Testing Major ISP Proxy Services

ISP proxies, the curious combination of datacenter and residential proxy servers, have always fascinated us. However, we never really had the time to sit down and take a proper look at them on a larger scale. That’s what this report is about.

We grabbed thousands of ISP proxies from major providers and dissected them the best we could. How big and diverse can these networks be? How do they perform compared to datacenter and residential addresses? Are there any gotchas you should be aware of? (Hint: there are!) Let’s find out!

Key Findings

- ISP proxies are usually made by renting IPs from brokers and paying residential internet service providers to announce the IPs on their networks (ASNs).

- Major proxy providers prefer selling ISP proxies in pool based formats rather than lists.

- Their pools in the US can exceed 100,000 IPs. But compared to peer-to-peer residential proxies, they’re hundreds of times less diverse.

- Providers manage to contract with top American ASNs, mostly Comcast and Sprint. However, the IP’s owner often doesn’t change, which can cause issues with databases like IP2Location.

- Connections to ISP proxies succeed 99.8% of the time, and they’re around 35% faster than residential proxy servers.

- It may be challenging to find locations outside the US or major European countries, and even harder to get IPs in specific cities.

- ISP proxies cost 25% more per gigabyte than residential networks. That said, it is possible to get them cheaply – if you’re okay with the restrictions.

A Primer on ISP Proxies

ISP proxies are IP addresses you can use to hide your own. They’re hosted in data centers and inherit the fast and stable connection of datacenter proxy servers. At the same time, they’re associated with consumer internet service providers and not cloud hosting companies. This gives ISP proxies a solid reputation in the eyes of websites, preventing premature IP-based restrictions or outright blocks.

ISP proxies initially found the most success in the sneaker scalping community, which valued connection speed, unlimited bandwidth, and faced well-protected websites. Predictable uptime and more transparent procurement are the other characteristics that make this proxy type a desirable choice, even in formats that meter traffic use.

How Are ISP Proxies Sourced?

The process usually involves these steps:

- Rent IP addresses from an IP broker (or in some cases, bring your own).

- Find an ISP that’s willing to share its IP space.

- Pay a hefty amount and sign a letter of authorization to announce your IPs on the ISP’s network. This results in the IPs acquiring the ASN (identifying number) of that internet service provider.

- Get major IP databases to update their records with the new information.

Some proxy vendors manage to source IPs directly from internet service providers. For example, NetNut pays them for sharing bandwidth through DiviNetworks (similarly to how Honeygain pays end users). This is hard to achieve with major ISPs – but as we’ll see, not impossible.

Participants & Methodology

We approached multiple major providers that offer ISP proxy services, disclosing the methodology and targets in advance. In the end, our line-up included eight companies. Here are the ISP proxy formats they offer:

| Proxy pool | Shared list | Dedicated list | |

| Bright Data | ✅ (10,000 IPs) | ✅ (~80,000 available at the time of testing) | ✅ (~50,000 available at the time of testing) |

| GeoSurf | ✅ (~10,000 IPs) | ❌ | ✅ (not public) |

| NetNut | ✅ (<1M IPs) | ❌ | ❌ |

| Oxylabs | ✅ | ❌ | ✅ |

| Rayobyte | ✅ | ✅ | ✅ |

| Smartproxy | ✅ (~20,000 IPs) | ❌ | ❌ |

| SOAX | ✅ (100,000 IPs) | ❌ | ❌ |

| Webshare | ✅ (Up to 20,000 IPs/month) | ✅ (>25,000 available at the time of testing) | ✅ (>1,000 available at the time of testing) |

Benchmarked Products

Of course, it’d be too much to cover all the formats. So we had to make compromises.

| Location | Format | Exceptions |

| US | Proxy pool | Webshare, Bright Data (5,000 shared IPs) |

The initial idea was to benchmark multiple locations. But looking at what the providers had to offer, we decided to stick to the US.

We also wanted to get our hands on as many IPs as we could. This ruled out dedicated IPs, as providers would be unwilling to give us exclusive access for a week. Instead, we opted for proxy pools where possible, given that some advertised as many as one million addresses!

Though Bright Data and Webshare offer pool-based access, we chose their shared IP lists instead. Bright Data’s pool implementation randomly assigns 10,000 IPs from dozens of countries, which resulted in only 256 US IPs. Webshare, on the other hand, gives up to 20,000 IPs per month. But this translates to only five ports rotating every five minutes, which wasn’t enough for our purposes.

Luckily, both providers have systems that automatically translate IP lists to rotating endpoints. We chose an arbitrary number of 5,000 shared IPs in the US – in hindsight, we probably could’ve tested even more.

Testing Methodology

- Web scraper: custom Python script, requests sent from Germany

- Target: Nearest data center of a global CDN (chosen by the CDN based on IP location)

- Duration: 7 days

- Requests: 100,000/day (~780,000 total)

- IP databases: MaxMind (IP location, ASN name), IP2Location (ISP, ISP usage type), IPinfo (ASN type)

Diving into ISP Proxy Pools

Let’s have a look at how big the ISP proxy networks are and what they’re composed of.

ISP Proxy Networks Can Get Really Big, But There’s Not Much Variety

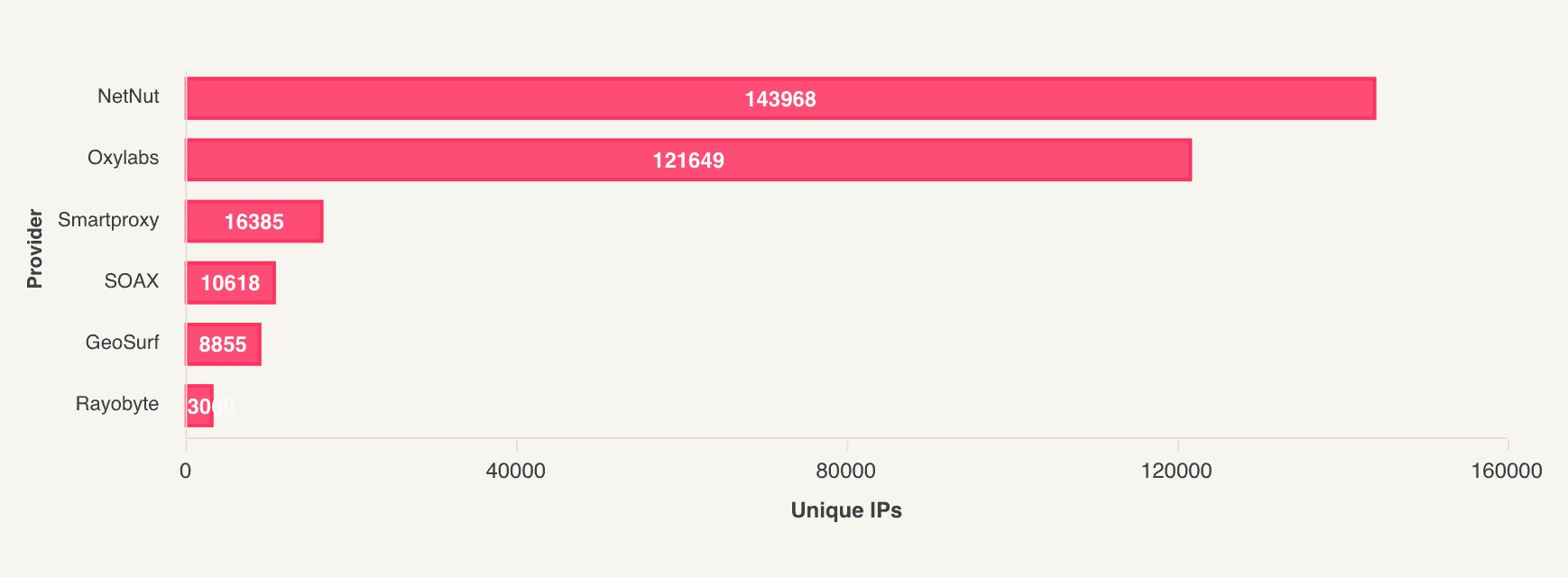

Some of our tested providers returned over 100,000 IPs in the US. Considering that ISP proxies are supposed to always be online (as opposed to residential IPs that come and go), you get really large proxy pools to work with.

It’s little surprise that NetNut had the most proxies. The company is known as one of the original and largest vendors of static residential proxies.

What did surprise us was Oxylabs. The provider is very vague in advertising its ISP proxies, so we expected less. SOAX subverted our expectations as well, but not for the better. The provider advertises 100,000 IPs, and that’s what we hoped to get. Instead, the first 700,000 requests returned only ~4,300 IPs, boosting the IP count with the last 80,000 connections.

| ASNs | C-class subnets | IPs/subnet | |

| NetNut | 3 | 567 | 254 |

| Oxylabs | 19 | 515 | 236 |

| Smartproxy | 2 | 64 | 256 |

| SOAX | 8 | 53 | 200 |

| GeoSurf | 3 | 35 | 253 |

| Rayobyte | 4 | 17 | 180 |

Note the number of subnets. It reveals how uniform ISP proxy networks are. And also, how little variety they offer. For comparison’s sake, we also tested a peer-to-peer residential proxy network in parallel. We found 82,000 unique IPs that were scattered throughout 17,000 different subnets – a usual number for this proxy type.

In some cases, dozens (or even hundreds) of subnets can come from just one ASN. Naturally, they’ll be structured into neat blocks. With ISP proxies, ensuring diversity is a big challenge.

| Unique IPs | ASNs | C-class subnets | IPs/subnet | |

| Bright Data | 5,148 | 11 | 234 | 22 |

| Webshare | 5,258 | 4 | 56 | 94 |

When you don’t exhaust a provider’s IP stock, the uniformity is less striking. Bright Data’s system did a great job at distributing our proxies throughout over 200 networks, providing around 22 IPs per subnet. The ratio would’ve likely regressed to the mean on a larger scale.

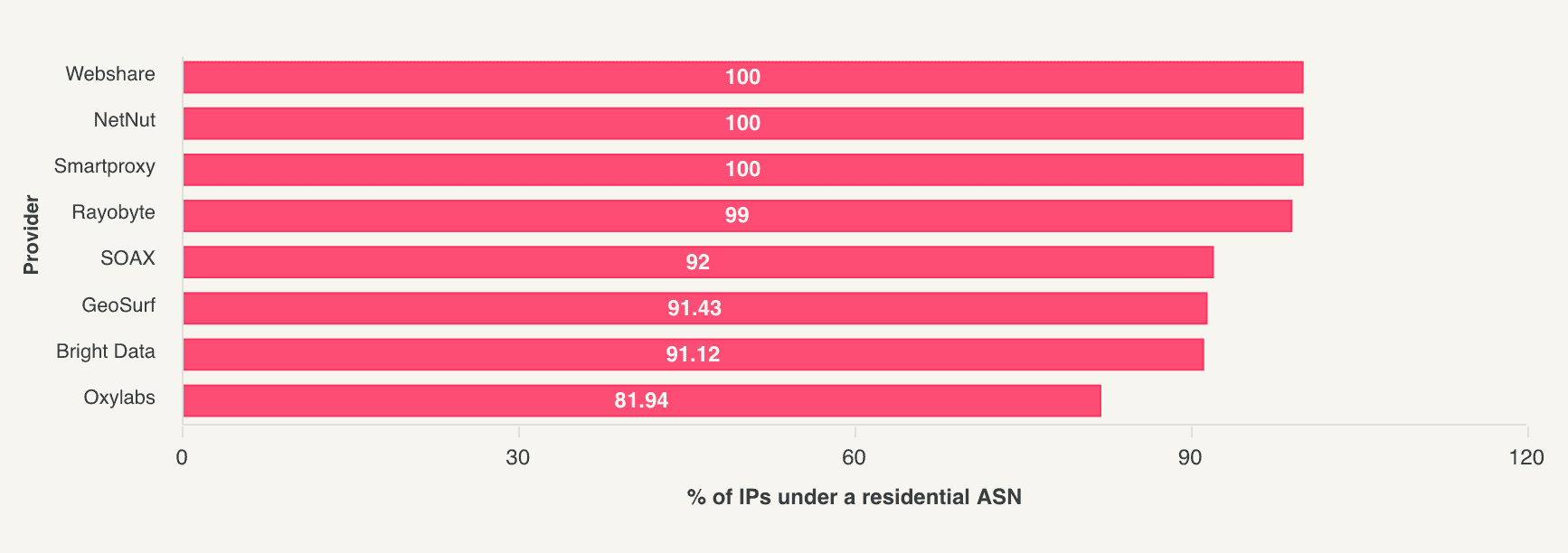

Most ISP Proxies Really Do Come from Residential ASNs

We checked the ASN type data point in the IPinfo database. It shows which ASNs function as ISPs, business or hosting networks.

The majority of IPs were under residential ASNs. That said, some providers (such as Oxylabs and SOAX), should keep their pools cleaner. Maybe some lease agreements have expired and the IPs reverted to their original ASNs? In any case, that’s not ideal.

For example, SOAX had a subnet from Charles River Corporation, a hosting company. Looking at WHOIS data, the subnet was likely assigned to Cogent before.

In addition, while the IPs themselves were predominantly located in the US, some ASNs weren’t US based. Oxylabs’ pool included proxies under Bite Lietuva, a Baltic ISP, and Bright Data had IPs with a Bulgarian AS number. We’re unsure if this has much significance if the other aspects are in order, so we decided not to pay much attention to it this time.

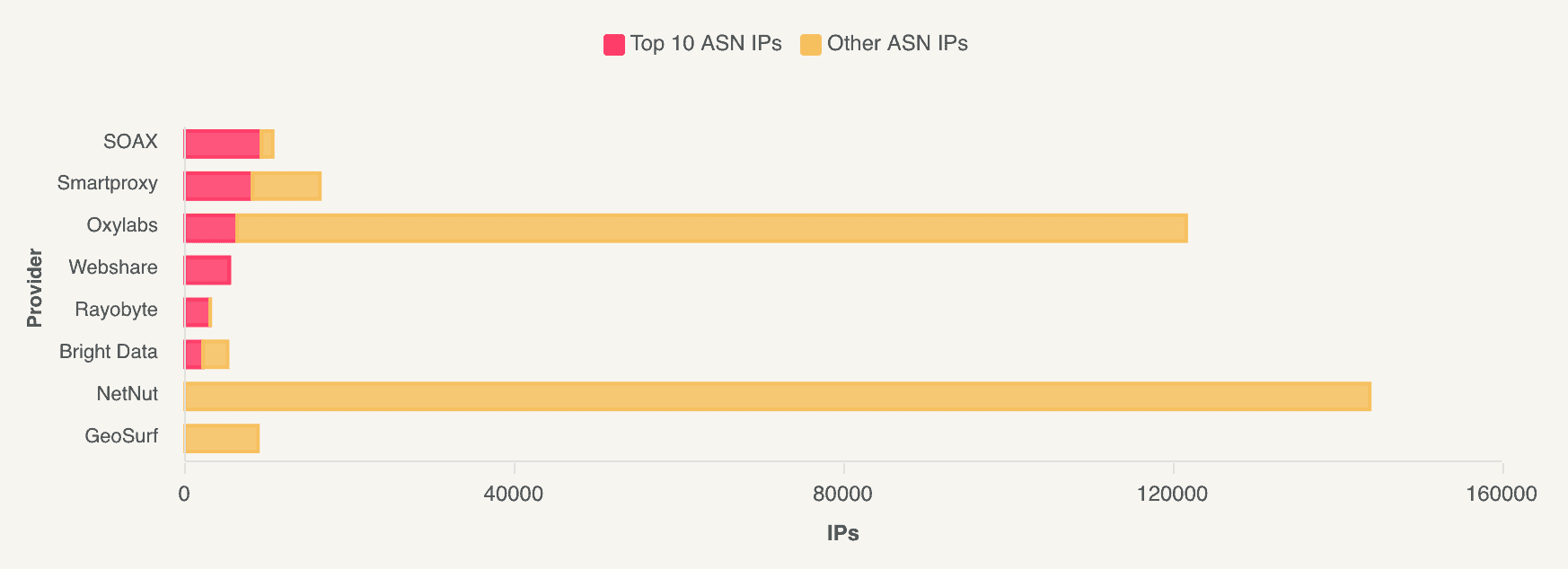

Providers Are Able to Source Surprisingly Many IPs from Top ASNs

We looked for IPs under the 10 largest American ASNs: Comcast, Charter, AT&T, Verizon, Cox, Altice, Lumen (CenturyLink), Frontier, Mediacom, and Astound (RCN).

Conceptually, an ISP proxy should do its job as long as it’s associated with a network that databases treat as residential. But as with all things in life, here you also want to get the best ISPs possible. This may be a vanity metric for a big chunk of jobs, but it begins to matter once you start accessing hardened websites.

Some providers make it a priority to fill their pools with major ASNs. This is especially evident with Webshare, Rayobyte, and SOAX. Others, like Smartproxy and Bright Data, aim to strike a balance, while Oxylabs and NetNut focus on IP quantity to ensure quality through a cleaner usage history.

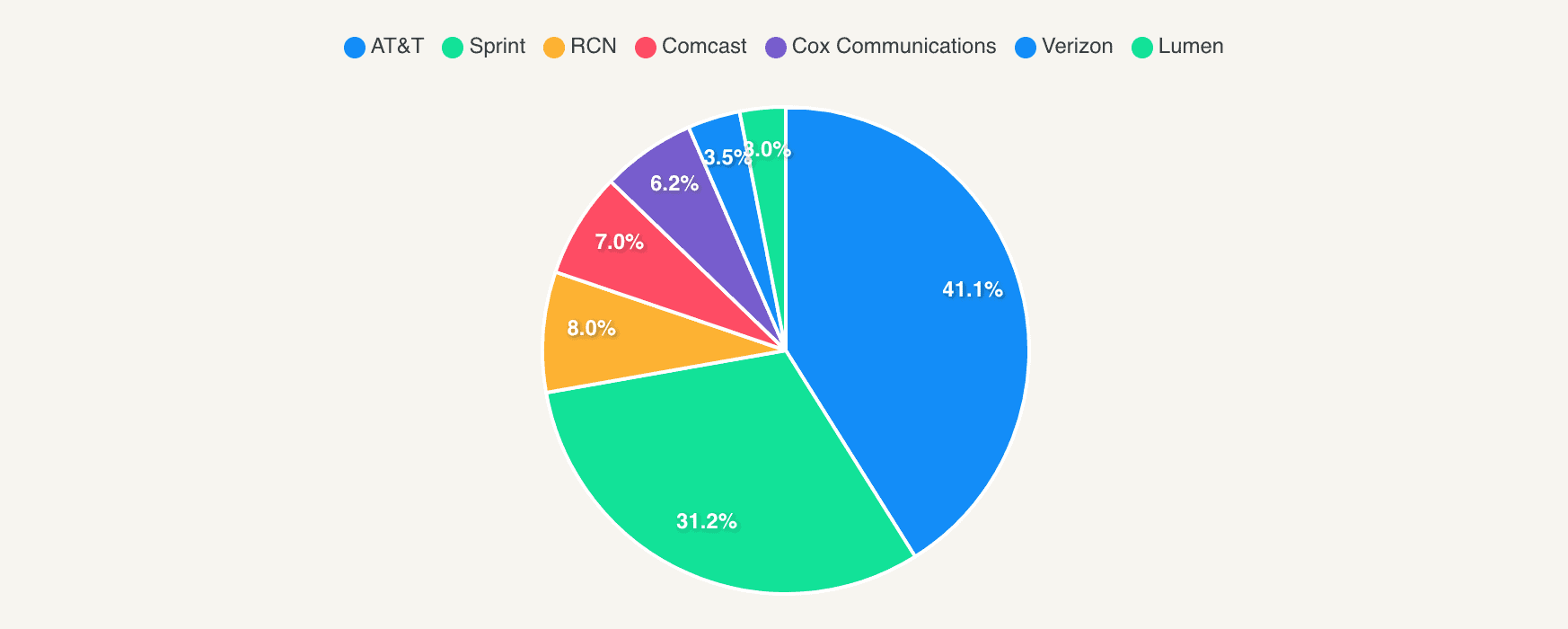

For the fun of it, let’s see which top ASNs are the most popular.

The ASN and Owner of These IPs Often Don’t Match – Which May Be a Problem

The sourcing practices of ISP proxies create a frequent situation where the ISP (owner of an IP address) and the ASN (the network it’s on) don’t match. It’s not unusual for databases to identify the ASN as Verizon and the ISP as IPXO, an IP broker.

Here’s what IP2Location had to say about our tested ISP proxy pools. We mapped the relationship between ASNs and ISP manually, and some cases were less than obvious, to say the least. So, you should treat the matching ASN & ISP data point as an approximation:

| IPs with matching ASN & ISP | |

| NetNut | 59% |

| Oxylabs | 35% |

| SOAX | 21.5% |

| Bright Data | 2.5% |

| GeoSurf, Rayobyte, Smartproxy, Webshare | 0% |

Across the board, few IPs had matching ASNs and ISP organizations. NetNut led the way, which is expected considering its bandwidth sharing model. Top 10 ASNs were the least likely to match. Having said that, SOAX somehow managed to source over 2,000 IPs directly from Comcast – an impressive feat but also an exception to the status quo.

When is the ASN-ISP match relevant? We’ve learned that anti-bot systems may monitor inconsistent IPs more closely. Of course, things aren’t as simple: factors like IP usage history and the web scraper’s fingerprint matter greatly.

The choice of an IP database also makes a difference. We found that Maxmind is naive with organizations, often matching them with ASNs. IP2Location and IPinfo, on the other hand, are quick to catch any inconsistencies.

IP2Location has a field called usage type that classifies an organization based on its business function. Many of these ISPs are IP brokers and hosting companies, so they get identified as data centers. And once that happens, the database tends to also mark their IPs as datacenter proxies. Scamalytics, an IP abuse service, does something similar: it relies on the ISP’s organization to evaluate fraud risk.

| ISP usage type – landline or mobile | |

| Oxylabs | 99% |

| Bright Data | 76.85% |

| NetNut | 59% (the rest – educational) |

| Rayobyte | 58.65% |

| SOAX | 28.59% |

| Webshare | 15.45% |

| GeoSurf, Smartproxy | 0% |

As you can see, having a residential ASN isn’t enough to fool IP identification services. Fortunately, not every database tracks this, and not every user considers it important to take action.

Infrastructure Performance

Knowing that ISP proxies are hosted in data centers, we can expect them to have datacenter-level performance. We tried to verify this by measuring their success rate, response time, and download speed.

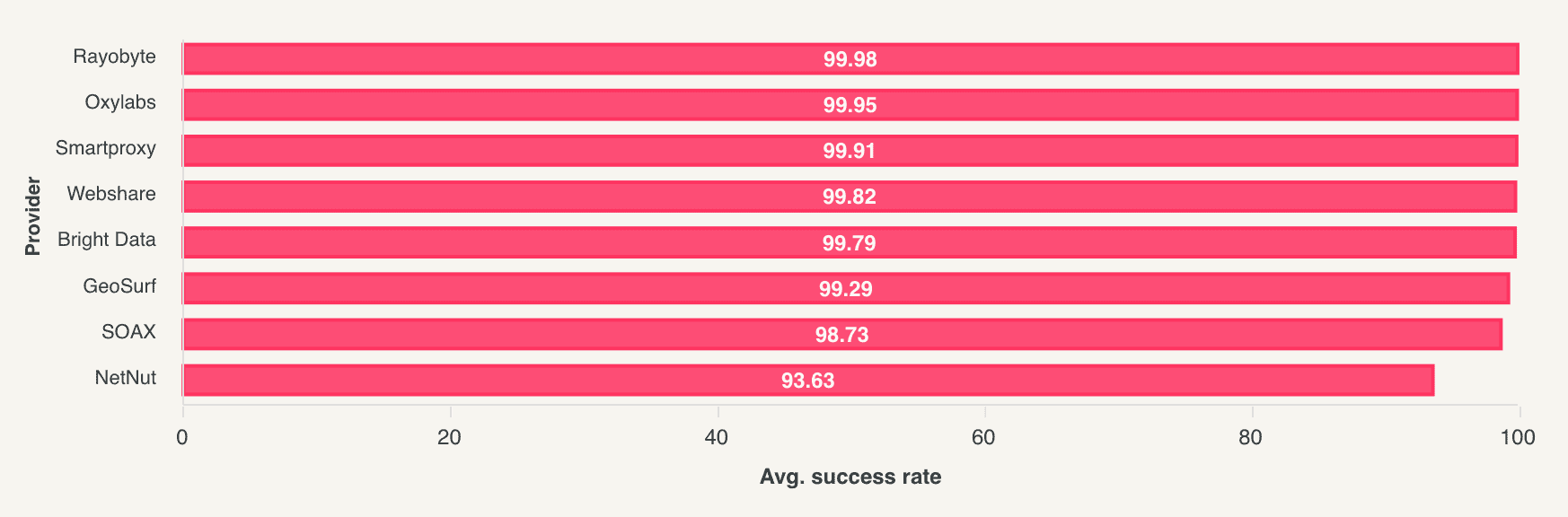

ISP Proxy Infrastructure Works Nearly Without Fail

The heading says it – at their best, the ISP proxy infrastructures reached an almost perfect success rate. Even the median result was 99.81%, promising very few connection errors. For some reason, NetNut had unusually many timeouts, which brought down its results.

| ISP (8 providers, 700k requests each) | Residential (11 providers, 500k requests each) | Datacenter (6 providers, 50k requests each) | |

| Median success rate | 99.81% | 98.29% | 99.94% |

ISP proxies look well compared to other proxy types. Though residential proxy networks have improved massively over the years, they’re still less reliable. With datacenter proxies, this depends on the server they’re hosted on and is hard to generalize. That said, our benchmarks produced similar results.

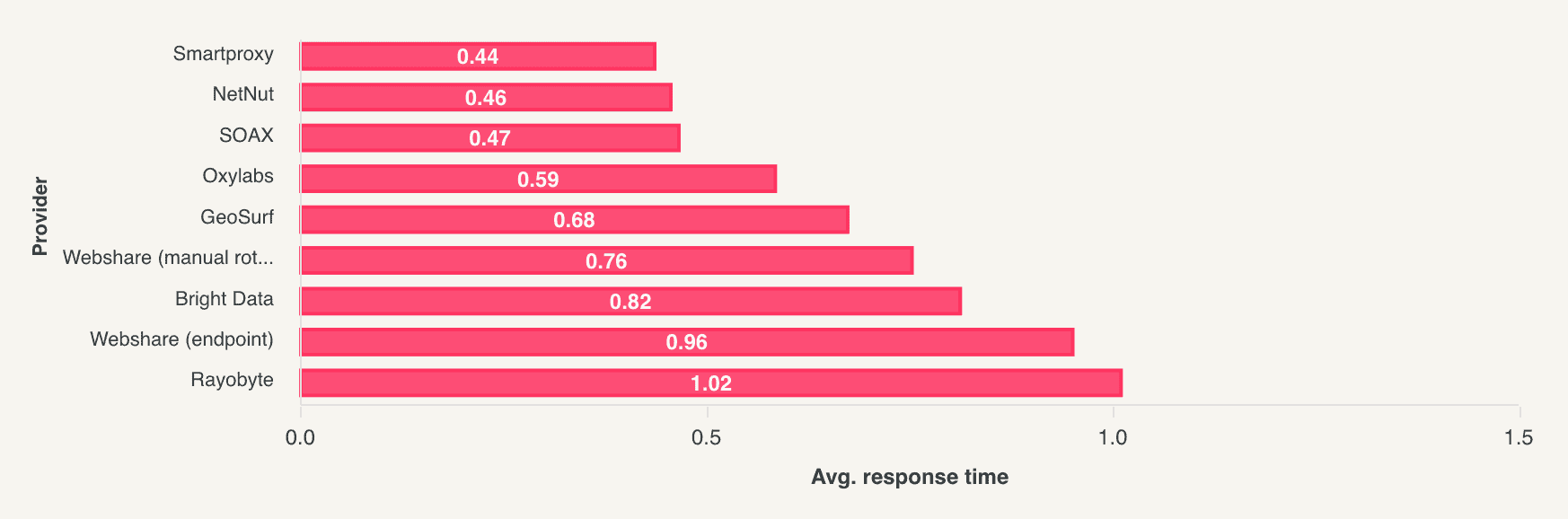

These Proxies Outpace Residential and Even Datacenter Proxy Servers

The ISP proxies had a median response time of 0.64 seconds, which is great. If you’ve ever used hyper-optimized IPs for sneakers, this may not seem that fast to you – but remember, we tested thousands of IPs, and our hardware was halfway across the world.

The three best performing proxy pools showed nearly identical results and were over twice faster than the slowest providers. Note that our benchmark was biased towards providers that had infrastructure in Europe. Rayobyte’s load balancing server was located in the US, so it took around 150 ms longer to reach from Germany.

| ISP (8 providers, 700k requests each) | Residential (11 providers, 500k requests each) | Datacenter (6 providers, 50k requests each) | |

| Median response time | 0.64 s | 1 s | 0.87 s |

Compared to other proxy types, ISP proxies had the lowest response time in the US: they were 35% faster than residential proxy servers and 25% quicker than rotating datacenter proxies.

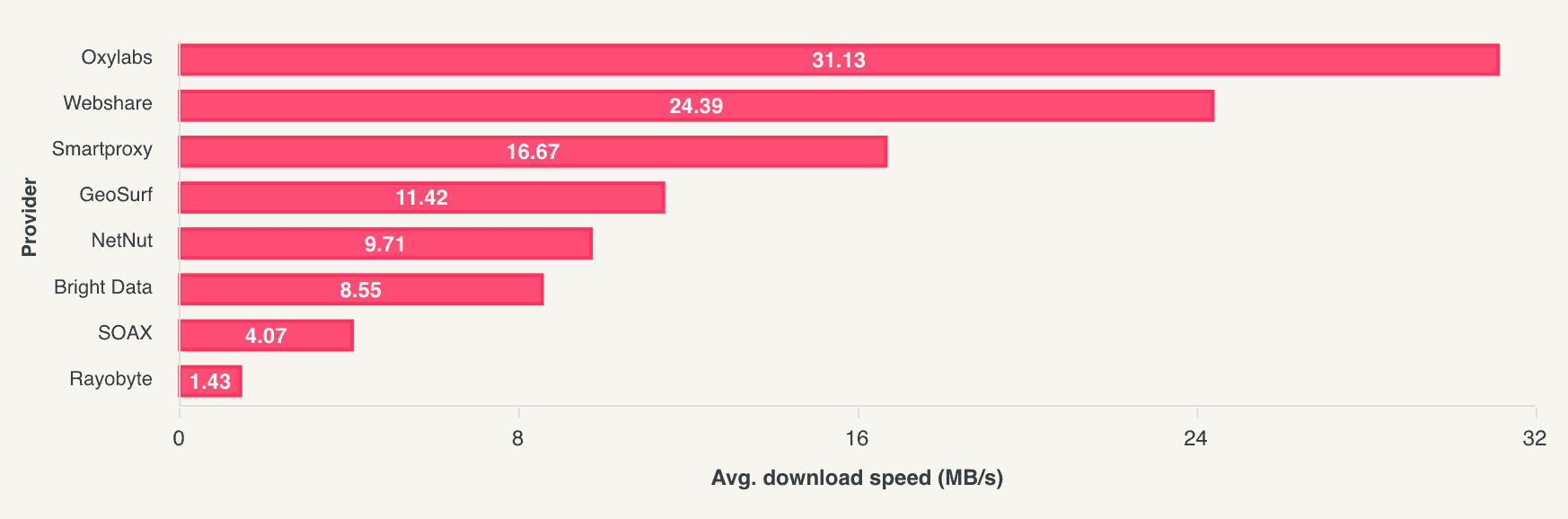

Throughput Isn’t an Issue – Most of the Time

Another benefit of ISP proxies is the throughput you get. We tested 10 random IPs from each proxy network, and their median download speed reached 10.57 MB/s. Of course, the results will largely depend on your own connection quality. But the point is – ISP proxies are fast.

They’re also highly variable. The fastest provider, Oxylabs, reached over 30 MB/s on average and actually beat our download speed without proxies. On the other hand, even the fastest proxy from Rayobyte’s 10 IPs ran at only 3.5 MB/s. This raises a three-pronged question: are some ISP proxies extremely overloaded, do providers limit throughput, or were we just unlucky?

Feature Overview

Let’s have a look at the functionality of ISP proxy services – more specifically, their location variety, protocol support, and rotation options.

ISP Proxies Are Closer to Datacenter Than Residential IPs in Location Variety

Being hosted on servers and not consumer hardware, ISP proxies face the same challenges as datacenter addresses: 1) it’s hard to get them in many countries, 2) it’s even harder to offer different cities within a country. This is evident in the table below:

| Available countries | Country selection | State selection | City selection | |

| Bright Data | ~50 | ✅ | ❌ | ✅ |

| NetNut | 30+ | ✅ | ✅ | ✅ |

| Oxylabs | 10+ | ✅ | ❌ | ❌ |

| GeoSurf | US, UK, AU, GB, DE, FR, SG | ✅ | ❌ | ❌ |

| Rayobyte | US, UK*, Germany*, Canada* | ✅ | ❌ | ✅* |

| Smartproxy | US, Hong Kong, Canada, France | ✅ | ❌ | ❌ |

| Webshare | US, Italy | ✅ | ❌ | ❌ |

| SOAX | US | ❌ | ❌ | ❌ |

Still, some providers make it possible, Bright Data and NetNut being prime examples. Otherwise, the main priority is to procure IPs in the US, then a major Western European location, and branch out to other continents afterwards.

City selection often works only in the US. Everywhere else, you’ll get the capital and up to three other cities, if you’re lucky (or the country is big). Peer-to-peer residential proxies are much more flexible in this regard.

Some ISP Proxy Services Have to Rotate – But Why?

ISP proxies can be static, and it’s one of the main qualities that distinguishes them from residential proxy servers. But most participants also have rotating formats for web scraping tasks.

| Formats that rotate | Frequency | |

| Bright Data | All | Every request, customizable w/ Proxy Manager |

| Webshare | All | Every request, 5 or 20 mins (pool only) |

| GeoSurf | Proxy pool | 30 minutes |

| NetNut | Proxy pool | Every request |

| Oxylabs | Proxy pool | Every request, 5 hours (forced) |

| Rayobyte | Proxy pool | Every request |

| Smartproxy | Proxy pool | Every request |

| SOAX | Proxy pool | Every request, 24 hours (forced) |

What we don’t understand is why some of the ISP proxy pools force rotation. There may be good reasons, but without knowing them, the decision looks arbitrary and limiting on purpose.

Bright Data and Webshare have really flexible systems where you can buy an IP list and get it to rotate without writing the logic yourself. Bright Data’s system puts all products behind an endpoint by default, and you can specify a particular IP by adding a parameter.

Webshare does it the other way around: it provides a list and offers the ability to create an endpoint for any product on its dashboard. Alternatively, you can get new IPs by automatically refreshing your list at set intervals (for example, 15 minutes). The scale and frequency depends on your budget.

Pricing Approaches

Let’s take a look at how ISP proxy providers structure their pricing and how much you’ll have to shell out for access.

You Likely Won’t Be Able to Pay as You Go

Only Bright Data offers the pay-as-you-go payment model. This contrasts sharply with residential proxy services where a no-commitment option has become an industry standard.

Pool Based Formats Have a Steep Entry Cost

| Proxy pools | Proxy lists | |||

| Entry price | Traffic | Entry price | IPs | |

| NetNut | $350 | 20 GB | – | – |

| Oxylabs | $340 | 20 GB | Not public | Not public |

| SOAX | $99 | 15 GB | – | – |

| Webshare | $94 | 250 GB | $6 | 20 IP |

| Smartproxy | $28 | 2 GB | – | – |

| Bright Data | $15 | 1 GB | $15.5 | 1 IP |

| Rayobyte | Not public | Not public | $12.5 | 5 IPs |

| Average | $154 | $9.7 | ||

Without an ability to pay without committing, you’ll have to rely on subscription plans. The bad news is that their entry fee is pretty steep – especially with business-minded providers like NetNut and Oxylabs, which likely treat ISP proxies as a premium product.

The situation is significantly better with ISP proxy lists. However, their price per unit is still high enough that you won’t get much. Webshare’s value proposition is the best without looking at the details (which we’ll do soon enough).

It’s Possible to Get ISP Proxies for as Little as $0.2/GB – But Residential Proxies Still Cost Less on Average

At 100 GB of data, the average gigabyte price for ISP proxy pools is $9.2. Compared to the pricing of residential proxy services by these same providers, the rates are 25% more expensive. That said, if you’re okay with restrictions, ISP proxy traffic can also get pretty cheap.

| 5 GB | 20 GB | 100 GB | 250 GB | 500 GB | 1,000 GB | |

| Bright Data | $15 | $12.75 | $11.25 | $10.50 | Custom | Custom |

| GeoSurf | – | $10 | $8 | $7 | Custom | Custom |

| NetNut | – | $15 | $10 | $8 | $6.5 | $5 |

| Oxylabs | – | $14 | $11 | – | – | $6 |

| Smartproxy | $14 | $11 | $9.5 | $8.5 | $7.5 | $6.5 |

| SOAX | – | $6.17 | $5.68 | $4 | $3.2 | $3 |

| Webshare (20,000 IPs/mo) | – | – | – | $0.52 | – | $0.2 |

| Webshare (5,000 IPs) | – | – | – | $6.6 | – | $2.31 |

How? Webshare. The 20,000 IP/month plan translates to $0.52/GB at 250 GB and $0.2 at 1 TB of data. But 60 IPs per hour (five ports that rotate every five minutes) might not be enough for large scale tasks.

Our list configuration increases the price tenfold, as you’ll probably want more than the base 500 threads (+37.5% to the price). It’s possible to further choose network priority (+25% on top), a monthly refresh (+20%), and even IPs that have been verified to work with Google (x10). The takeaway is that you should be mindful of the add-ons – and that comparing Webshare to more straightforward pricing models is hard.

Otherwise, SOAX handily beats most alternatives, Smartproxy tries to position itself the second value choice, and NetNut only gets started at 1 TB.