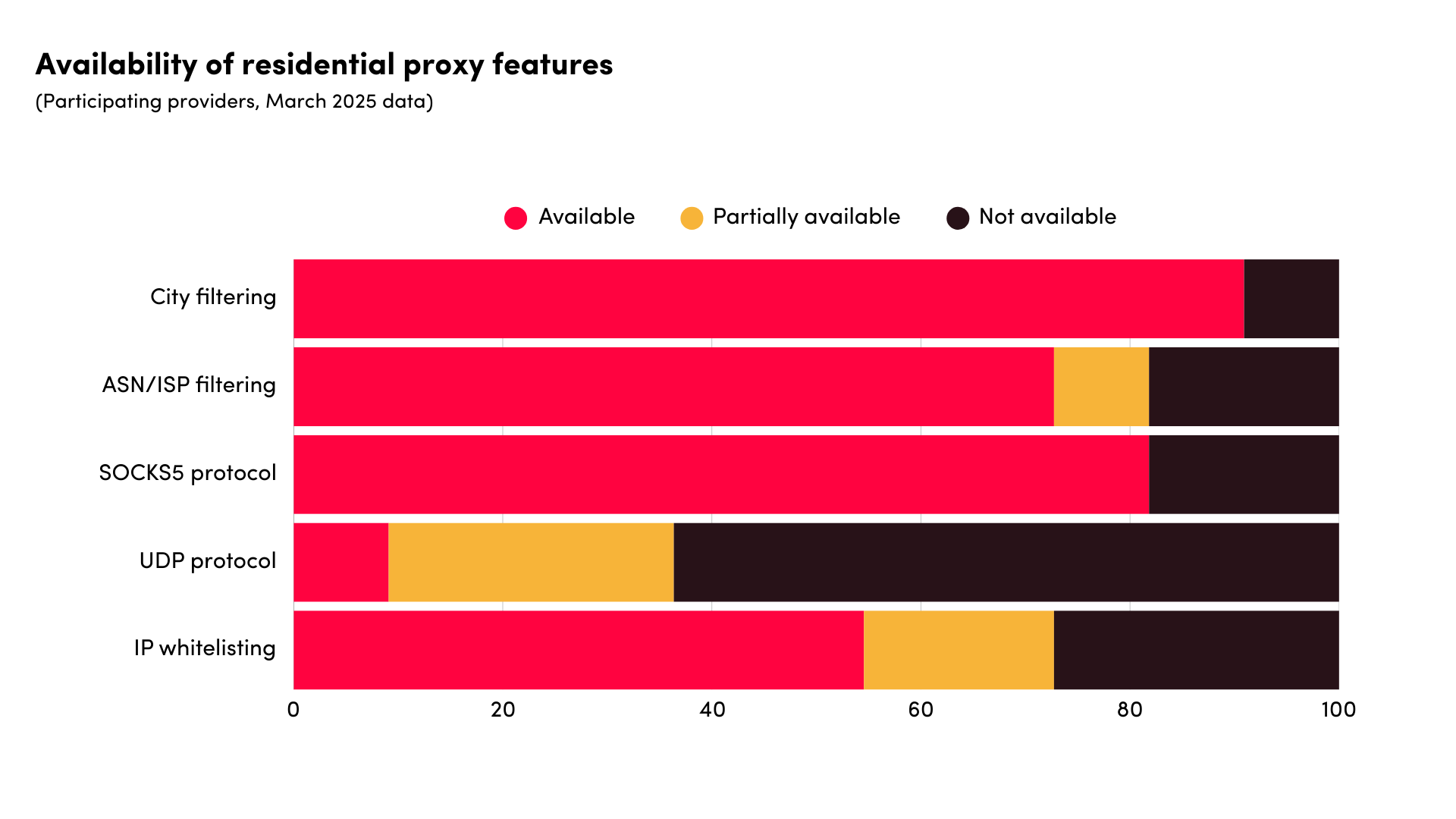

Let’s take residential proxies, for example. Nowadays, wherever you turn, you’ll get the same basic package: country, city, and increasingly ASN filtering, multiple rotation settings, and SOCKS5 support (though it may not necessarily include the UDP protocol). There will be a self-service dashboard with at least rudimentary usage tracking and invoicing features.

If you need sub-users or API access, this rules out a good deal of the resellers. Still, you’re left with at least 10 options to choose from, all taking notes from each other’s marketing copy and shouting about their superiority from the rooftops (though more often Google ads).

In terms of infrastructure performance, the gulf is no longer decisive or sometimes even obvious. This year’s median success rate has surpassed 99%, reaching an impressive 99.95% at its best. The differences in response time remain starker; but they depend on how you run tests, and the median isn’t that far off from the best result.

Granted, we’re not doing mammoth-scale tests that would put the infrastructure under significant pressure. But how many of you actually run hundreds of thousands or even thousands of requests per second?

The elephant in the room is, of course, price. From spring 2023 till now, we’ve seen three rounds of price cuts for residential proxies, the last one taking place this March. It’s been more cautious so far, with some providers opting for coupons. However, multiple vendors have already revised their rates in response, reinforcing the new status quo.

Assuming that the discounts will last, a gigabyte of residential proxy traffic now costs between two and three times less than it did two years ago. The barrier to entry is also much lower, with even premium providers offering pay-as-you-go plans.

While the price cuts have less impact on enterprise customers who play by different rules, they change the optics for entry and mid-market clients. First, they give more weight to brand recognition, making resellers a less compelling choice. And second, they push more users toward residential proxies, accelerating the broader trend.

With products becoming more alike, how do you differentiate? We asked providers directly. Their answers can be broadly put into four buckets:

- Improving the infrastructure. This can come in various shapes. For example, Infatica deployed more gateway servers to improve redundancy and response time. NetNut spent millions in sourcing more IPs, and SOAX has started using AI to enhance the proxy routing logic.

- Giving more value to the customer. IPRoyal and Rayobyte both offer scalable plans with no subscription. Decodo and Webshare prioritize ease of use through polished self-service tools. Dataimpulse focuses on providing tailored features for clients. Finally, Bright Data and SOAX are among the few providers whose platforms offer unified access to all products.

- Ensuring great customer service. With everyone moving to AI chatbots, human support has become a coveted feature. This was emphasized by Dataimpulse, and Rayobyte’s CEO goes as far to personally support big clients.

- Virtue signaling. Massive and Oxylabs both mentioned transparency and compliance, which they believe are important for companies to avoid reputational risks.

Sometimes, the best approach is to find easier fights. SOAX and Rayobyte spoke a lot about moving up the value chain. Vertical expansion has been the area of focus for Bright Data and Oxylabs for a while; though proxies are unlikely to go anywhere, maybe that’s where the real margins will be from now on.

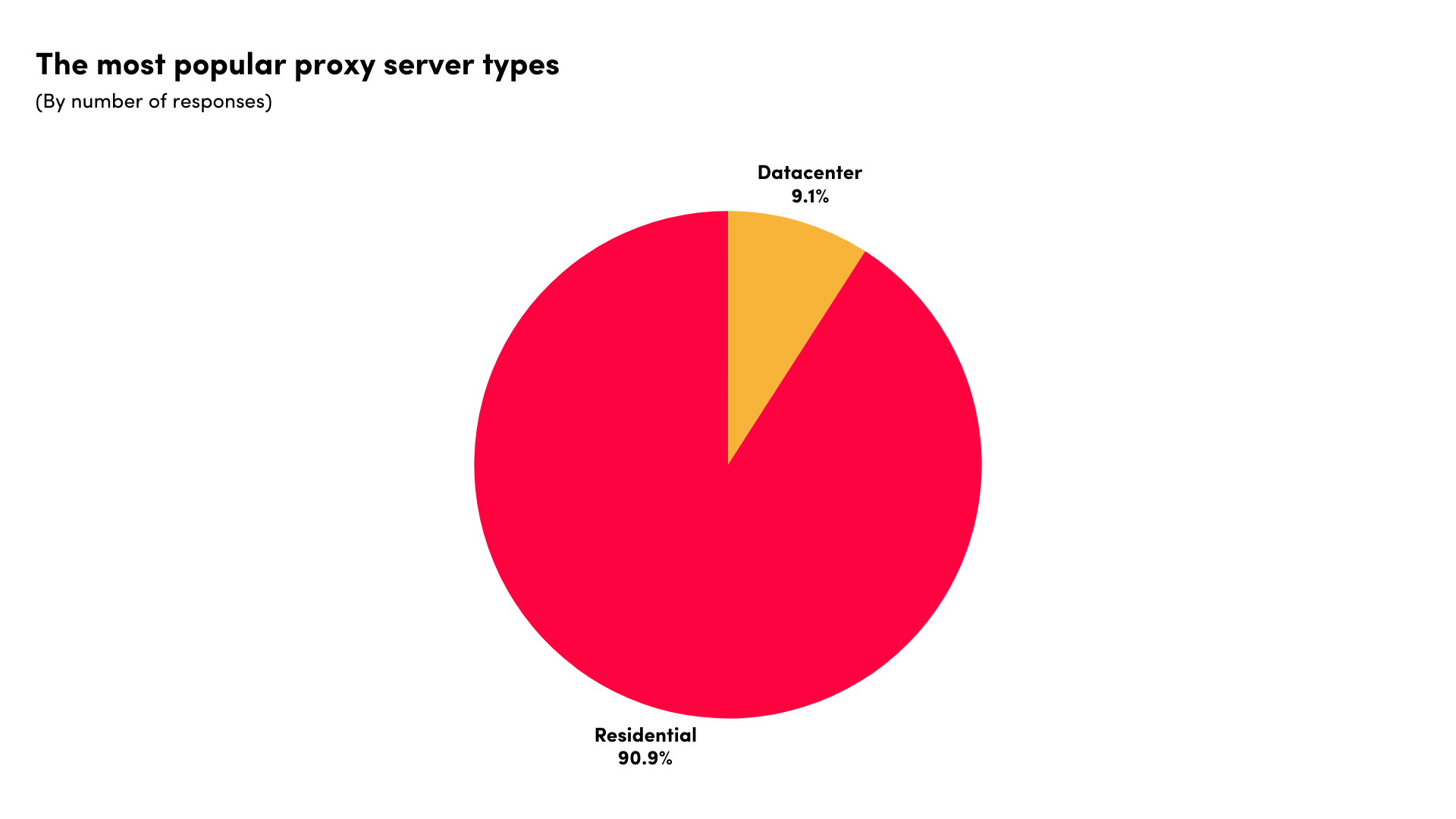

Proxy Types: Residential IPs Dominate, as Usual

- All but one participant chose residential proxies as their primary proxy type.

- The respondents split over the question if datacenter proxies are going away.

- ISP proxy servers have found success in high-volume scraping tasks, such as downloading video content for AI.

Full version

The story repeats itself: like last year, or the year before, residential proxies remain the most popular proxy type. This stands true for all participants but Webshare, where datacenter proxies still generate the lion’s share of revenue.

Even in the context of all their services, the majority identified residential proxies to be the main growth driver. For NetNut, they played a key role in increasing usage and driving revenue growth. Others too expected the demand to continue. The one outlier was SOAX, which pinpointed its e-commerce API as the main driver for growth.

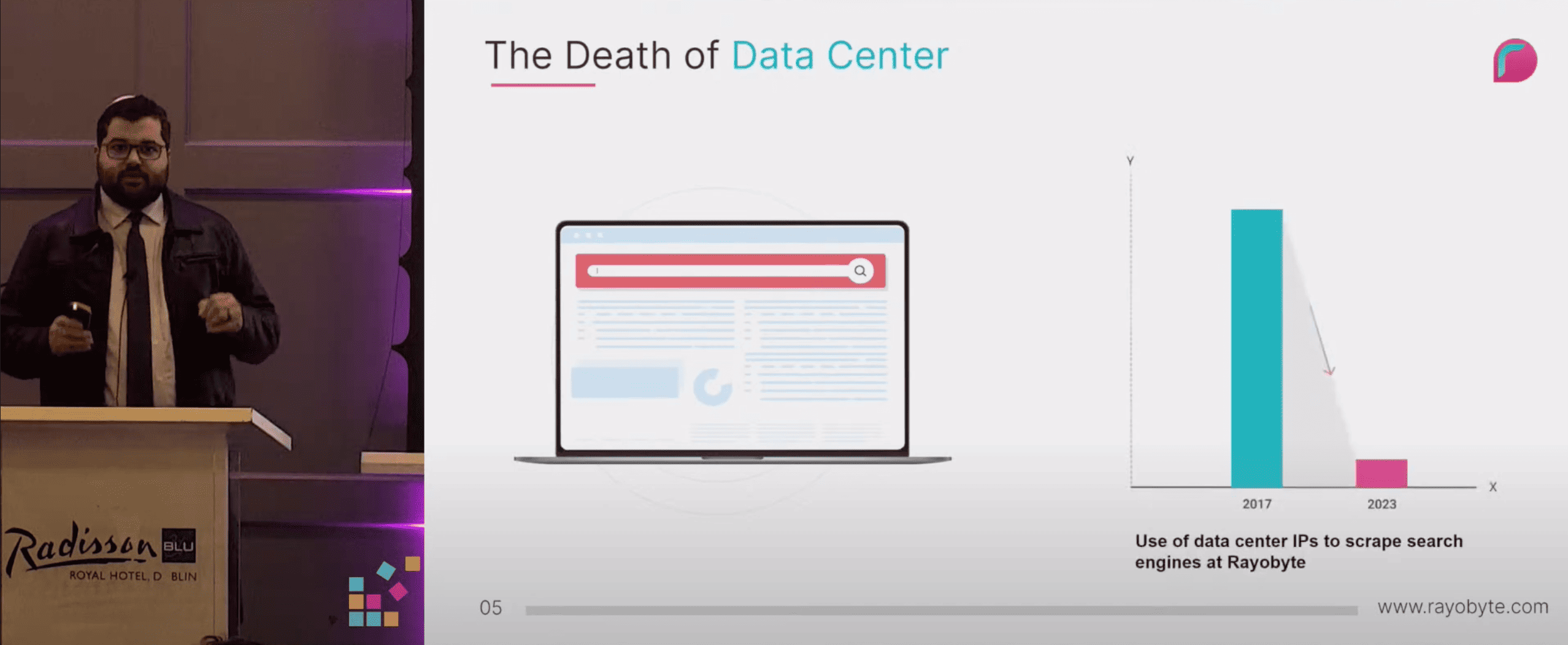

It’s fascinating that even Rayobyte, whose flagship was always datacenter proxies, has flipped over. Residential IPs have become the provider’s dominant revenue driver, reportedly accounting for over 100% yearly growth on seven figures of revenue.

What makes this proxy type so sought after? It’s mostly because residential proxies are highly effective. Websites are becoming increasingly hard to scrape, gradually pushing out datacenter proxy servers. As Rayobyte observed, even if they cost more, residential IPs require fewer development resources, saving on development expenses. There’s also the matter of cost, which is getting less in disfavor of residential proxy networks.

We’ve been hearing about datacenter proxies going away for some time now. Is it really the case? This was another question we asked the participants. The answers were surprisingly divisive. The biggest doomsayer was actually Rayobyte, which claimed this was “absolutely the case”. IPRoyal agreed, concluding that “it appears to be an emerging reality for proxy service providers”, and so did Infatica.

The other providers weren’t so sure. Their consensus was that while datacenter proxies can no longer crack the toughest nuts, they remain relevant. According to Decodo, datacenter IPs are desirable for use cases which value speed, stability, and cost over success. SOAX stated that they’re still an essential part of a broader data collection strategy, especially in combination with other proxy types. And so, Oxylabs concluded that relegating datacenter proxies to irrelevance just yet is an overstatement.

Come to think of it, the two camps aren’t so incompatible. Datacenter proxy servers are absolutely getting harder to use with protected targets. But if you’re willing to invest in other aspects of your scraper’s fingerprint, or the target isn’t as tough, they prove a strong option.

It’s fascinating to learn how providers find ways to improve the effectiveness of their datacenter proxy networks. Some of them go against the conventional wisdom of promoting dedicated and unused IPs. DataImpulse, for example, crowdsources its proxies, which ensures that they come from a large variety of small subnetworks. A part of Webshare’s clients use its cheap datacenter IPs for manual operations, effectively becoming an unpaid CAPTCHA solving service.

Are residential proxies the only – or even natural – replacement of datacenter proxies? Not necessarily. Massive, Decodo, SOAX, and Webshare all identified a strong uptake of ISP proxy servers. Increased availability, better packaging (priced per IP instead of traffic), and more attractive prices that go as low as $0.3/IP in shared formats have all helped. In addition, the demand is greatly boosted by traffic-heavy scraping of multimodal data – though it’s unclear how long this will last.

Finally, what about mobile proxies? We get the impression that the peer-to-peer variant remains highly situational, even after losing most of its price premium. Though often the first choice for minor vendors, mobile dongle farms fail to make their way to major providers.

When asked why, they cited a lack of scalability, reliability, and high operational costs as the reasons. Surprisingly, the main concern proved to be ethics, also phrased as regulatory considerations – it was highlighted by multiple respondents.

Use Cases: E-Commerce Still on Top, But the Main Protagonist Is AI

- E-commerce remains the most popular use case and continues to grow in demand.

- AI has entrenched itself in the minds and wallets of most providers by now.

- The demand from AI companies is shifting to real-time data, whether for RAG or AI agents.

Full version

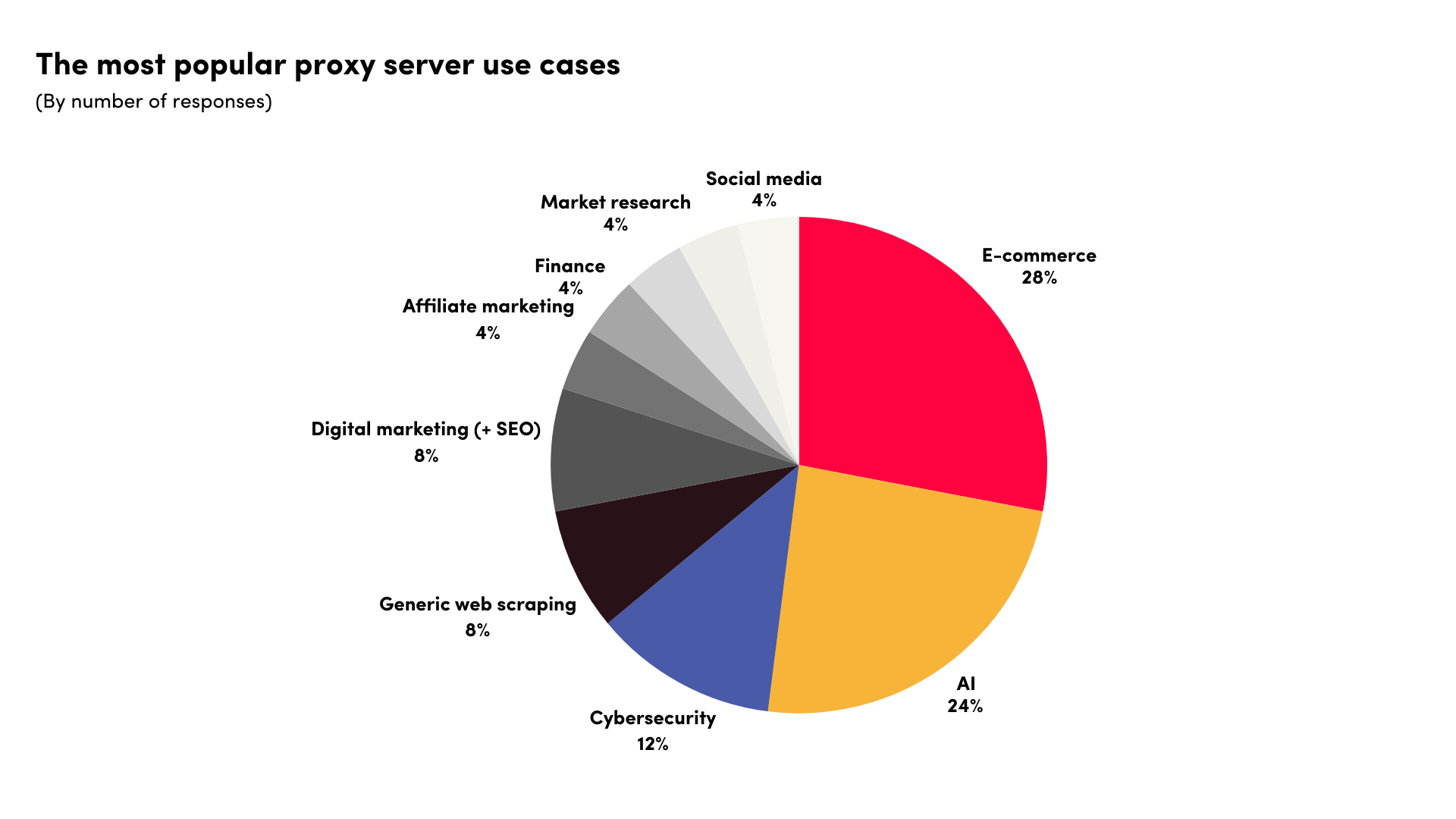

As usual, our questionnaire asked the respondents to list their top three use cases. Unsurprisingly, e-commerce was once again the star of the show, raking in the largest piece of the pie. E-commerce companies are huge consumers of data, and their needs are growing every year. According to Oxylabs, competition in this industry is even becoming “increasingly impossible without real-time data”. A bold claim.

Another use case that’s gained more recognition is cybersecurity. Companies in this field use proxies for threat intelligence, fraud detection, security testing, and similar tasks. Cybersec has displaced ad verification in popularity, which is underrepresented this year but still very much a needle mover for many providers.

It’s interesting that mentions of digital marketing, and SEO in particular, have declined significantly. We could hypothesize that this vertical has remained stagnant while others have grown, or that LLMs have started displacing traditional search engines. But the grounding isn’t strong enough, especially considering how much AI tools rely on search for retrieval-augmented generation.

Now that we’ve broached AI, let’s not beat around the bush any longer – the AI vertical (if we can call it such) has thoroughly embedded itself into the minds and wallets of web data companies. If last year every second proxy server provider still hadn’t felt much impact, today artificial intelligence customers occupy a quarter of our pie chart.

What do AI companies need proxies for? One big use case is training models, another – giving these models unrestricted access to the web.

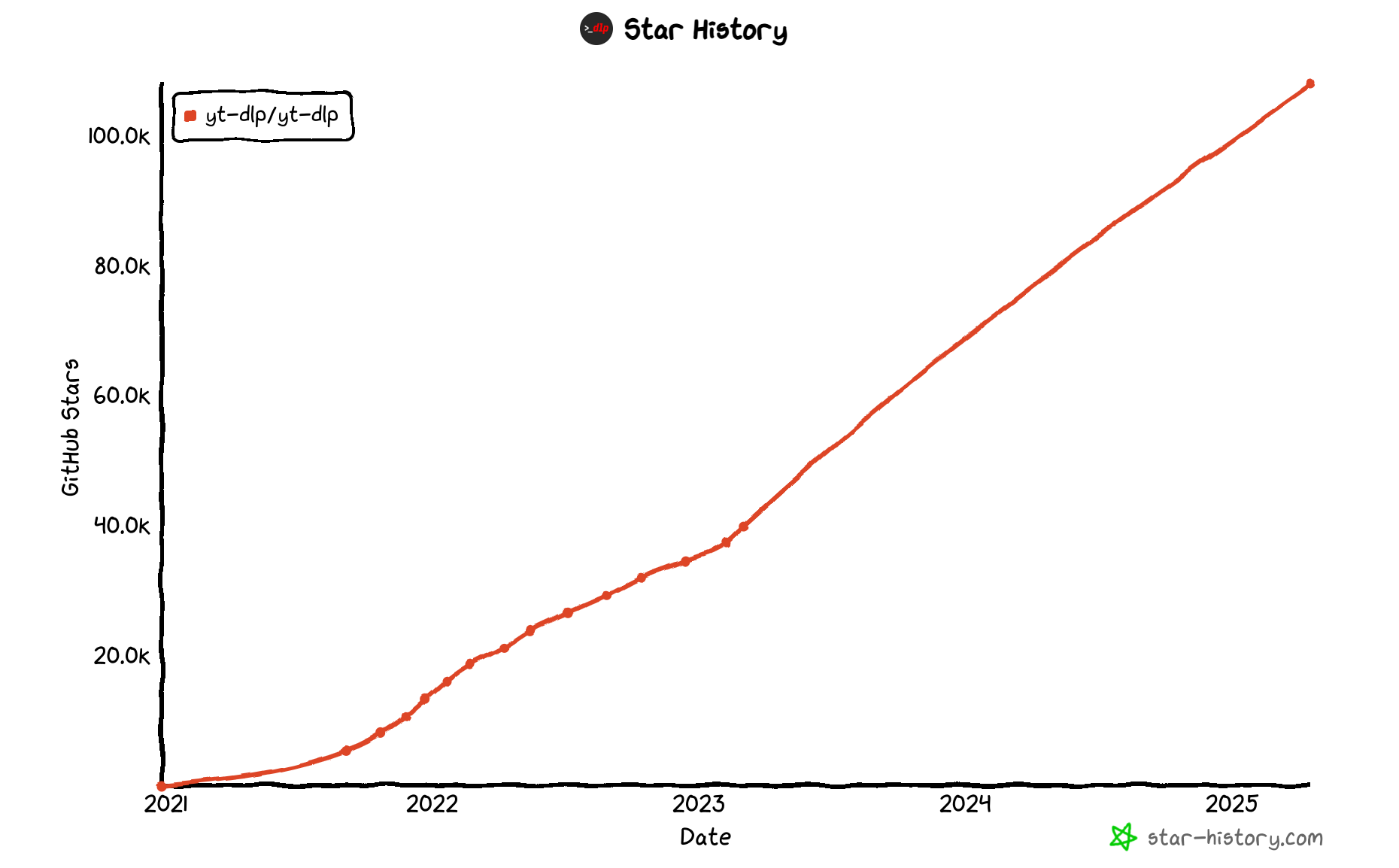

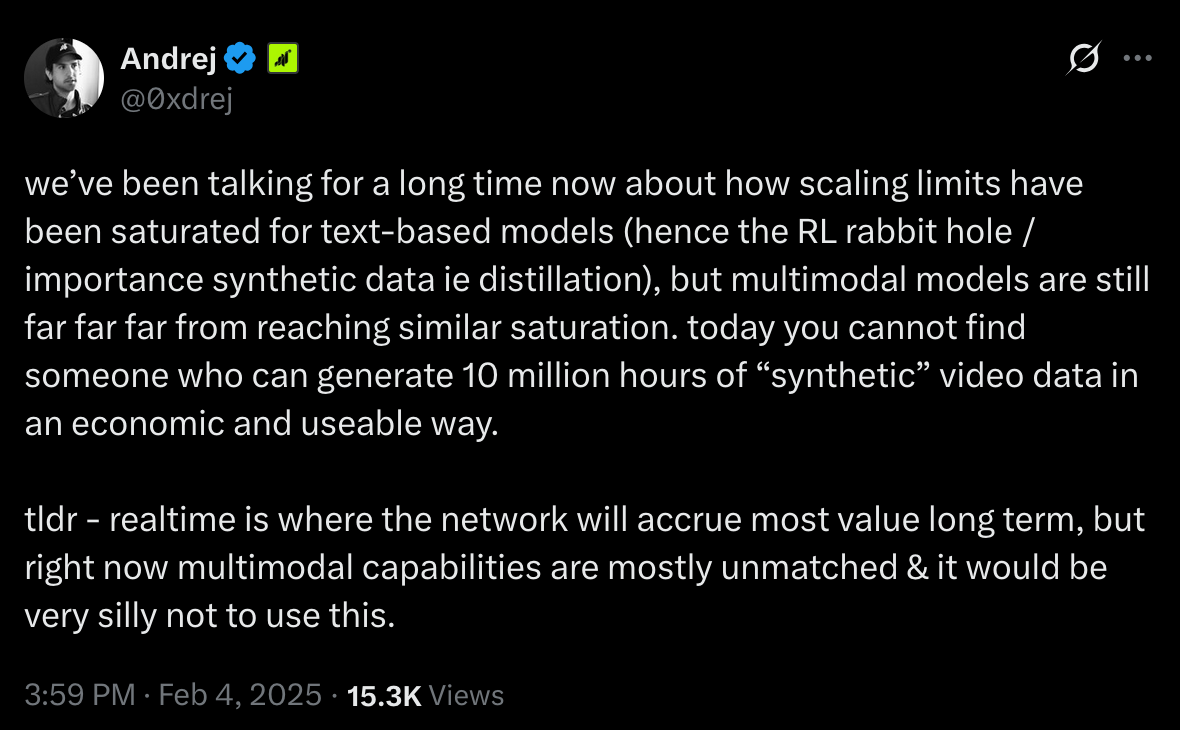

While it’s true that textual data has been thoroughly exhausted, the frontier has moved to multimodal data, such as videos. According to the founder of Grass, which has been hoovering up hundreds of terabytes every day, there’s a long way to go here. Consequently, proxy providers have experienced soaring demand for websites like YouTube, and for proxy servers that can move a lot of traffic fast.

However, the focal point of 2024 was getting AI to interact with the web, either by referencing fresh information (RAG) or actually using websites to complete tasks (agentic AI). Most respondents pinpointed this shift from static to real-time data, sometimes calling it an “evolution”. In any case, it both reinforces and continues the demand for proxies and overlying data extraction tools.

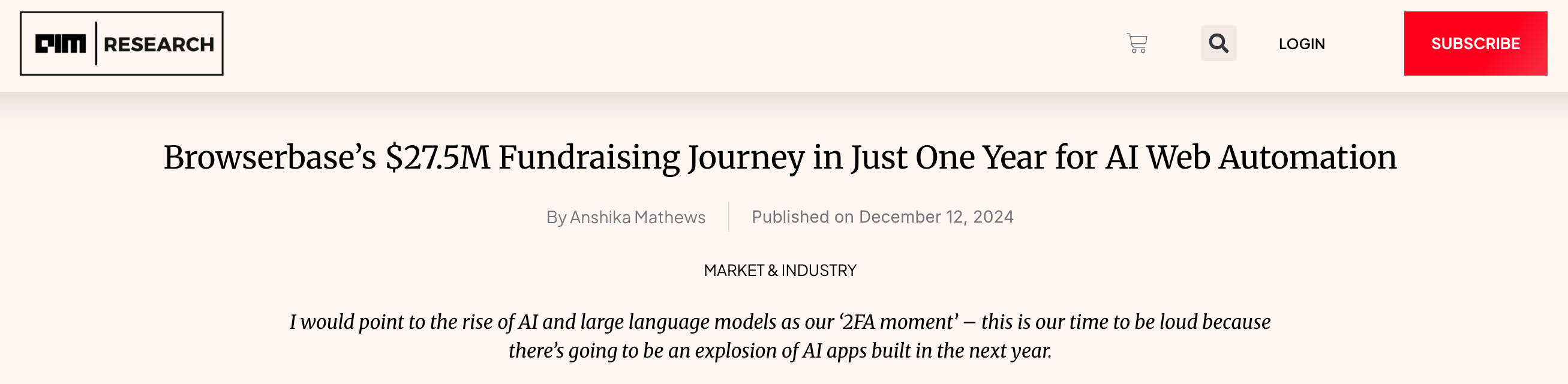

In particular, the hype around agentic AI has spawned a new category of web scraping infrastructure called scraping browsers. More flexible than APIs, they use established protocols like CDP to interact with web browsers and ensure unrestricted access to websites. New entrants Browserbase and Browser-Use have received millions ($27.5M and $17M, respectively) to try and build the tooling for AI agents.

According to Massive, AI-native companies operate on venture capital and have low risk tolerance. Therefore, they care about compliance and ethical proxy use. In addition, such businesses don’t mind paying more for quality data which is easy to ingest – but that goes beyond proxy servers.

Overall, Bright Data illustrates the impact AI has had on the web data collection industry. After a homepage uplift in March 2025, it completely revolved around AI, putting this use case front, center, and above everything else. In April, the headline even lost its “everything else”, now keeping only AI and BI. The company even hired for what it called the California AI vertical – such is the hype and perceived opportunity.

Not Quite Proxies: Proxy APIs (Unblockers) Struggle to Find Footing in the Market

- The last few years saw multiple providers launch unblockers – web scrapers that integrate as proxy servers.

- Unblockers are often functionally inferior to web scraping APIs, and the latter can have proxies as one of the integration methods.

- As such, some have discontinued their unblocker products or pivoted them to be more like APIs.

Full version

The proxy server market is quite predictable. First, a large provider implements something that customers may find desirable. Soon after, other large providers flock to replicate the same thing. This applies to features, pricing approaches or, in the case of web unblockers, whole product categories.

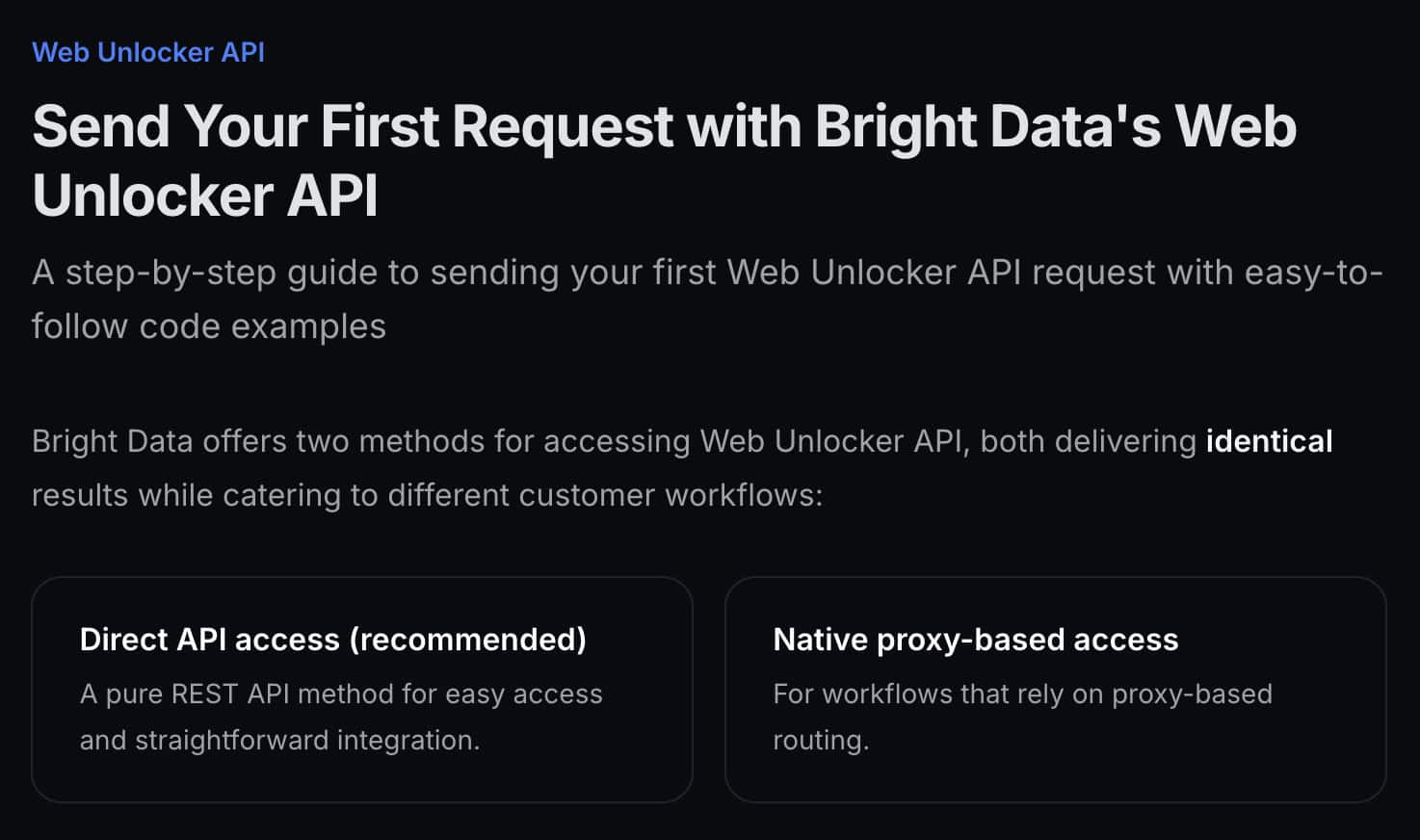

We can’t recall who exactly launched the first unblocker – whether it was Bright Data with its Web Unlocker, Oxylabs with Next-Gen Residential Proxies, or maybe a different provider altogether. The fact is that within a couple of years, NetNut, Decodo, SOAX, Rayobyte, Zenrows, and who knows how many more companies had unblockers of their own.

An unblocker is basically a remotely hosted web scraper. Its defining characteristic is that it integrates primarily (and sometimes only) as a proxy server: using a hostname, port, and credentials to authenticate. This distinguishes unblockers from the more established category of web scraping APIs, which communicate via an HTTP API interface.

The problem with this separation is that both products perform effectively the same task. What’s more, there’s nothing to prevent web scraping APIs from implementing proxy-like integration; many do that already, even while selling a separate unblocker product on the side. It doesn’t help that unblockers are often functionally inferior to APIs, particularly when it comes to data parsing or interacting with the underlying headless browser if rendering is involved.

This leads to a conclusion that unblockers are first and foremost a marketing category. It finds more justification in search engine keywords and not engineering constraints. Perhaps the only real difference comes in the form of pricing, if it’s based on traffic rather than successful requests.

Judging from the market’s actions in 2024, it looks like web unblockers also fail to persuade customers. SOAX pivoted Web Unblocker to a regular API, and Nimble discontinued its proxy-like scraper altogether in October. Even Bright Data, whose Web Unlocker had only proxy integration for the longest time, now offers an HTTP interface and calls its product an API.

Are web unblockers in their current shape doomed to disappear? Probably not, even if they fail to cover more marketing ground. But many providers had to face the reality – they’re not the golden goose they’d seemed to be.

Provider Comparison

This section compares the participants in key metrics. In addition, it includes our makeshift evaluation graphs. We hope they’ll be helpful, but we also understand that different people may have differing priorities. As such, it’s always a good idea to consult the raw data provided in the tabs.

Residential Proxies

Residential proxies are home devices connected to consumer internet service providers like Comcast and Sky. These devices can be computers, phones, TVs, and even smart fridges. Residential proxies are the prevalent proxy server type for accessing popular websites like Google or Shopee.

The graphs are interactive. You can hover on a provider’s name to highlight it or click to hide.

Enterprise providers

Mid-market providers

Entry/mid-market providers

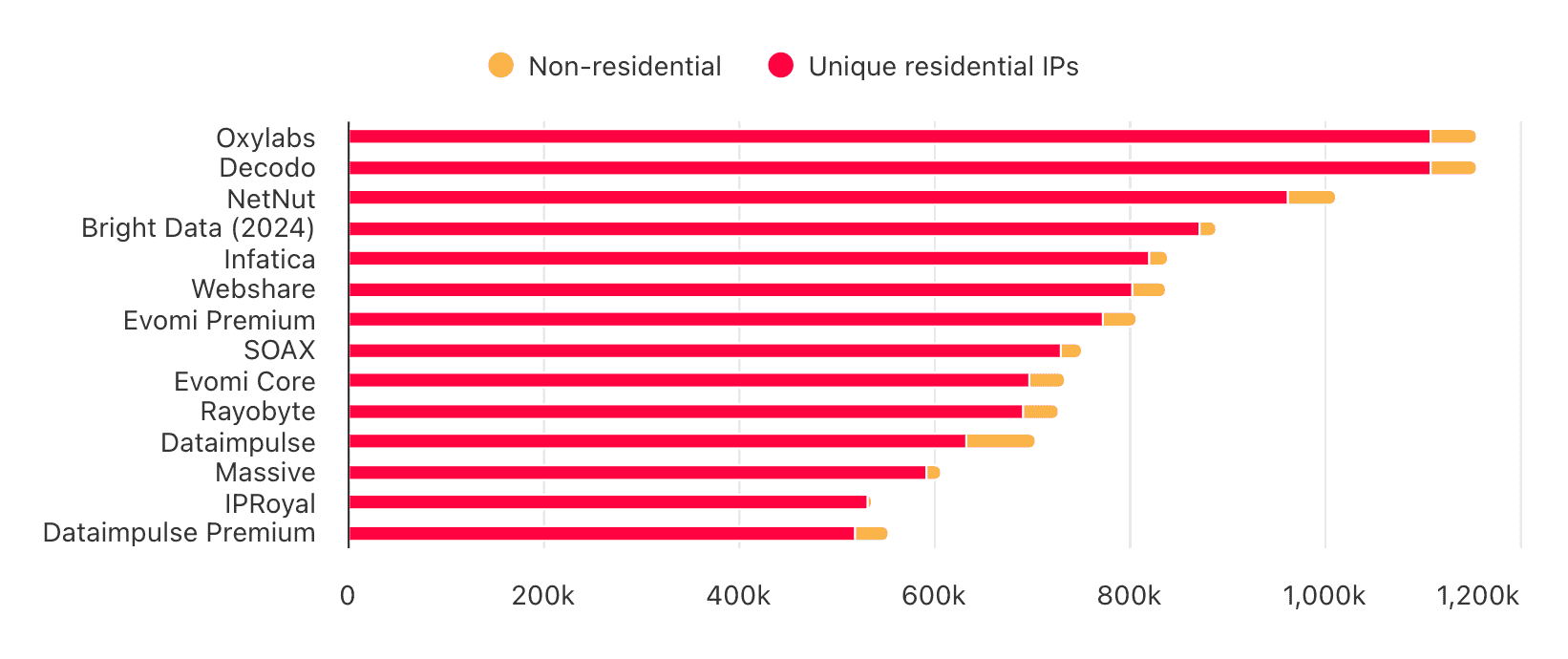

🌐 Proxy pools

- Advertised pool size: median – 60.5 million, largest – 175 million (Oxylabs)

- Global pool: most unique IPs – 1,155,660/1.2 million (Oxylabs)

- US pool: most unique IPs – 489,032/560,000 (Oxylabs)

📊 Infrastructure success rate

- Global pool: median – 99.56% (+0.97% YoY), best – 99.90% (Oxylabs).

- US pool: median – 99.56%, best – 99.87% (Massive)

- Any pool: best – 99.95% (Oxylabs, Decodo’s Brazil proxies)

⏱️ Infrastructure response time

- Global pool: median – 0.93 s (-0.37 s YoY), best – 0.63 s (Decodo)

- US pool: median – 0.98 s, best – 0.55 s (SOAX)

- Any pool: best – 0.32 s (Infatica’s UK proxies)

🎯 Target benchmarks (Amazon, Google, Instagram)

- Success rate: median – 94.30%, best – 95.20% (Infatica)

- Response time: median – 4.63 s, best – 4.05 s (Decodo)

⚙️ Features

- Targeting options: city – 11/12, ASN – 9/12, ZIP/coordinates – 5/12

- New trend: pool filters – by quantity, quality, device, even fraud score

- Protocol support: SOCKS5 – 10/12, UDP – 5/12 (4 with caveats)

- IP whitelisting: 6/12, 3 more with caveats

💵 Pricing

- 5 GB: median – $4/GB (-53% YoY)

- 50 GB: median – $3.47/GB (-36% YoY)

- 500 GB: median – $2.58/GB (-26% YoY)

Advertised proxy pools

| Advertised pool size | Yearly change | |

|---|---|---|

| Oxylabs | 175,000,000 | +75% |

| SOAX | 155,000,000 | N/A |

| Bright Data | 150,000,000 | +109% |

| Decodo | 115,000,000 | +110% |

| NetNut | 85,000,000 | N/A |

| Rayobyte | 36,000,000 | N/A |

| IPRoyal | 32,000,000 | N/A |

| Webshare | 30,000,000 | N/A |

| Dataimpulse | 15,000,000 | +200% |

| Infatica | 15,000,000 | N/A |

| Evomi | Unknown | |

| Massive | Unknown | |

The advertised pools haven’t changed much; but where they did change, the numbers were anything but modest.

Unique IPs in the global (unfiltered) proxy pool

This year, some providers mustered an impressive number of IPs, exceeding 90% uniqueness. It’s interesting that DataImpulse’s Premium pool actually includes fewer proxies than the regular one – that’s probably due to stricter selection criteria.

Unique IPs in country-filtered pools

This graph is interactive.

The pool sizes of specific country pools generally correlate with the global pool, with Rayobyte and Infatica being the main outliers.

Pool composition (Global pool, 500,000 unique IPs)

This graph is interactive.

Infatica, Oxylabs, and Decodo aside, most providers had Android as the dominant OS type. Note that some have desktop IPs off by default and enable them upon request, which may have been the case here.

Proxy uptime

This graph is interactive.

Phones tend to stay online briefer than computers, but our data didn’t really corroborate this. There may be several reasons why: Android is also used by IoT devices and TV boxes; and providers may assign different IPs when sessions are involved.

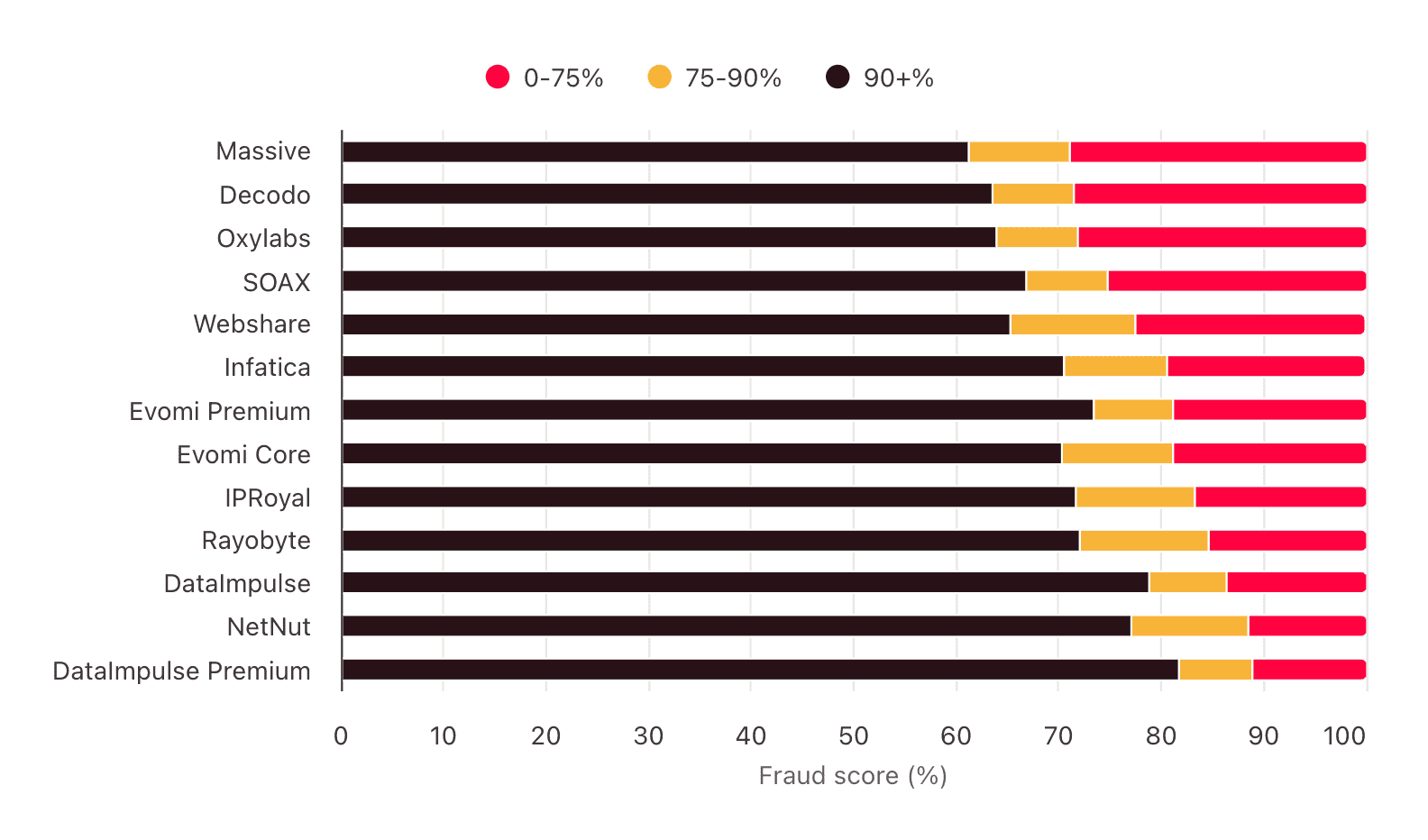

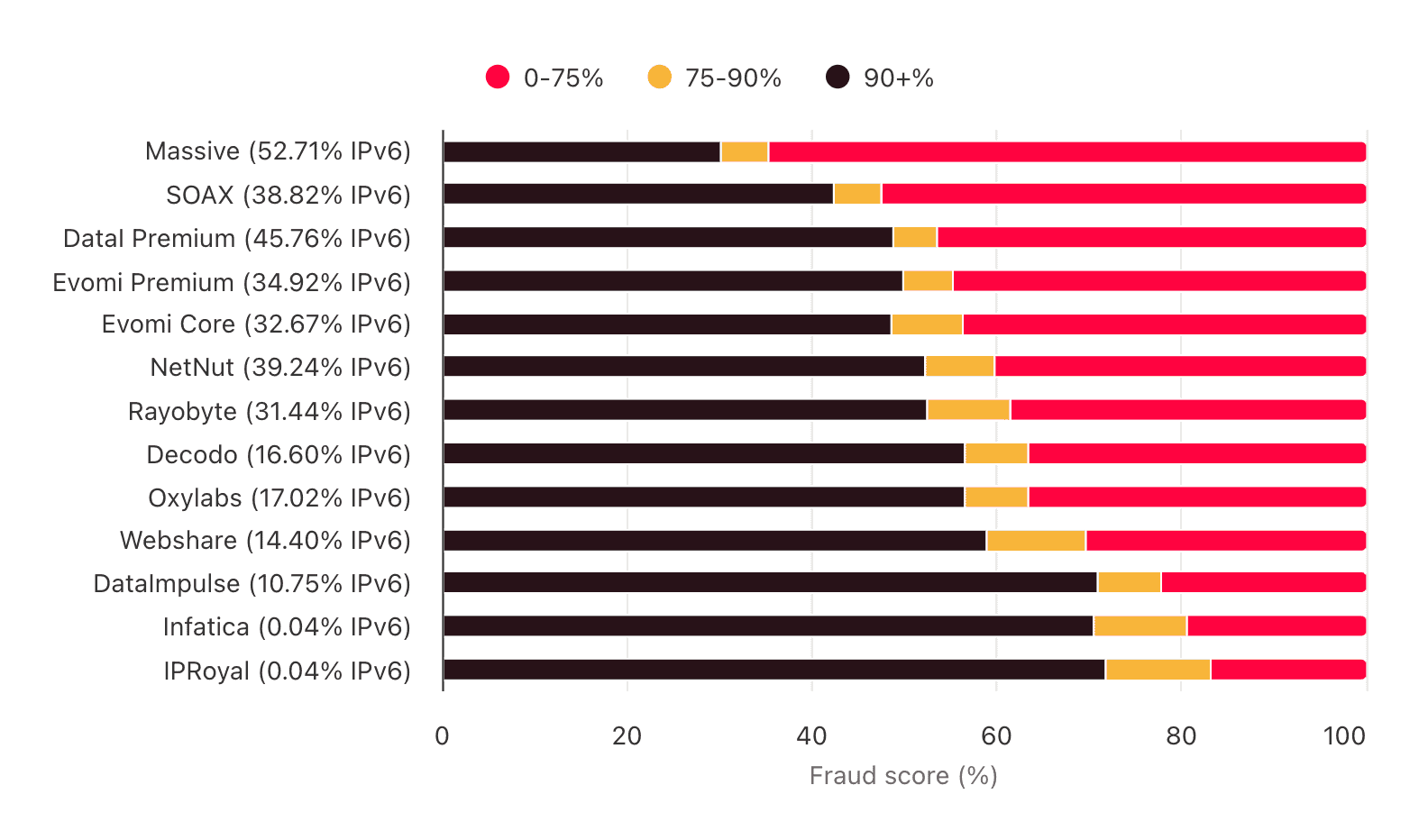

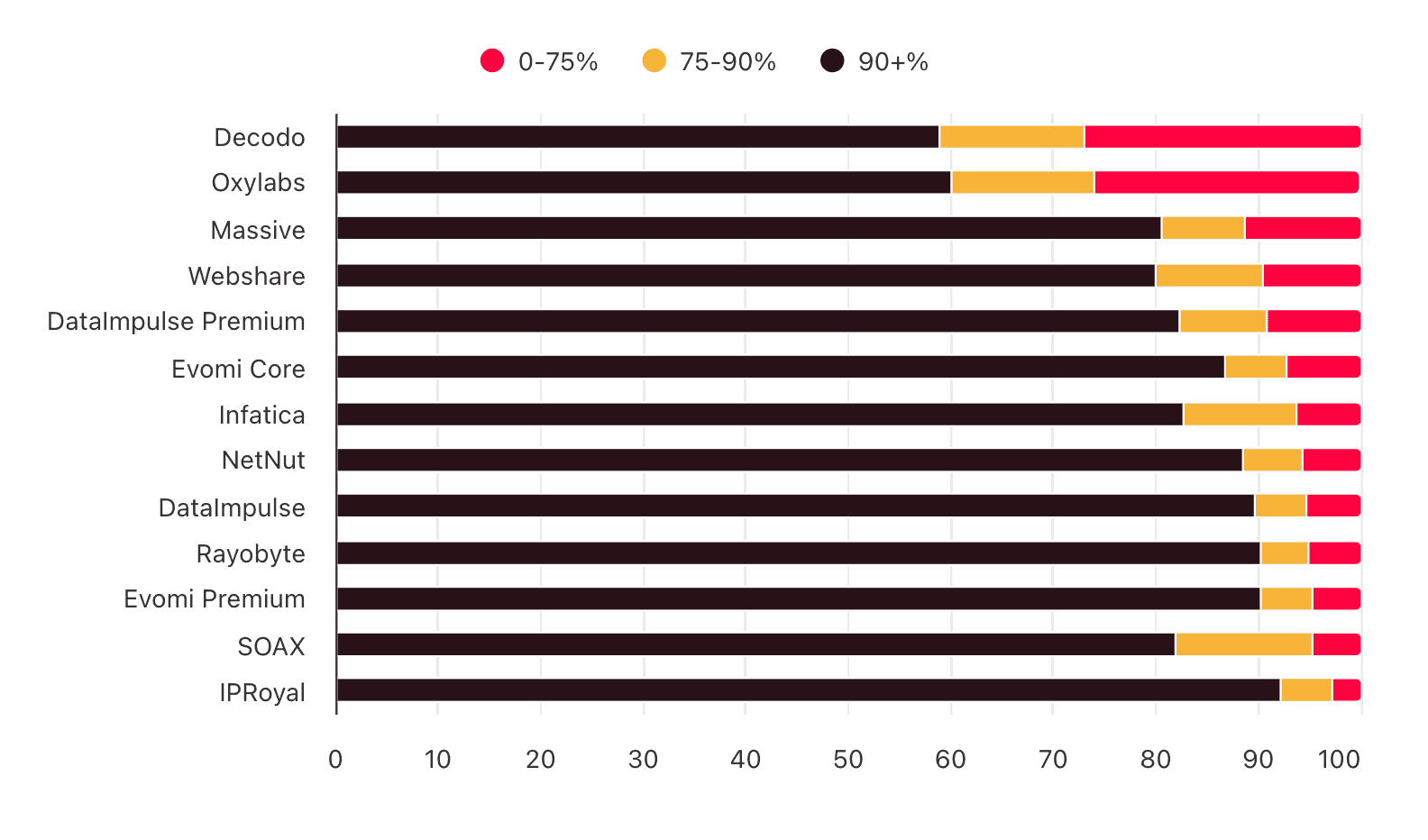

According to IPQualityScore, which we used to conduct this test:

Fraud Scores >= 75 are suspicious and likely to be a proxy, VPN, or TOR connection, but not necessarily a fraudulent user. Fraud Scores >=88 or 90 are high-risk users likely to engage in malicious behavior.

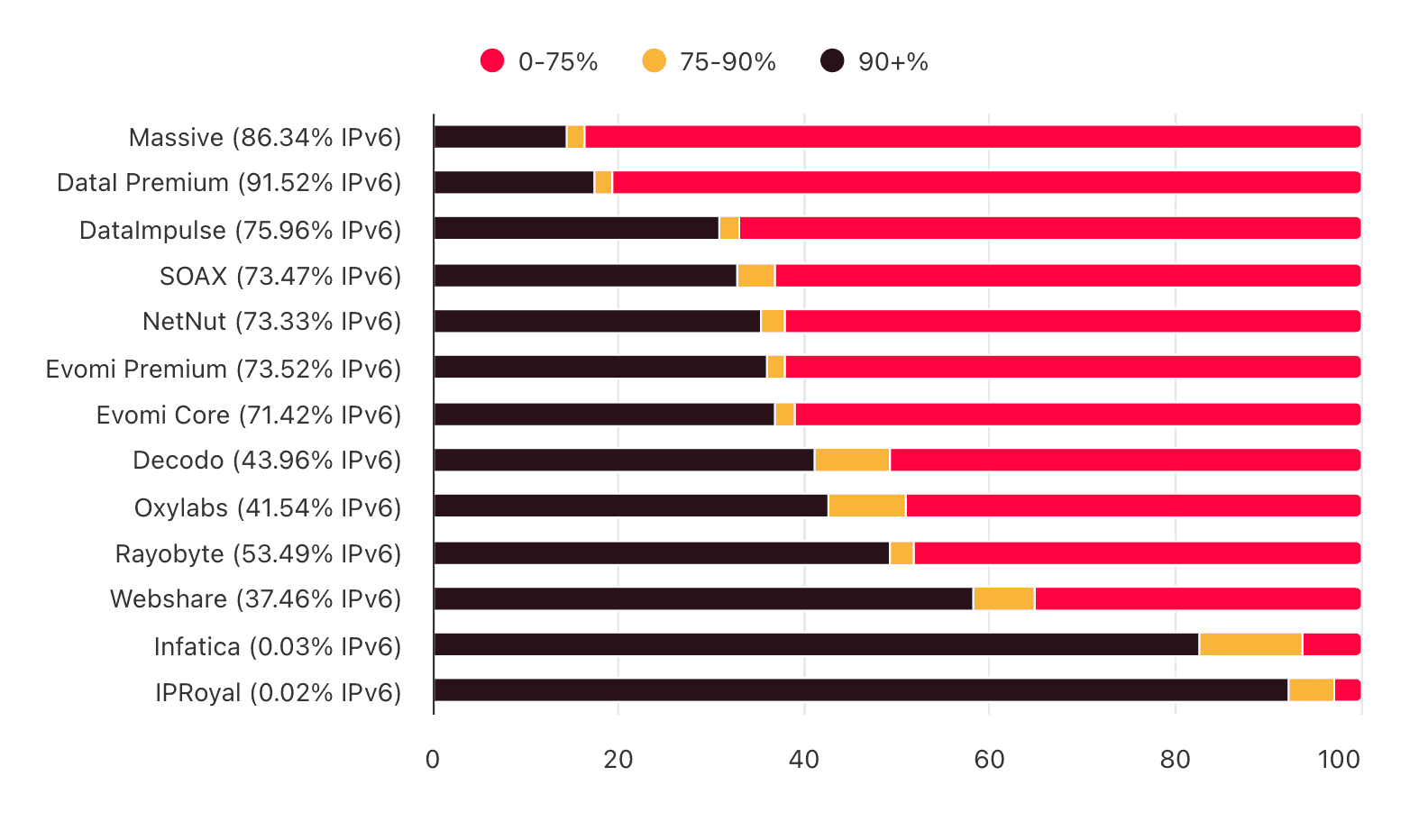

We decided to separate the results into all IPs and IPv4 only. We found the tool to be much more lenient toward IPv6 proxies, no matter which network we tested. As we’ll see, this gives a huge advantage to providers with a bigger share of IPv6 IPs in their pools.

Fraud score in the Global pool

Fraud score in the US pool

Infrastructure success rate

This graph is interactive.

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | Global | US | UK | EU | BR | IN | AU |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Oxylabs | 99.90 | 99.83 | 99.68 | 99.64 | 99.95 | 99.72 | 99.89 | ||||

| 2 | Decodo | 99.86 | 99.82 | 99.66 | 99.86 | 99.95 | 99.72 | 99.89 | ||||

| 3 | SOAX | 99.73 | 98.25 | 99.79 | 99.78 | 98.26 | 99.52 | 99.77 | ||||

| 4 | Dataimpulse Premium | 99.66 | 99.75 | 99.24 | 99.43 | 99.79 | 99.10 | 98.80 | ||||

| 5 | Massive | 99.66 | 99.87 | 99.58 | 99.62 | 99.84 | 99.67 | 98.58 | ||||

| 6 | Webshare | 99.58 | 99.27 | 99.75 | 99.64 | 99.30 | 99.57 | 99.73 | ||||

| 7 | IPRoyal | 99.56 | 99.43 | 99.46 | 99.20 | 99.48 | 98.97 | 99.87 | ||||

| 8 | Dataimpulse | 99.51 | 99.48 | 99.31 | 99.49 | 99.59 | 98.84 | 98.67 | ||||

| 9 | Rayobyte | 99.47 | 98.98 | 99.76 | 99.59 | 99.75 | 98.24 | 98.24 | ||||

| 10 | Evomi Premium | 99.44 | 99.65 | 99.61 | 99.57 | 99.70 | 99.08 | 99.30 | ||||

| 12 | Evomi Core | 99.12 | 99.56 | 99.08 | 99.27 | 99.83 | 98.61 | 98.33 | ||||

| 13 | Bright Data (2024) | 98.96 | 99.14 | 99.01 | 99.12 | 99.51 | 98.69 | 99.28 | ||||

| 14 | NetNut | 98.40 | 98.44 | 98.27 | 98.93 | 96.28 | 97.06 | 98.56 | ||||

| 16 | Infatica | 95.17 | 99.35 | 99.00 | 96.44 | 91.54 | 92.55 | 97.18 |

| 2025 | vs 2024 | vs 2023 | vs 2022 | vs 2021 | |

|---|---|---|---|---|---|

| Oxylabs | 99.90% | 0.08% | 0.29% | 0.33% | 0.66% |

| Decodo | 99.86% | 0.18% | 0.43% | 1.17% | 0.60% |

| SOAX | 99.73% | 1.24% | 0.70% | 0.21% | 1.23% |

| DataImpulse | 99.66% | 0.97% | |||

| IPRoyal | 99.56% | 1.34% | 10.00% | ||

| Rayobyte | 99.47% | 0.46% | 1.13% | 0.50% | |

| NetNut | 98.40% | 0.25% | 4.88% | 5.58% | 10.11% |

| Infatica | 95.17% | -1.95% | -0.78% |

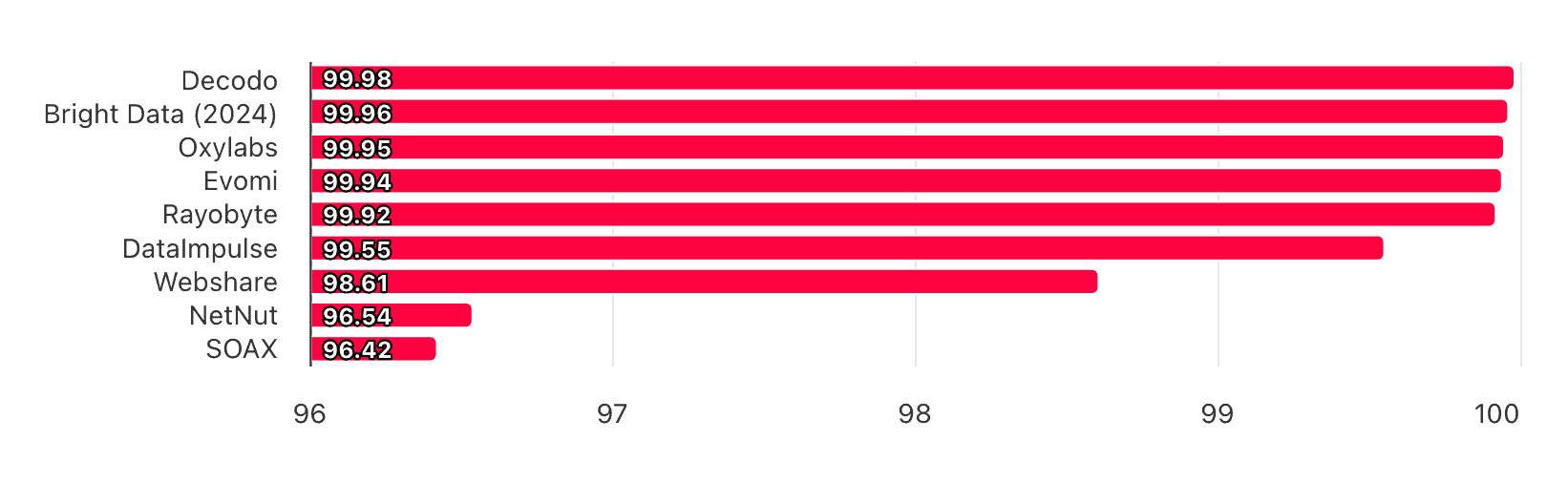

The infrastructure success rate has improved greatly compared to 2024: most providers easily reached 99% and more. We’re still having issues with NetNut and Infatica, though.

Success rate with popular targets

This graph is interactive.

In real world scenarios, the difference becomes starker, as more variables like IP quality get involved. Rayobyte’s were the only proxies we couldn’t get to run with our Google script.

Infrastructure response time

This graph is interactive.

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | Global | US | UK | EU | BR | IN | AU |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Decodo | 0.63 | 0.60 | 0.61 | 0.44 | 0.82 | 0.76 | 0.78 | ||||

| 3 | Oxylabs | 0.65 | 0.68 | 0.63 | 0.60 | 0.96 | 0.77 | 0.79 | ||||

| 4 | Infatica | 0.89 | 0.80 | 0.32 | 0.37 | 1.24 | 1.50 | 1.37 | ||||

| 5 | SOAX | 0.90 | 0.55 | 0.48 | 0.49 | 0.89 | 2.14 | 2.30 | ||||

| 6 | Massive | 0.92 | 0.67 | 0.59 | 0.59 | 1.05 | 1.07 | 1.06 | ||||

| 7 | Evomi Premium | 0.93 | 0.97 | 0.63 | 0.70 | 1.22 | 2.55 | 2.42 | ||||

| 8 | Evomi Core | 0.98 | 0.77 | 0.43 | 0.49 | 0.70 | 2.24 | 2.29 | ||||

| 9 | Dataimpulse Premium | 1.01 | 0.63 | 0.45 | 0.48 | 0.78 | 0.89 | 1.39 | ||||

| 10 | IPRoyal | 1.06 | 1.01 | 0.48 | 0.52 | 1.57 | 1.45 | 1.04 | ||||

| 12 | Bright Data (2024) | 1.12 | 1.00 | 0.75 | 0.80 | 1.04 | 1.76 | 1.73 | ||||

| 13 | Dataimpulse | 1.22 | 0.73 | 0.59 | 0.71 | 0.96 | 1.16 | 1.48 | ||||

| 14 | NetNut | 1.22 | 0.84 | 0.69 | 0.68 | 1.17 | 1.49 | 1.00 | ||||

| 15 | Webshare | 1.49 | 1.36 | 1.14 | 1.05 | 1.57 | 1.51 | 1.47 | ||||

| 17 | Rayobyte | 2.09 | 1.55 | 1.79 | 2.05 | 2.06 | 5.27 | 3.96 |

| 2025 | vs 2024 | vs 2023 | vs 2022 | vs 2021 | |

|---|---|---|---|---|---|

| Decodo | 0.63 s | 0.09 s | 0.06 s | -0.66 s | -0.34 s |

| Oxylabs | 0.65 s | 0.24 s | 0.08 s | -0.21 s | -0.33 s |

| Infatica | 0.89 s | -0.10 s | -0.31 s | ||

| SOAX | 0.90 s | -1.21 s | -0.15 s | -1.44 s | -2.79 s |

| DataImpulse | 1.01 s | -0.57 s | |||

| IPRoyal | 1.06 s | -0.30 s | -2.67 s | ||

| NetNut | 1.22 s | 0.01 s | -0.92 s | -0.15 s | -0.18 s |

| Rayobyte | 2.09 s | -0.03 s | -0.08 s | -0.04 s |

The differences in response time are significantly more pronounced, reaching more than three times at their most extreme. The participants that were already fast are showing fewer (and sometimes negative) yearly gains, maybe optimizing for other aspects like IP uniqueness.

Response time with popular targets

This graph is interactive.

Real world targets tend to reflect our synthetic benchmarks relatively accurately.

Available filters

| Location | ISP/ASN | Other filters | |

|---|---|---|---|

| Bright Data | Country, state, city, ZIP, coordinates | ✅ | OS, targeting individual IPs |

| Dataimpulse | Country, state, city, ZIP | ✅ | Exclude countries, states, cities, ASNs |

| Decodo | Country, state, city, ZIP | ✅ | |

| Evomi | Country, state, city | ✅ | Ad blocking, fraud score, OS, IP quantity, latency, uptime |

| Infatica | Country, state, city, ZIP | ✅ | |

| IPRoyal | Country, state, city | Enterprise | IP quantity, quality, exclude ISP proxies, IP ranges |

| Massive | Country, state, city, ZIP | ✅ | Device (desktop, mobile, TV) |

| NetNut | Country, state, city | ✅ | |

| Oxylabs | Country, state, city, ZIP, coordinates | ✅ | |

| Rayobyte | Country, state, city | ❌ | |

| SOAX | Country, state, city | ✅ | IP quantity, stability |

| Webshare | Country | ❌ |

City and ASN targeting won’t surprise anyone in 2025. However, we are seeing more ways to filter the pool that are not based on location. IP uniqueness & quality are two of the more prominent examples.

Rotation settings

| Every request | Sessions | Custom duration | Other | |

|---|---|---|---|---|

| Bright Data | ✅ | ✅ | With extra software | |

| Dataimpulse | ✅ | ✅ | 1-120 min | |

| Decodo | ✅ | ✅ | 1 sec-24 hr | |

| Evomi | ✅ | ✅ | 1-120 min | Hard session |

| Infatica | ✅ | ✅ | 5-60 min | Manual rotation |

| IPRoyal | ✅ | ✅ | 1 sec-24 hr | Manual rotation |

| Massive | ✅ | ✅ | 1-60 min | Hard session |

| NetNut | ✅ | ✅ | ❌ | Geo-sessions (longer duration) |

| Oxylabs | ✅ | ✅ | 1-30 min | |

| Rayobyte | ✅ | ✅ | 1-120 min | Hard session |

| SOAX | ✅ | ✅ | 10 sec-60 min | Hard session |

| Webshare | ✅ | ✅ | ❌ |

Some providers are distinguish between regular and hard sessions; the latter tend to keep the same proxy beyond the first connection error. NetNut’s geo-sessions may be useful, but they require dealing with request headers.

Protocol support

| HTTPS | SOCKS5 | UDP | |

|---|---|---|---|

| Bright Data | ✅ | ✅ | Select enterprises |

| Dataimpulse | ✅ | ✅ | Upon request |

| Decodo | ✅ | ✅ | Upon request |

| Evomi | ✅ | ✅ | ❌ |

| Infatica | ✅ | ✅ | ❌ |

| IPRoyal | ✅ | ✅ | ❌ |

| Massive | ✅ | ✅ | ❌ |

| NetNut | ✅ | ✅ | ❌ |

| Oxylabs | ✅ | ✅ | Upon request |

| Rayobyte | ❌ | ❌ | ❌ |

| SOAX | ❌ | ✅ | Available + QUIC |

| Webshare | ❌ | ❌ | ❌ |

By HTTPS, we refer to the path between your device and the provider’s gateway server; it’s mostly a corporate requirement. SOCKS5 is widely available, but UDP (and by relation, HTTP3) support remains limited.

Access features

| Credentials | IP whitelist | Sub-users | Other | |

|---|---|---|---|---|

| Bright Data | ✅ | Limited functionality | ✅ | Whitelist/blacklist domains |

| Dataimpulse | ✅ | ✅ | Multiple plans | Blacklist domains |

| Decodo | ✅ | ✅ | ✅ | |

| Evomi | ✅ | ❌ | ❌ | |

| Infatica | ✅ | ✅ | ❌ | |

| IPRoyal | ✅ | Limited functionality | ✅ | |

| Massive | ✅ | ❌ | Custom setup | |

| NetNut | ✅ | Custom setup | Custom setup | |

| Oxylabs | ✅ | ✅ | ✅ | |

| Rayobyte | ✅ | ❌ | ❌ | |

| SOAX | ✅ | ✅ | ❌ | |

| Webshare | ✅ | ✅ | ✅ |

Proper IP whitelisting isn’t easy to implement, and so quite a few participants still lack it. The same goes for sub-users.

General information

| Subscription | PAYG | Entry price | Largest plan | Upsells | Trial | |

|---|---|---|---|---|---|---|

| Bright Data | ✅ | ✅ | $4.20 | $1,999 (678 GB) | Available | |

| DataImpulse | ❌ | ✅ | $50 | $800 (1 TB) | $5 plan | |

| Decodo | ✅ | ✅ | $3.50 | $1,500 (1 TB) | Free trial, refund | |

| Evomi | ✅ | ✅ | $15 | $790 (1 TB) | More IPs, targeting options, filters | Available |

| Infatica | ✅ | ✅ | $4 | $2,600 (1.2 TB) | Paid trial | |

| IPRoyal | ✅ | Scaling | $3.50 | $12,250 (5 TB) | ❌ | |

| Massive | ✅ | ✅ | $3.9 | $1,600 (1 TB) | For companies | |

| NetNut | ✅ | ❌ | $99 | $3,750 (2 TB) | For companies | |

| Oxylabs | ✅ | ✅ | $4 | $2,000 (1 TB) | Trial for companies, refund | |

| Rayobyte | Enterprise | Scaling | $3.50 | $4,500 (5 TB) | Free trial | |

| SOAX | ✅ | ✅ | $4 | $1,600 (800 GB) | Paid trial | |

| Webshare | ✅ | ❌ | $7 | $8,400 (3 TB) | More threads, network priority | Refund |

Residential proxy networks have become much more approachable, with the entry price often in single digits. There’s no rule that enterprise-minded providers will have bigger plans on display – more often than not, quite the opposite.

Pricing table

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | 5 GB | 50 GB | 100 GB | 250 GB | 500 GB | 1 TB |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Bright Data | 4.20 | 4.20 | 4.20 | 3.57 | 3.15 | 2.94 | ||||

| 3 | DataImpulse* | 1.00 | 1.00 | 1.00 | 1.00 | 0.80 | |||||

| 4 | DataImpulse (Premium) | 5.00 | 5.00 | 5.00 | 5.00 | 4.00 | |||||

| 5 | Decodo | 3.00 | 2.45 | 2.25 | 2.00 | 1.75 | 1.50 | ||||

| 6 | Evomi | 4.00 | 3.40 | 3.20 | 3.00 | 2.80 | 2.60 | ||||

| 7 | Evomi (Core)** | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | |||||

| 8 | Infatica | 4.00 | 3.84 | 3.60 | 2.90 | 2.70 | 2.60 | ||||

| 9 | IPRoyal | 3.50 | 2.45 | 2.28 | 2.10 | 1.75 | 1.58 | ||||

| 10 | Massive | 3.99 | 3.75 | 2.45 | 2.00 | 2.00 | 1.60 | ||||

| 12 | NetNut | 3.53 | 3.45 | 3.32 | 2.85 | 2.49 | |||||

| 13 | Oxylabs | 4.00 | 3.75 | 3.49 | 3.01 | 2.75 | 2.00 | ||||

| 14 | Rayobyte | 3.50 | 2.00 | 2.00 | 1.50 | 1.50 | 0.90 | ||||

| 15 | SOAX | 4.00 | 3.40 | 3.40 | 3.40 | 2.46 | 2.00 | ||||

| 16 | Webshare | 6.00 | 4.90 | 4.50 | 4.00 | 3.50 | 3.00 | ||||

| Avg = 4.02 | Avg = 3.15 | Avg = 2.95 | Avg = 2.66 | Avg = 2.41 | Avg = 2.04 |

* More targeting options double the price.

** More IPs, targeting options, and other filters increase the base price by up to 15x.

The average price per gigabyte is very affordable this year, but it no longer scales as much. Providers are effectively giving up their margins with small customers. It’s also interesting to see the difference between regular and premium pools – will we encounter similar segmentations more going forward?

Mobile Proxies

Mobile proxies are home devices connected mobile carriers like Verizon. They can be crowdsourced from people or set up as mobile dongle farms. Mobile IPs are considered to be the most effective due to factors like carrier-grade subnetting, but their high cost makes them a situational choice.

We’re interested in peer-to-peer mobile proxies rather than dedicated device farms.

This graph is interactive. You can hover on a provider’s name to highlight it or click to hide.

🌐 Proxy pools

- Advertised pool size: median – 8.5 million, largest – 33 million (SOAX)

- Global pool: most unique IPs – 199.7/260k (Oxylabs)

- US pool: most unique IPs – 143.3/260k (NetNut)

📊 Infrastructure success rate

- Global pool: median – 99.61%, best – 99.94% (Oxylabs).

- US pool: median – 99.81%, best – 99.94% (Decodo, Evomi’s US pools, Oxylabs’ global pool)

- Any pool: best – 99.94% (Decodo, Evomi, Oxylabs)

⏱️ Infrastructure response time

- Global pool: median – 1.32 s, best – 0.57 s (Decodo, Oxylabs)

- US pool: median – 0.82 s, best – 0.61 s (Evomi)

- Any pool: best – 0.57 s (Decodo’s global, Oxylabs’ global & UK pools)

🎯 Target benchmarks (Amazon, Google, Instagram)

- Success rate: median – 90.55%, best – 94.20% (Infatica)

- Response time: median – 4.60 s, best – 3.99 s (Oxylabs)

⚙️ Features

- Targeting options: city – 7/8, ASN – 8/8

- Protocol support: SOCKS5 – 8/8, UDP – 3/7 (2 with caveats)

- IP whitelisting: 7/8 (2 with caveats)

💵 Pricing

- 1 GB: median – $8/GB

- 50 GB: median – $6/GB

- 250 GB: median – $5/GB

Advertised proxy pools

| Advertised # of IPs | Yearly change | |

|---|---|---|

| SOAX | 33,000,000 | N/A |

| Oxylabs | 20,000,000 | N/A |

| Decodo | 10,000,000 | N/A |

| Bright Data | 7,000,000 | N/A |

| Infatica | 5,000,000 | N/A |

| NetNut | 5,000,000 | +2,000% |

| DataImpulse | Not specified | N/A |

| Evomi | Not specified | N/A |

The advertised mobile proxy pools have barely changed in a year.

Unique IPs in the global (unfiltered) proxy pool

NetNut had the most unique IPs, but a database identified 40,000 of them as not belonging to mobile networks.

Unique IPs in country-filtered pools

This graph is interactive.

Oxylabs and the Decodo had the largest pools in individual locales. However, NetNut & DataImpulse both produced over 100,000 unique proxies in the US – an impressive number for this proxy type.

Percentage of mobile IPs in country-filtered pools

| Provider avg. | US | UK | EU | BR | IN | AU | |

|---|---|---|---|---|---|---|---|

| Infatica | 99.40% | 99.76% | 99.68% | 98.75% | 99.15% | 99.96% | 99.10% |

| Oxylabs | 98.27% | 99.71% | 99.45% | 91.38% | 99.64% | 99.57% | 99.88% |

| Evomi | 98.13% | 99.17% | 98.97% | 93.02% | 99.05% | 99.86% | 98.69% |

| SOAX | 97.85% | 97.27% | 99.11% | 92.77% | 98.87% | 99.96% | 99.13% |

| Bright Data (2024) | 97.48% | 92.54% | 98.49% | 98.06% | 97.43% | 99.86% | 98.48% |

| NetNut | 80.99% | 89.55% | 77.77% | 94.05% | 40.87% | 99.88% | 83.84% |

| Decodo | 78.33% | 33.60% | 89.15% | 83.18% | 96.31% | 99.76% | 67.95% |

| DataImpulse | 76.25% | 87.71% | 82.88% | 85.81% | 26.34% | 98.99% | 75.77% |

| Country avg. | 77.94% | 91.90% | 90.97% | 81.83% | 99.76% | 86.51% |

Infrastructure success rate

This graph is interactive.

| 2025 | vs 2024 | vs 2023 | vs 2022 | |

|---|---|---|---|---|

| Oxylabs | 99.94% | 1.51% | 2.04% | 2.05% |

| Decodo | 99.76% | 1.28% | 2.39% | |

| SOAX | 99.61% | 1.23% | 1.39% | 0.75% |

| Netnut | 96.88% | -1.50% | 1.71% | |

| Infatica | 91.59% | -4.25% |

Mobile proxy networks have caught up to – and even exceeded – residential proxies in success rate. We find this amazing, knowing that the difference was significant just a year ago.

Success rate with popular targets

This graph is interactive.

Most participants displayed very similar performance, proving that IP quality was rarely a bottleneck – as it should be with mobile proxies.

Infrastructure response time

This graph is interactive.

| 2025 | vs 2024 | vs 2023 | vs 2022 | |

|---|---|---|---|---|

| Decodo | 0.57 s | -0.31 s | -0.55 s | |

| Oxylabs | 0.57 s | -0.32 s | -0.53 s | -1.03 s |

| Infatica | 1.25 s | 0.02 s | ||

| SOAX | 1.39 s | -0.65 s | -0.33 s | -2.13 s |

| NetNut | 1.80 s | 0.60 s | -0.47 s |

As with residential proxies, the differences in response time were often significant. Participants proved to be the fastest in European countries.

Response time with popular targets

This graph is interactive.

When accessing real world targets, Amazon opened relatively evenly with all proxy networks, while the response time with the other two was more pronounced.

Available filters

| Location | ISP/ASN | Other filters | |

|---|---|---|---|

| Bright Data | Country, state, city, ZIP | ✅ | OS |

| DataImpulse | Country, state, city, ZIP | ✅ | Exclude locations, ASNs |

| Decodo | Country, city | ✅ | Operating system |

| Evomi | Country, state, city | ✅ | |

| Infatica | Country, state, city, ZIP | ✅ | |

| NetNut | Country | ✅ | |

| Oxylabs | Country, city, coordinates | ✅ | |

| SOAX | Country, state, city | ✅ |

Mobile proxy networks offer fewer filtering options than residential proxies. Due to smaller pools, there’s less leeway to play around with their distribution.

Rotation options

| Every request | Sessions | Custom duration | Other | |

|---|---|---|---|---|

| Bright Data | ✅ | ✅ | With extra software | |

| DataImpulse | ✅ | ✅ | 1-120 min | |

| Decodo | ✅ | ✅ | 1 sec-24 hr | |

| Evomi | ✅ | ✅ | 1-120 min | |

| Infatica | ✅ | ✅ | 5-60 min | |

| NetNut | ✅ | ✅ | ❌ | |

| Oxylabs | ✅ | ✅ | 1-30 min | |

| SOAX | ✅ | ✅ | 10 sec-60 min |

Mobile proxy networks lack the ability to optimize for session length, which is understandable given their nature.

Protocol support

| HTTPS | SOCKS5 | UDP | |

|---|---|---|---|

| Bright Data | ✅ | ✅ | Select enterprises |

| DataImpulse | ✅ | ✅ | Upon request |

| Decodo | ✅ | ✅ | ❌ |

| Evomi | ✅ | ✅ | ❌ |

| Infatica | ✅ | ✅ | ❌ |

| NetNut | ✅ | ✅ | ❌ |

| Oxylabs | ✅ | ✅ | ❌ |

| SOAX | ❌ | ✅ | Available + QUIC |

SOCKS5 is widely available, but only in limited capacity.

Access features

| Credentials | IP whitelist | Sub-users | Other | |

|---|---|---|---|---|

| Bright Data | ✅ | Limited functionality | ✅ | Whitelist/blacklist domains |

| Dataimpulse | ✅ | ✅ | Multiple plans | Blacklist domains |

| Decodo | ✅ | ✅ | ✅ | |

| Evomi | ✅ | ❌ | ❌ | |

| Infatica | ✅ | ✅ | ❌ | |

| NetNut | ✅ | Custom setup | Custom setup | |

| Oxylabs | ✅ | ✅ | ✅ | |

| SOAX | ✅ | ✅ | ❌ |

Sub-users are a rarer sight compared to residential proxy networks.

General information

| Subscription | PAYG | Entry price | Largest plan | Upsells | Trial | |

|---|---|---|---|---|---|---|

| Bright Data | ✅ | ✅ | $8.40 | $1,999 (339 GB) | Available | |

| DataImpulse | ❌ | ✅ | $50 | $1,600 (1 TB) | Location filters | $5 plan |

| Decodo | ✅ | ✅ | $8 | $2,250 (500 GB) | Free trial, refund | |

| Evomi | ✅ | ✅ | $16 | $11,000 (5 TB) | Trial available | |

| Infatica | ✅ | ✅ | $8 | $800 (200 GB) | Paid trial | |

| NetNut | ✅ | ❌ | $99 | $4,500 (1 TB) | For companies | |

| Oxylabs | ✅ | ✅ | $9 | $3,000 (600 GB) | Trial for companies, refund | |

| SOAX | ✅ | ✅ | $4 | $1,600 (800 GB) | Paid trial |

Mobile proxies are easy to pick up, even if you’re buying them from a premium provider. NetNut remains the only participant without a pay-as-you-go option.

Pricing table

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | 1 GB | 20 GB | 50 GB | 100 GB | 250 GB | 500 GB |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Bright Data | 8.40 | 8.40 | 8.40 | 7.14 | 6.30 | 5.88 | ||||

| 3 | DataImpulse* | 2.00 | 2.00 | 2.00 | 2.00 | ||||||

| 4 | Decodo | 8.00 | 6.50 | 6.00 | 5.50 | 5.00 | 4.50 | ||||

| 5 | Evomi | 4.00 | 3.40 | 3.20 | 3.00 | 2.80 | 2.60 | ||||

| 6 | Infatica | 8.00 | 6.50 | 6.00 | 5.00 | 4.00 | |||||

| 7 | NetNut | 7.60 | 7.35 | 6.93 | 6.12 | 5.88 | |||||

| 9 | Oxylabs | 9.00 | 8.25 | 7.89 | 7.50 | 6.50 | 5.00 | ||||

| 10 | SOAX | 4.00 | 4.00 | 3.40 | 3.40 | 3.40 | 2.46 | ||||

| Avg = 6.90 | Avg = 6.38 | Avg = 5.53 | Avg = 5.06 | Avg = 4.52 | Avg = 4.05 |

* More targeting options double the price.

Though much cheaper compared to 2024, mobile proxies were mostly unaffected by the latest round of price cuts, so the gap between them and residential IPs remains significant. The newcomers, DataImpulse and Evomi, push the price down.

Datacenter Proxies

Datacenter proxies are servers owned by cloud hosting providers like Amazon Web Services or IPXO. They’re fast, stable, and efficient. At the same time, their distinctive usage habits and public IP ranges make datacenter proxies simple to block.

We’re investigating shared datacenter proxies because this gives us a way to test the largest number of servers. Our preferred format is the proxy pool, or the hybrid approach – IP lists that include optional rotation functionality.

This graph is interactive. You can hover on a provider’s name to highlight it or click to hide.

🌐 Proxy pools

- Advertised pool size: largest – 770,000 (Bright Data)

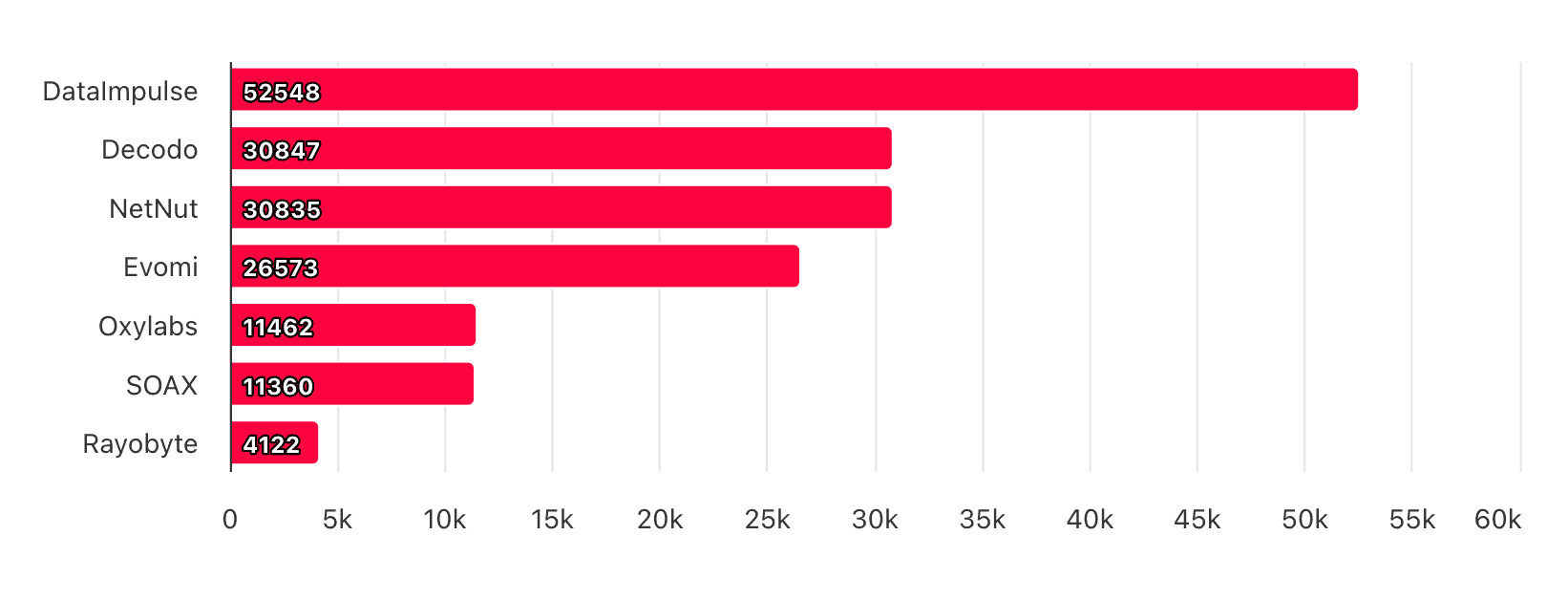

- US pool: most unique IPs – 52,548/70,000 requests (DataImpulse)

📊 Infrastructure performance

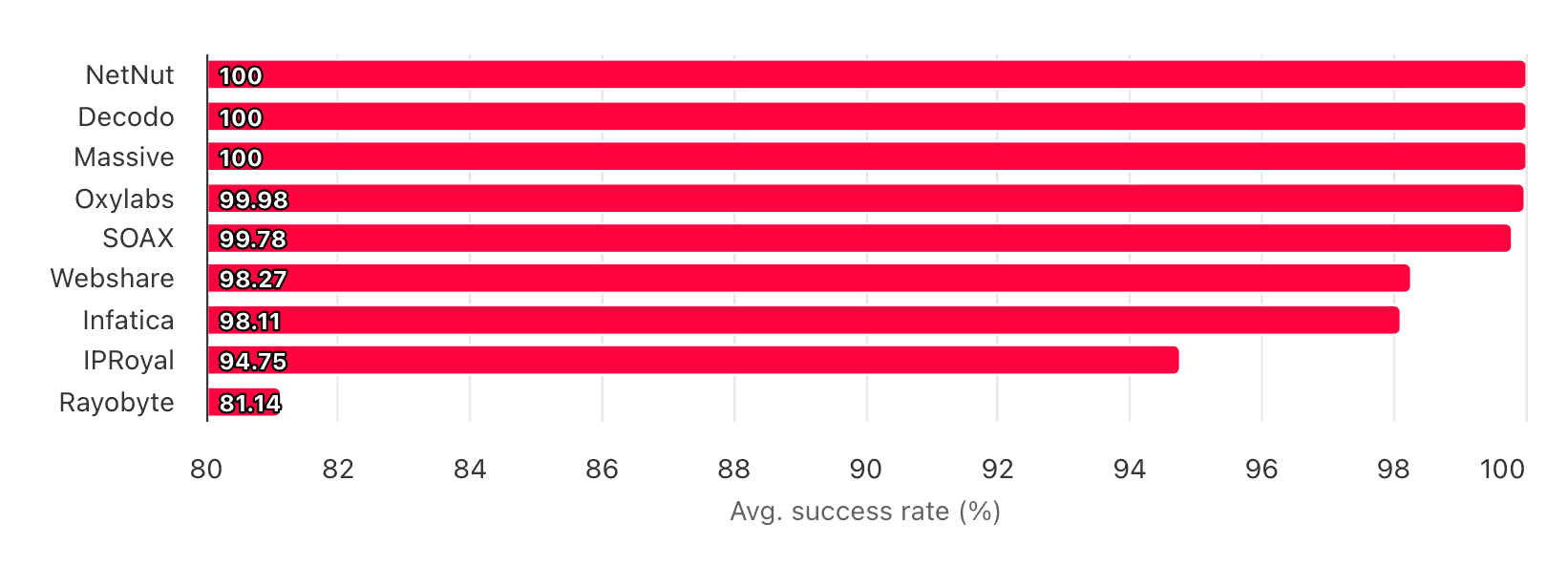

- Success rate: median – 99.87%, best – 99.98% (Decodo)

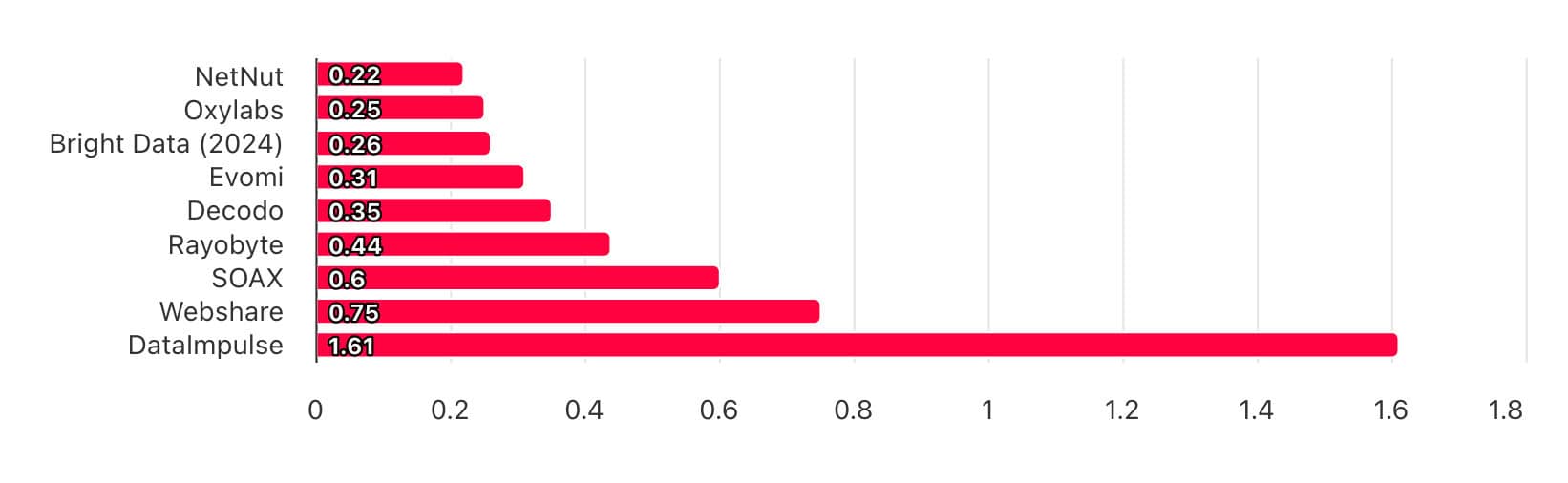

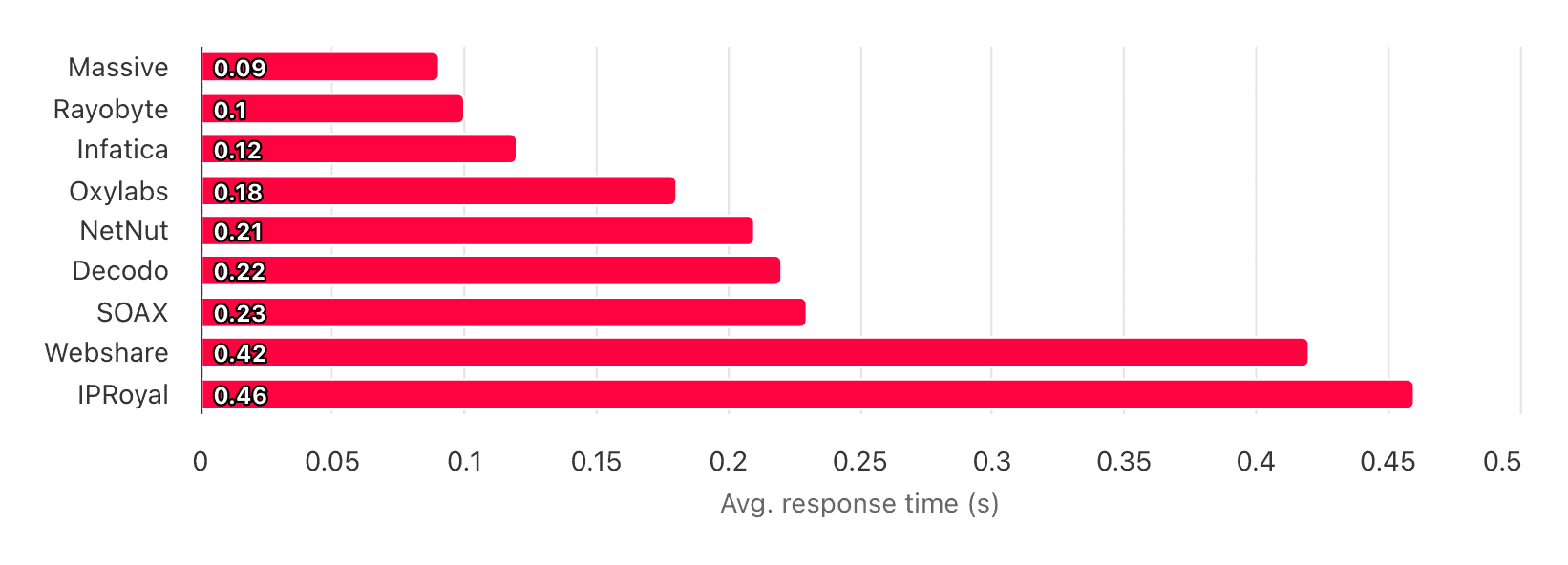

- Response time: median – 0.29 s, best – 0.22 s (NetNut)

- Throughput: median – 1.50 MB/s, fastest – 7.03 MB/s (Oxylabs)

🎯 Target benchmarks (Amazon, Google)

- Success rate: median – 59.80%, best – 88.50% (SOAX)

- Response time: median – 3.71 s, best – 2.32 s (Decodo)

⚙️ Features

- Targeting options: city – 2/9, ASN – 2/9

- Protocol support: SOCKS5 – 8/9, UDP – 5/9 (2 with caveats)

- IP whitelisting: 6/9 (1 with caveats)

💵 Pricing

- 50 GB: median – $0.60/GB

- 250 GB: median – $0.60/GB

- 1 TB: median – $0.50/GB

General Information

| Advertised pool size | Coverage | Details | |

|---|---|---|---|

| Bright Data | 770,000, incl. dedicated IPs | ~90 countries | Pool with 20,000 random IPs & pay-per-IP formats available |

| Webshare | 400,000, incl. dedicated IPs | ~45 countries | Pay-per-IP format with optional rotation |

| NetNut | 150,000 | 200 advertised, 2 countries available in the setup widget | |

| Decodo | 100,000+ | 17 countries | Pool & pay-per-IP formats available |

| Rayobyte | 60,000 | 4 countries | |

| Oxylabs | 40,000 | 24 countries | Pool & pay-per-IP formats available |

| DataImpulse | Not specified | 100+ countries available, ~60 with at least 200 IPs | Peer-to-peer pool. 200k+ IPs online when checked |

| Evomi | Not specified | 100+ countries available | Peer-to-peer pool |

| SOAX | Not specified | 7 countries |

Datacenter proxy networks these days offer quite a bit of variety. It’s interesting too see that some participants, namely DataImpulse and Evomi, crowdsource their IPs like residential proxy networks. At the expense of stability, such pools can balloon to serious sizes.

Unique IPs (US pool)

The benchmark proves our previous point. For some reason, Rayobyte performed very poorly compared to the advertised numbers, which should be accurate knowing the origin of these proxies.

Infrastructure success rate

Suprisingly, connections to datacenter proxy servers can fail more than to residential or mobile proxies. SOAX had just erected a new gateway server, which may explain its performance; we have no explanation for NetNut.

Success rate with popular targets

This graph is interactive.

Shared datacenter IPs aren’t exactly great for scraping protected targets. Still, some participants performed very well with at least one target. We couldn’t get Rayobyte to work with Google; Oxylabs did work, but every single request we made got blocked.

Infrastructure response time

The response time was fast on average, but there was also huge variance. DataImpulse’s peer-to-peer approach evidently has a cost, though Evomi managed to avoid its drawbacks better.

Response time with popular targets

This graph is interactive.

Curiously, NetNut’s response time advantage failed to translate to real-world results. As we’ll see below, it was probably due to the very limited throughput allocated to the user.

Download speed of 10 random US IPs

This graph is interactive.

Most of the proxy servers were fast enough for 1080p video streaming, but only two could have streamed 4K comfortably. The throughput also varied a lot between the 10 IPs we tested from each provider, showing a lack of consistency.

Available filters

| Location | ISP/ASN | Other | |

|---|---|---|---|

| Bright Data | Country, state, city | ❌ | OS |

| DataImpulse | Country, state, city | ✅ | Exclude location/ASN |

| Decodo | Country | ❌ | ❌ |

| Evomi | Country | ❌ | ❌ |

| NetNut | Country | ❌ | ❌ |

| Oxylabs | Country | ❌ | ❌ |

| Rayobyte | Country (US only) | ❌ | ❌ |

| SOAX | Country | ✅ | ❌ |

| Webshare | Country | ❌ | ❌ |

Datacenter proxy networks generally lack the fancy targeting features due to limited distribution. They are possible to find but as an exception rather than the norm.

Rotation options

| Every request | Sessions | Custom duration | Other | |

|---|---|---|---|---|

| Bright Data | ✅ | ✅ | With extra software | |

| DataImpulse | ✅ | ✅ | 1-120 min | |

| Decodo | ✅ | ✅ | ❌ | |

| Evomi | ✅ | ✅ | 1 min-24 hr | |

| NetNut | ✅ | ✅ | ❌ | |

| Oxylabs | ✅ | ✅ | ❌ | |

| Rayobyte | ✅ | ✅ | 1-120 min | |

| SOAX | ✅ | ✅ | 1 min-24 hr | |

| Webshare | ✅ | ✅ | ❌ |

Providers are also less equipped to outfit datacenter proxy pools with customizable sessions. It makes sense, as these IPs stay online indefinitely, and you can manage session duration on your end.

Protocol support

| HTTPS | SOCKS5 | UDP | |

|---|---|---|---|

| Bright Data | ✅ | ✅ | Select enterprises |

| DataImpulse | ✅ | ✅ | Upon request |

| Decodo | ✅ | ✅ | ✅ |

| Evomi | ✅ | ✅ | ❌ |

| NetNut | ✅ | ✅ | ❌ |

| Oxylabs | ✅ | ✅ | ✅ |

| Rayobyte | ❌ | ❌ | ❌ |

| SOAX | ❌ | ✅ | ✅ |

| Webshare | ❌ | ✅ | ❌ |

SOCKS5 is widely available, but as always – you may have difficulties finding a setup that supports UDP.

Access features

| Credentials | IP whitelist | Sub-users | Other | |

|---|---|---|---|---|

| Bright Data | ✅ | ✅ | ✅ | Whitelist/blacklist domains |

| DataImpulse | ✅ | ❌ | Multiple plans | Blacklist domains |

| Decodo | ✅ | ✅ | ❌ | |

| Evomi | ✅ | ❌ | ❌ | |

| NetNut | ✅ | Custom setup | Custom setup | |

| Oxylabs | ✅ | ✅ | ✅ | |

| Rayobyte | ✅ | ❌ | ❌ | |

| SOAX | ✅ | ✅ | ❌ | |

| Webshare | ✅ | ✅ | ✅ |

Every second participant offers IP whitelisting and sub-user functionality, which is decent for this proxy type.

General information

| Subscription | PAYG | Entry | Largest plan | Upsells | Trial | |

|---|---|---|---|---|---|---|

| Bright Data | ✅ | ✅ | $0.60 | $1,999 (5 TB) | Available | |

| DataImpulse | ❌ | ✅ | $50 | $450 (1 TB) | Location filters | $5 plan |

| Decodo | ✅ | ❌ | $3.5 | $500 (1 TB) | Free trial | |

| Evomi | ✅ | ✅ | $13.5 | $300 (1 TB) | Available | |

| NetNut | ✅ | ❌ | $100 | $1,000 (2 TB) | For companies | |

| Oxylabs | ✅ | ❌ | $12 | $500 (1 TB) | 5 free IPs | |

| Rayobyte | ❌ | ✅ | $0.30 | $230 (1 TB) | Free trial | |

| SOAX | ✅ | ✅ | $15 | $4,000 ( 10 TB) | Paid trial | |

| Webshare | ✅ | ❌ | $2.99 | $1,076 (60k IPs) | More threads, traffic, refreshes, network priority | 10 free IPs |

For an entry-level product, the entry price can be higher than residential or even mobile proxies. There’s also less paying as you go. On the other hand, there are now two completely free plans available.

Pricing table

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Provider | 50 GB | 100 GB | 250 GB | 500 GB | 1 TB | 2 TB |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Bright Data | 0.60 | 0.60 | 0.60 | 0.60 | 0.51 | 0.45 | ||||

| 3 | DataImpulse | 0.50 | 0.50 | 0.50 | 0.50 | 0.45 | 0.45 | ||||

| 7 | Decodo | 0.60 | 0.55 | 0.55 | 0.53 | 0.50 | 0.30 | ||||

| 8 | Evomi | 0.45 | 0.45 | 0.40 | 0.35 | 0.30 | 0.30 | ||||

| 9 | NetNut | 1.00 | 0.74 | 0.70 | 0.50 | 0.46 | |||||

| 10 | Oxylabs | 0.65 | 0.60 | 0.55 | 0.50 | 0.48 | |||||

| 12 | Rayobyte | 0.30 | 0.28 | 0.25 | 0.23 | 0.23 | 0.23 | ||||

| 13 | SOAX | 0.80 | 0.62 | 0.62 | 0.62 | 0.49 | 0.42 | ||||

| 14 | Webshare* | 0.48 | 0.48 | 0.17 | 0.17 | ||||||

| Avg = 0.54 | Avg = 0.58 | Avg = 0.53 | Avg = 0.51 | Avg = 0.41 | Avg = 0.36 |

* 5,000 shared datacenter IPs.

Rotating datacenter proxies are cheap, but they’re less impacted by economies of scale. Webshare sees a steep drop in price thanks to its pricing model, and Rayobyte is currently very cheap in general.

ISP Proxies

ISP proxy servers are hosted at data centers but use the networks of consumer internet service providers. In theory, this lets them combine the best qualities of datacenter and residential proxies. In practice, there’s much more nuance involved.

Customers of ISP proxies often care about their quality. Therefore, we decided to test them in the format of a dedicated IP list – in particular, 100 US IPs. Of course, our scope is too small to represent a provider’s full stock; still, it gives us a good glean into this proxy type.

This graph is interactive. You can hover on a provider’s name to highlight it or click to hide.

🌐 Proxy pools

- Biggest coverage: 30+ countries (IPRoyal)

📊 Infrastructure performance

- Success rate: median – 99.78%, best – 100% (NetNut, Decodo, Massive)

- Response time: median – 0.21 s, best – 0.09 s (Massive)

- Throughput: median – 20.75 MB/s, fastest – 50 MB/s (Oxylabs)

🎯 Target benchmarks (Amazon, Google)

- Success rate: median – 89.34%, best – 99.02% (Massive)

- Response time: median – 2.76 s, best – 2.49 s (Massive)

⚙️ Features

- Protocol support: SOCKS5 – 9/9, UDP – 4/9

- IP whitelisting: 7/9 (1 with caveats)

💵 Pricing

- 10 IPs: median – $3.58/IP

- 50 IPs: median – $3.02/IP

- 500 IPs: median – 2.70/IP

General Information

| Advertised # of IPs | Countries | Country distribution | Targeting options | |

|---|---|---|---|---|

| IPRoyal | 500,000 | 30+ | One per plan | Country, state, city |

| Webshare | 100,000+ | ~10 | Free choice | Country |

| Massive | 20,000 | US | One per plan | Country |

| Decodo | Not specified | 11 | Free choice | Country |

| Infatica | Not specified | 16 | One per plan | Country |

| Oxylabs* | Not specified | 20+ | Free choice | Country |

| Rayobyte | Not specified | |||

| NetNut | Custom | |||

| SOAX | Custom | |||

* Information not publicly available.

Because these proxies are reserved for one user, their stocks fluctuate a lot, and the advertised number can only give you a general idea of how many IPs a provider controls. It’s not rare to find no proxies in a specific location, even if it’s marketed as available.

Still, we can see that IPRoyal and Webshare have built diverse infrastructures. On the other hand, quite a few providers only sell ISP proxies by request, with little to no public information available.

Basic analysis of 100 IPs

| /24 subnets | Location (MaxMind) | Location (IP2Location) | ASNs | |

|---|---|---|---|---|

| Decodo | 22 | US (100%) | US (96%), CA (4%) | Verizon (58%), AT&T (42%) |

| Infatica | 53 | US (91%), HU (9%) | US (100%) | Crocker (57%), Lumen (43%) |

| IPRoyal | 100 | US (99%), NC (1%) | US (100%) | AT&T (38%), Crocker (18%), CenturyLink (17%), Internet Holdings LLC (7%), Charter (7%), Frontier (5%), X-DSL Networking (2%), Secured Servers (2%), Windstream (2%), Bunny Communications (2%) |

| Massive | 1 | US (100%) | US (100%) | AT&T (100%) |

| NetNut | 1 | US (100%) | US (100%) | Plains Internet (100%) |

| Oxylabs | 10 | US (100%) | US (100%) | Astound (50%), Windstream (50%) |

| Rayobyte | 8 | US (100%) | US (100%) | Verizon (100%) |

| SOAX | 3 | US (50%), CA (50%) | CA (50%), US (25%), CN (25%) | Rogers Cable (50%), Internap Corp (25%), Optimum WiFi (25%) |

| Webshare | 44 | US (97%), NZ (2%), RS (1%) | US (100%) | RCN (74%), AT&T (16%), Sprint (7%), Comcast (3%) |

The participants took different approaches to distributing our 100 US IPs. Infatica, IPRoyal, and Webshare went the route of diversity, while Massive and NetNut assigned proxies from only one subnet. The latter option can also be perfectly viable if the IP range is protected from abuse.

SOAX had the unfortunate role of demonstrating a struggle many ISP proxy vendors face: these IPs are often rented from organizations abroad, and it can be hard to match their country with the target ASN in major databases. Still, what we see is a serious oversight.

Proxy quality

| Major ASNs | Residential % | Matching ASN & organization | Matching ASN & org. location | |

|---|---|---|---|---|

| Decodo | 100% | 57% | 47% | 100% |

| Infatica | 43% | 100% | 57% | 78% |

| IPRoyal | 87% | 99% | 27% | 60% |

| Massive | 100% | 0% | 0% | 100% |

| NetNut | 0% | 100% | 100% | 100% |

| Oxylabs | 100% | 0% | 0% | 100% |

| Rayobyte | 100% | 100% | 88% | 100% |

| SOAX | 75% | 75% | 50% | 75% |

| Webshare | 100% | 36% | 33% | 31% |

ISP proxies are a complex product because they have even more factors to consider. For example, customers prefer IPs from major consumer networks (ASNs) – it’s often the first and only criterion proxy vendors care about.

However, IP databases like IP2Location classify IPs into residential or datacenter not by their ASN but rather the organization that owns the IP address. These are often IPXO and similar IP brokers. As such, it’s extremely hard to find ISP proxies that have a matching ASN & organization. NetNut pulled it off very well, and so did Rayobyte with its Verizon Business proxies acquired directly from the source.

Finally, there are databases (mostly Chinese) which care if the IP’s owner and ASN operate in the same country. This can be another giveaway, often reflected in the IP’s contact metadata.

We don’t know which of these factors matter the most, but they all affect the ISP proxy’s effectiveness to some degree.

Infrastructure success rate

Most of the proxies performed very well, sometimes without fail. 18 of Rayobyte’s IPs were down during our test, hence the result.

Success rate with popular targets

This graph is interactive.

IP diversity evidently isn’t enough to guarantee results. Massive’s and NetNut’s subnets were likely better rested, which allowed us to push their proxies more without punishment. In general, the success rate was high across the board.

Infrastructure response time

Most ISP proxies were extremely fast, reaching 0.09 s at their best. Both our testing server and the target were located in Ashburn, so this benchmark was relatively easy to game by placing the ISP proxies in data centers nearby.

Response time with popular targets

This graph is interactive.

The response times with popular targets were also fast, with no big deviations. Once again, for some reason we couldn’t get Rayobyte to run with our Google scraper.

Download speed of 10 random US IPs

This graph is interactive.

Even the slowest ISP proxies had wide pipes. Maybe NetNut aside, all participants could stream 4K comfortably. However, the difference between the slowest and average proxy was often bigger than we’d like.

Rotation options

| Available | Every request | Sessions | Custom duration | |

|---|---|---|---|---|

| Decodo | ✅ | ✅ | ✅ | ❌ |

| Infatica | ❌ | N/A | N/A | N/A |

| IPRoyal | ❌ | N/A | N/A | N/A |

| Massive | ✅ | ✅ | ✅ | ❌ |

| NetNut | ✅ | ✅ | ✅ | ❌ |

| Oxylabs | ❌ | N/A | N/A | N/A |

| Rayobyte | ❌ | N/A | N/A | N/A |

| SOAX | ❌ | ❌ | ❌ | ❌ |

| Webshare | ✅ | ✅ | ✅ | 15s - 7 days |

The majority gave us direct access with no gateway server in-between. This means no built in rotation.

Protocol support

| HTTPS | SOCKS | UDP | |

|---|---|---|---|

| Decodo | ✅ | ✅ | ✅ |

| Infatica | ✅ | ❌ | |

| IPRoyal | ✅ | ✅ | |

| Massive | ✅ | ✅ | ❌ |

| NetNut | ✅ | ❌ | |

| Oxylabs | ✅ | ✅ | |

| Rayobyte | ✅ | ❌ | |

| SOAX | ✅ | ✅ | |

| Webshare | ✅ | ❌ |

We found SOCKS5 to be universally available. This proxy type also had the most participants with UDP enabled by default.

Access features

| Credentials | IP whitelist | Concurrency | Traffic | IP replacement | |

|---|---|---|---|---|---|

| Decodo | ✅ | ✅ | Unlimited | Unlimited | |

| Infatica | ✅ | ❌ | Unlimited | Unlimited | |

| IPRoyal | ✅ | ✅ | Unlimited | Unlimited | Free monthly, with individual replacements |

| Massive | ✅ | ❌ | Unlimited | Unlimited | |

| NetNut | ✅ | Custom | |||

| Oxylabs | ✅ | ✅ | Unlimited | Unlimited | |

| Rayobyte | ✅ | ✅ | Unlimited | 1 replacement credit per IP | |

| SOAX | ✅ | ✅ | |||

| Webshare | ✅ | ✅ | 500-3,000 threads | 500 GB to unlimited | Free monthly, paid individual or full replacements |

Everything else being more or less straightforward, the two features we find trickier are traffic allowances and replacement rules. Most providers advertise unlimited traffic but really have fair usage policies in place (often 100 GB/IP/mo).

The basic replacement rule – changing the whole proxy list after the subscription period – should be universally available. Otherwise, several providers offer dashboard tools to change individual IPs at will. Webshare’s system remains the most flexible in this regard – it includes both manual and automated replacements with intervals of up to five minutes.

General information

| Type | Entry | Largest plan | Price modifiers | Trial | |

|---|---|---|---|---|---|

| Decodo | Self-service | $35 | $500 (200 IPs) | ❌ | |

| Infatica | Self-service | $5 | Not mentioned | ❌ | |

| IPRoyal | Self-service | $4 | Not mentioned | State, city targeting | ❌ |

| Massive | Sales-based | Custom | Not mentioned | ||

| NetNut | Sales-based | Custom | Not mentioned | ||

| Oxylabs | Sales-based | Custom | Not mentioned | ||

| Rayobyte | Self-service | $5 | $9,400 (4,999 IPs) | Location | ❌ |

| SOAX | Sales-based | Custom | Not mentioned | ||

| Webshare | Self-service | $4.20 | Not mentioned | More traffic, threads, network priority, IP refreshes | ❌ |

Four participants didn’t even have self-service, giving us very little to work with. There was also a tendency not to show the available pricing ranges.

Pricing table